- United States

- /

- Diversified Financial

- /

- NYSE:EQH

Can Equitable Holdings’ Recent 8% Drop Signal a Bargain for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Equitable Holdings could be an overlooked bargain or if the recent buzz is justified? You are not alone in wanting to dig into whether the current price makes sense.

- While the stock is up a hefty 109% over the past five years and 58% over three years, recent months have been bumpier with an 8.1% drop this week and a 7.2% decline over the last 30 days.

- Investor sentiment has been shifting as the market responds to sector-wide uncertainty and regulatory updates affecting diversified financials. Fresh headlines around policy changes and stronger industry oversight have added fuel to short-term volatility.

- On our valuation scorecard, Equitable Holdings shines with a perfect 6/6 for undervaluation, meaning it is ticking all the right boxes by traditional measures. We will break down what drives this result using a few classic valuation methods, then spotlight an even smarter way to spot real value at the end of this article.

Find out why Equitable Holdings's -5.7% return over the last year is lagging behind its peers.

Approach 1: Equitable Holdings Discounted Cash Flow (DCF) Analysis

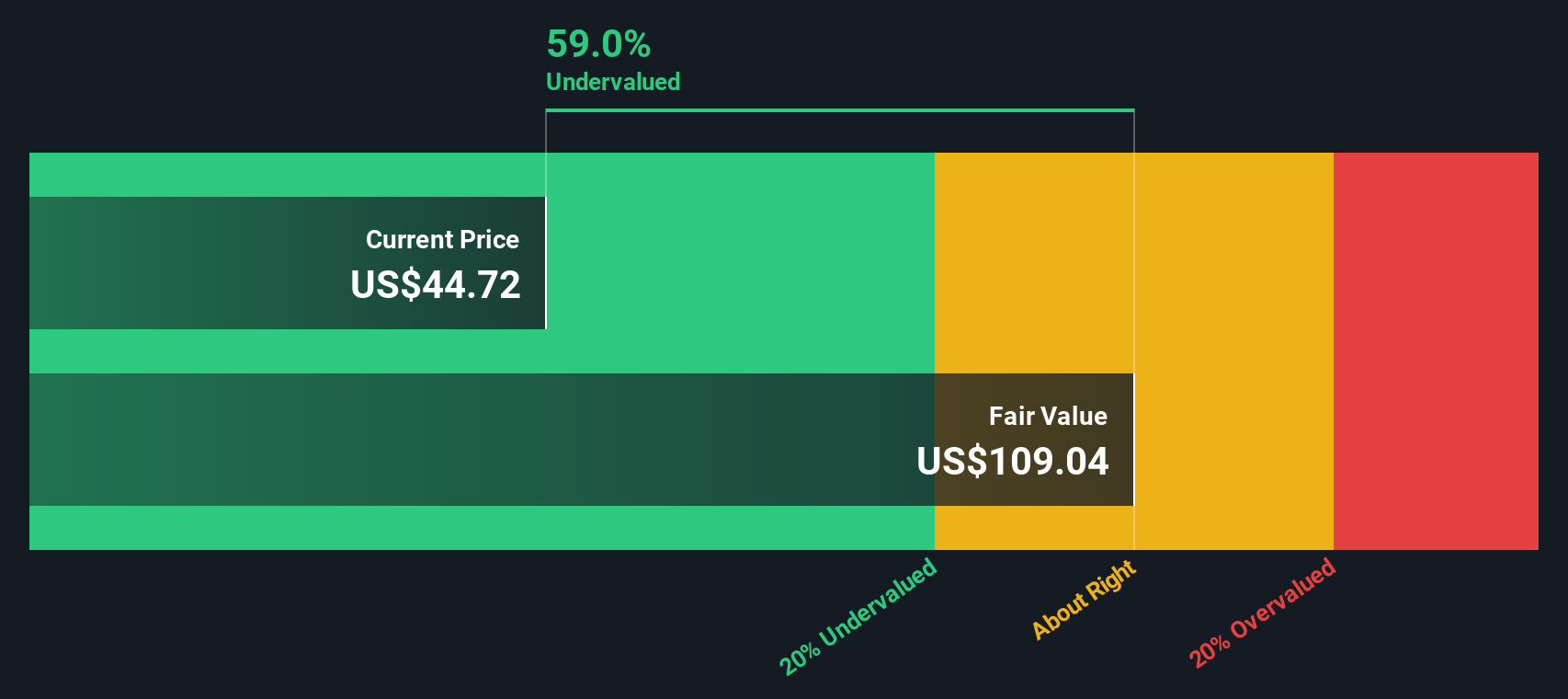

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge what a business is genuinely worth, regardless of short-term sentiment swings.

For Equitable Holdings, the DCF model uses a “2 Stage Free Cash Flow to Equity” method. The company generated $1.13 billion in Free Cash Flow over the last twelve months. According to analyst projections, FCF will reach $1.55 billion by the end of 2027. Beyond this, estimates are extrapolated, with FCF expected to climb to $2.13 billion by 2035. All of these figures are in US dollars.

