- United States

- /

- Capital Markets

- /

- NYSE:BK

A Look at Bank of New York Mellon’s (BK) Valuation Following WisdomTree Digital Assets Partnership

Reviewed by Simply Wall St

Bank of New York Mellon (BK) is expanding its position in digital finance with a new partnership. WisdomTree Inc. has selected the company to provide core banking-as-a-service for its retail platform focused on tokenized assets and cryptocurrency.

See our latest analysis for Bank of New York Mellon.

This digital assets milestone arrives while Bank of New York Mellon's share price has enjoyed serious momentum, climbing 40% year-to-date and fueling a hefty 42.7% total return over the past year. The market's appetite for BNY Mellon's long-term digital finance positioning is reflected in a remarkable 168% three-year total shareholder return, and recent news has only boosted the narrative that momentum is still building.

If moves like this get you thinking about bigger opportunities, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

The question for investors now is clear. With BNY Mellon’s digital strategy driving exceptional returns and industry buzz, does the current stock price offer an attractive entry, or is future growth already fully reflected?

Most Popular Narrative: 8.2% Undervalued

With the narrative fair value set at $118.10 and Bank of New York Mellon's last close at $108.42, the difference signals continued optimism from the market’s most closely watched forecast. This presents a compelling angle on where BNY Mellon's long-term growth could be headed next.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years. Scalable technology is expected to reduce costs and increase cross-selling opportunities.

The real story behind this valuation is built on a bold vision of digital expansion, with rising profit margins and significant technology investments changing the rules of engagement. Want to see which ambitious numbers give the narrative such firepower? Click through and get the inside track.

Result: Fair Value of $118.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee pressure or setbacks in achieving digital efficiency could quickly challenge the optimistic outlook that is shaping Bank of New York Mellon's current trajectory.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: What Does Our DCF Model Show?

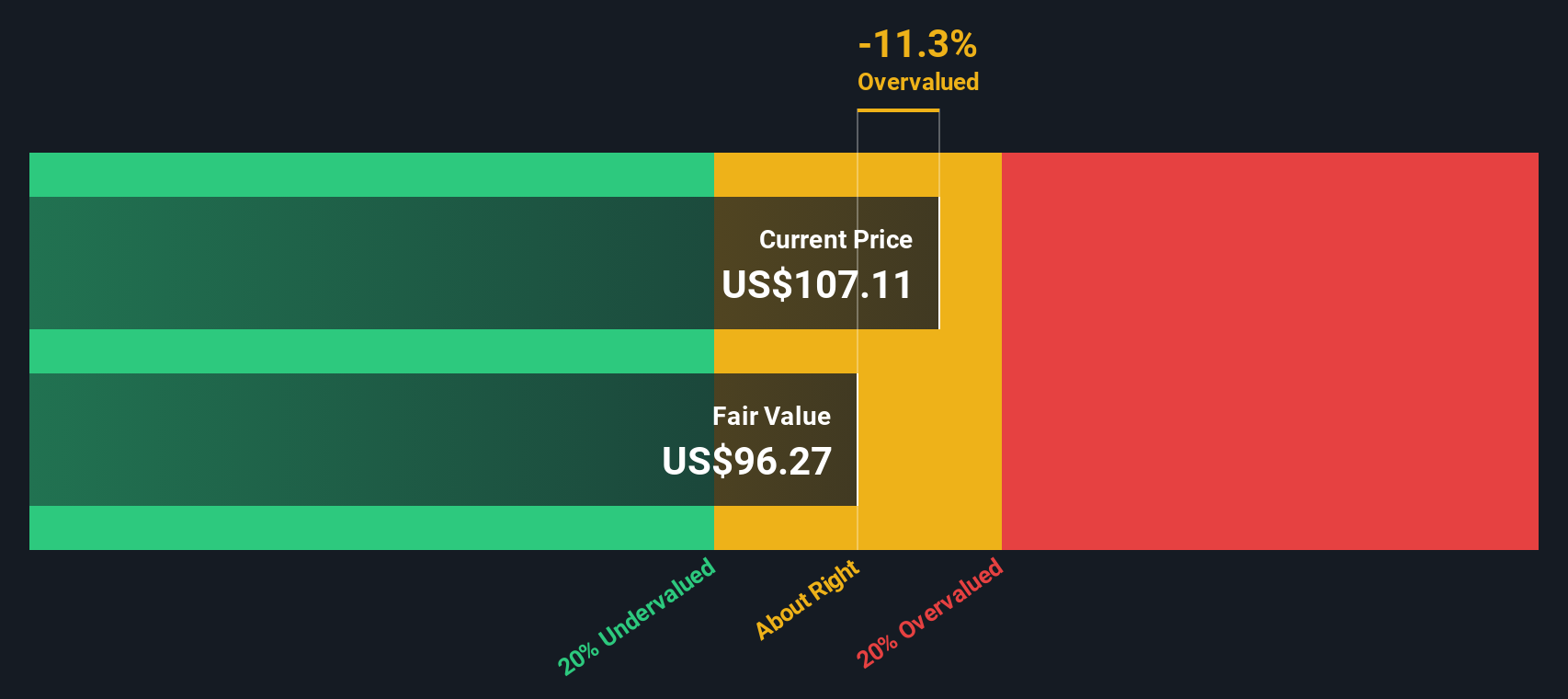

Looking at Bank of New York Mellon through the lens of our DCF model, a different story emerges. According to this approach, BK is trading above its estimated fair value of $98.67. This suggests shares could be a bit ahead of themselves right now. Does this mean the market’s optimism is already priced in, or is there still upside just waiting to be realized?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If our take does not fit your outlook, dive in and shape your own investment story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Looking for more investment ideas?

Smart investors always scan the horizon for emerging opportunities. Don’t let your next winner slip away. Supercharge your research by tapping into these hand-picked ideas right now:

- Seize the potential for steady cash flow by evaluating these 17 dividend stocks with yields > 3% yielding over 3% in the current market.

- Fast-track your search for tomorrow’s breakthrough innovators through these 24 AI penny stocks on the forefront of artificial intelligence.

- Capitalize on mispriced gems by checking out these 862 undervalued stocks based on cash flows with strong cash flow fundamentals that might be flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives