- United States

- /

- Diversified Financial

- /

- NYSE:EVTC

Investors three-year losses continue as EVERTEC (NYSE:EVTC) dips a further 7.6% this week, earnings continue to decline

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term EVERTEC, Inc. (NYSE:EVTC) shareholders have had that experience, with the share price dropping 30% in three years, versus a market return of about 15%. And the share price decline continued over the last week, dropping some 7.6%. However, this move may have been influenced by the broader market, which fell 4.4% in that time.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for EVERTEC

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

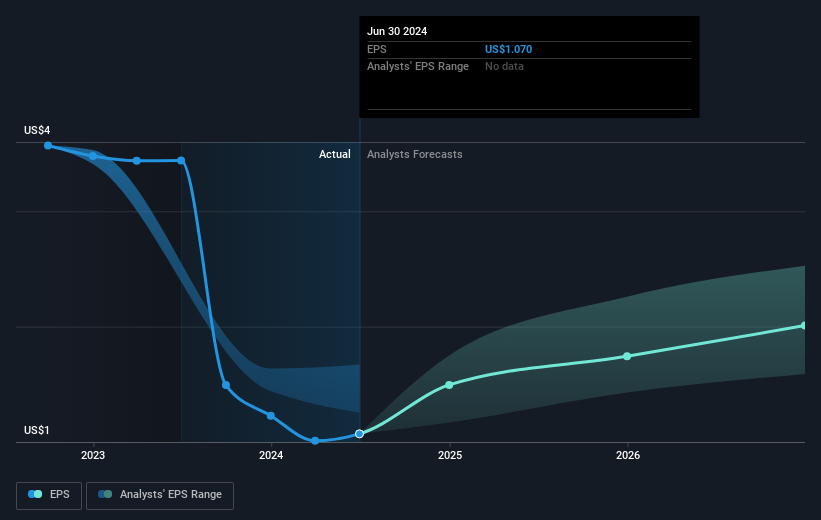

During the three years that the share price fell, EVERTEC's earnings per share (EPS) dropped by 20% each year. In comparison the 11% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into EVERTEC's key metrics by checking this interactive graph of EVERTEC's earnings, revenue and cash flow.

A Different Perspective

Investors in EVERTEC had a tough year, with a total loss of 16% (including dividends), against a market gain of about 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for EVERTEC you should be aware of, and 1 of them is potentially serious.

Of course EVERTEC may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EVERTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EVTC

EVERTEC

Engages in transaction processing business and financial technology in Latin America and the Caribbean.

Reasonable growth potential and fair value.