By discounting these forecasted cash flows back to their present value, the DCF analysis calculates an intrinsic value per share of $107.75. Compared to its current market price, this implies the stock is trading at a 58.3% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equitable Holdings is undervalued by 58.3%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Equitable Holdings Price vs Sales

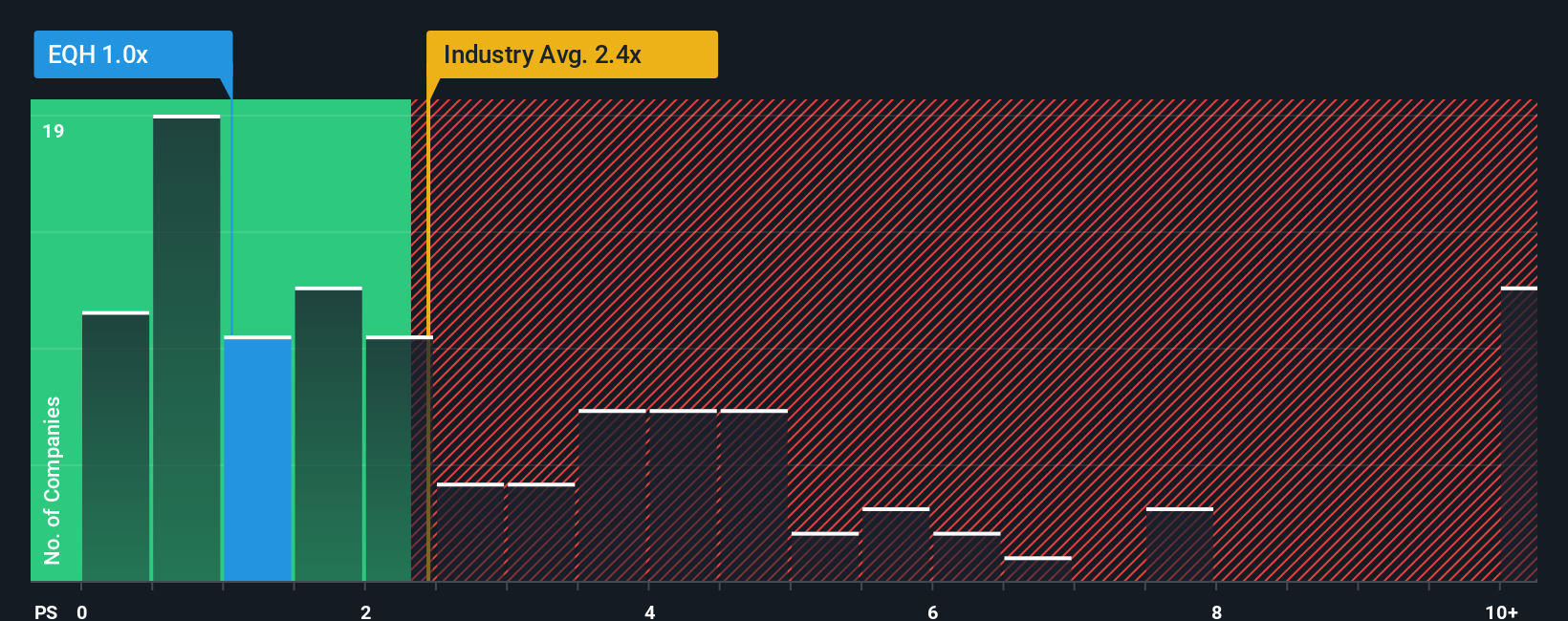

The Price-to-Sales (P/S) ratio is a favored valuation method for profitable companies like Equitable Holdings, as it gives investors a direct way to compare the company’s stock price to its revenues. Since sales figures are harder to manipulate and less volatile than earnings, the P/S ratio is often seen as a reliable indicator, especially when earnings are impacted by non-cash charges or fluctuations.

Growth expectations and perceived risk play an important role in what is considered a “normal” or “fair” P/S ratio. Companies with higher sales growth and lower risks usually command a higher ratio, while slower-growing or riskier firms tend to trade at a discount.

Equitable Holdings currently trades at a P/S ratio of 1.05x. To put this in perspective, the average for peers is around 1.45x, while the diversified financial industry as a whole averages 2.46x. Both benchmarks suggest the stock is trading at a discount to its sector.

Simply Wall St’s proprietary “Fair Ratio” takes things further. This metric calculates what the multiple should be by considering Equitable Holdings’ unique mix of expected growth, profit margins, market cap, industry, and specific risks. For Equitable Holdings, the Fair Ratio comes out to 2.37x, which is much higher than its current valuation. Unlike basic peer or industry comparisons, the Fair Ratio gives a tailored benchmark that reflects all the key drivers of value for this specific company.

With Equitable Holdings’ actual P/S ratio (1.05x) well below the Fair Ratio (2.37x), the stock appears meaningfully undervalued by this metric as well.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equitable Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story; it ties together your view of where the company is headed with your own estimates for future revenue, earnings, margins, and ultimately, what you believe Equitable Holdings’ shares should be worth.

By linking a company’s real-world story (for example, shifting retirement trends or innovative product launches) directly to your forecast numbers, Narratives allow you to set a fair value that actually reflects your unique perspective. On Simply Wall St’s Community page, this tool makes sophisticated investing accessible for everyone by guiding you through the process of connecting the company’s outlook to your bottom-line number.

Narratives are incredibly practical for deciding when to buy or sell; you can instantly compare your calculated Fair Value to the real market Price and see if the odds are in your favor. As news or earnings roll in, Narratives update automatically, so your assumptions and fair value always stay current.

For instance, based on different Narratives shared for Equitable Holdings, one investor expects continued product innovation and robust earnings to justify a target of $77, while another is more cautious, projecting just $58 due to regulatory or profitability risks. This demonstrates how your perspective can shape smarter, more relevant investing decisions.

Do you think there's more to the story for Equitable Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equitable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQH

Equitable Holdings

Together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives