- United States

- /

- Mortgage REITs

- /

- NYSE:ARI

How Apollo’s Swing to Profitability in Q3 Changed Its Investment Story at Apollo Commercial Real Estate (ARI)

Reviewed by Sasha Jovanovic

- Apollo Commercial Real Estate Finance reported third-quarter 2025 earnings in the past week, achieving net income of US$50.79 million after a loss in the same quarter last year.

- This significant shift to profitability reflects improving fundamentals and was accompanied by more favorable assessments from multiple financial analysts.

- We’ll explore how Apollo’s return to profitability marks a potential turning point in its investment narrative after recent share price declines.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Apollo Commercial Real Estate Finance's Investment Narrative?

To own Apollo Commercial Real Estate Finance stock, you need to believe in the company's ability to sustain its recent turnaround after posting a sharp swing to profitability this quarter. This positive shift bucks a run of previous losses, bringing much-needed momentum that has attracted favorable analyst attention and a bump in price targets. While dividend payouts remain attractive, the sustainability of those payouts continues to be questioned due to earnings coverage concerns. Before this earnings result, the main risks revolved around falling revenues and limited operating cash flow coverage for debt, plus ongoing uncertainty for commercial real estate loans. Now, the earnings beat and profitable quarter could alter those risk calculations and lift sentiment, at least in the short term, but falling revenue forecasts and a relatively low return on equity still stand out. The real test will be whether this recent profitability is more than a one-off event in a still-challenging sector. However, concerns about dividend sustainability are still important for investors to keep in mind.

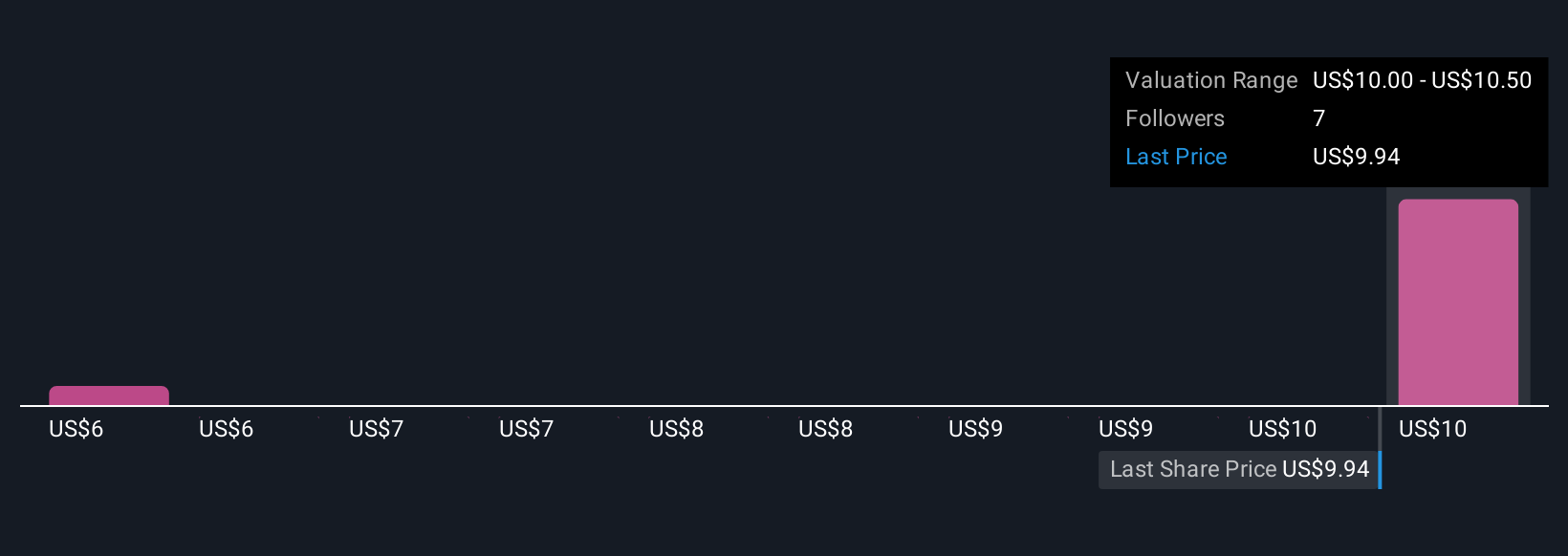

Insights from our recent valuation report point to the potential undervaluation of Apollo Commercial Real Estate Finance shares in the market.Exploring Other Perspectives

Explore 3 other fair value estimates on Apollo Commercial Real Estate Finance - why the stock might be worth as much as 8% more than the current price!

Build Your Own Apollo Commercial Real Estate Finance Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apollo Commercial Real Estate Finance research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Apollo Commercial Real Estate Finance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apollo Commercial Real Estate Finance's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARI

Apollo Commercial Real Estate Finance

Apollo Commercial Real Estate Finance, Inc.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives