- United States

- /

- Capital Markets

- /

- NYSE:BLSH

Can Bullish’s (BLSH) US Expansion Sustain Its Trading Momentum and Institutional Appeal?

Reviewed by Sasha Jovanovic

- Bullish reported October operating results showing a total trading volume of US$80.5 billion, surging by over double compared to September, and successfully launched in 20 US states after receiving key regulatory licenses.

- This period also saw Bullish’s rapid entrance with institutional clients and over US$82 million in trading on its new crypto options platform within just five days of launch.

- We'll explore how Bullish's US regulatory expansion and trading volume surge may reshape its investment narrative for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bullish's Investment Narrative?

To feel confident as a Bullish shareholder, I think you need to believe in both broader institutional adoption of digital assets and the ongoing expansion of regulated crypto trading in the US. The recent surge in October trading volumes, entrance into 20 new US states, and rapid institutional client uptake are all potentially material short-term catalysts, given Bullish’s previous challenges around scale and regulation. These developments could reshape investor perceptions, particularly with US$80.5 billion in monthly trading suggesting rising engagement despite the business still being unprofitable and shares trading at a high Price-To-Sales multiple. Still, recent share price declines highlight a cautious market wrestling with questions about profitability and competitive pressures. For now, expanded access and growing volumes do appear set to alter the catalyst-risk balance, but unprofitability and valuation remain clear, unresolved risks for Bullish. On the flip side, share lock-up expiry is approaching and could raise volatility, something to watch.

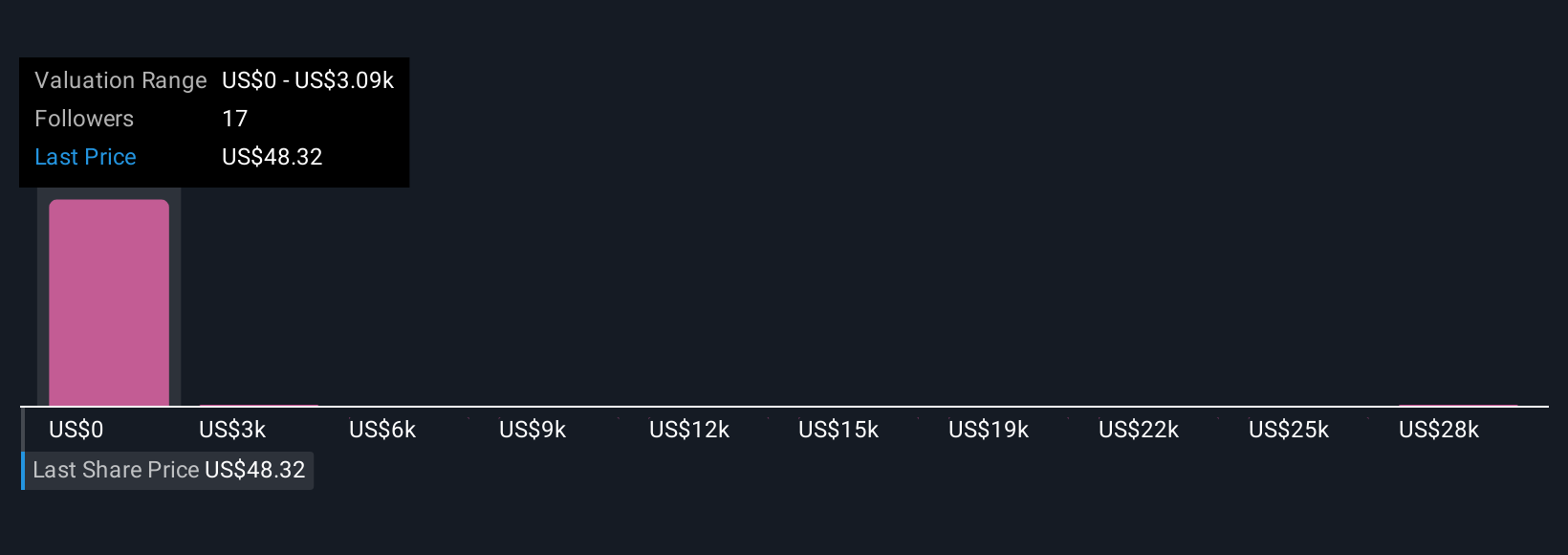

According our valuation report, there's an indication that Bullish's share price might be on the expensive side.Exploring Other Perspectives

Explore 6 other fair value estimates on Bullish - why the stock might be worth just $3088!

Build Your Own Bullish Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bullish research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bullish research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bullish's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bullish might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLSH

Bullish

Provides market infrastructure and information services in United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives