- United States

- /

- Capital Markets

- /

- NYSE:APAM

Is Artisan Partners (APAM) Prioritizing Shareholder Returns Over Reinvestment With Its Variable Dividend Move?

Reviewed by Sasha Jovanovic

- Artisan Partners Asset Management announced third quarter 2025 financial results, reporting revenue of US$301.3 million and net income of US$66.8 million, alongside the declaration of a variable quarterly dividend of US$0.88 per share, equivalent to 80% of cash generated in the quarter and payable November 28, 2025.

- While quarterly net income and earnings per share declined compared to the prior year, the company’s decision to distribute a significant portion of available cash through a variable dividend highlights its focus on returning capital to shareholders.

- We’ll explore how Artisan’s choice to distribute 80% of quarterly cash flow as a variable dividend shapes its investment narrative moving forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Artisan Partners Asset Management Investment Narrative Recap

To be a shareholder in Artisan Partners Asset Management, you have to believe in the company’s ability to deliver consistent profits while maintaining disciplined capital returns even as earnings fluctuate. The latest results, with a variable dividend set at 80% of quarterly cash flow, affirm the firm’s ongoing commitment to shareholder payouts. Still, softer net income and earnings per share hint that the biggest short-term catalyst remains fund inflows, while the main risk centers on margin pressure from expanding operations; this news does not meaningfully shift those priorities.

The announcement of the variable quarterly dividend of US$0.88 per share, reflecting most of the quarter’s available cash, stands out. Compared to prior quarters’ regular dividends, this higher payout level closely ties shareholder returns to cash generation, which could be attractive when earnings growth is under scrutiny, and highlights how the company’s capital return strategy intersects with its earnings cycle.

On the other hand, this reliance on robust cash flow brings into focus the risk investors should be aware of if operating expenses continue to grow faster than...

Read the full narrative on Artisan Partners Asset Management (it's free!)

Artisan Partners Asset Management is projected to reach $1.4 billion in revenue and $303.7 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 8.1% and an increase in earnings of $56.7 million from the current $247.0 million.

Uncover how Artisan Partners Asset Management's forecasts yield a $46.12 fair value, in line with its current price.

Exploring Other Perspectives

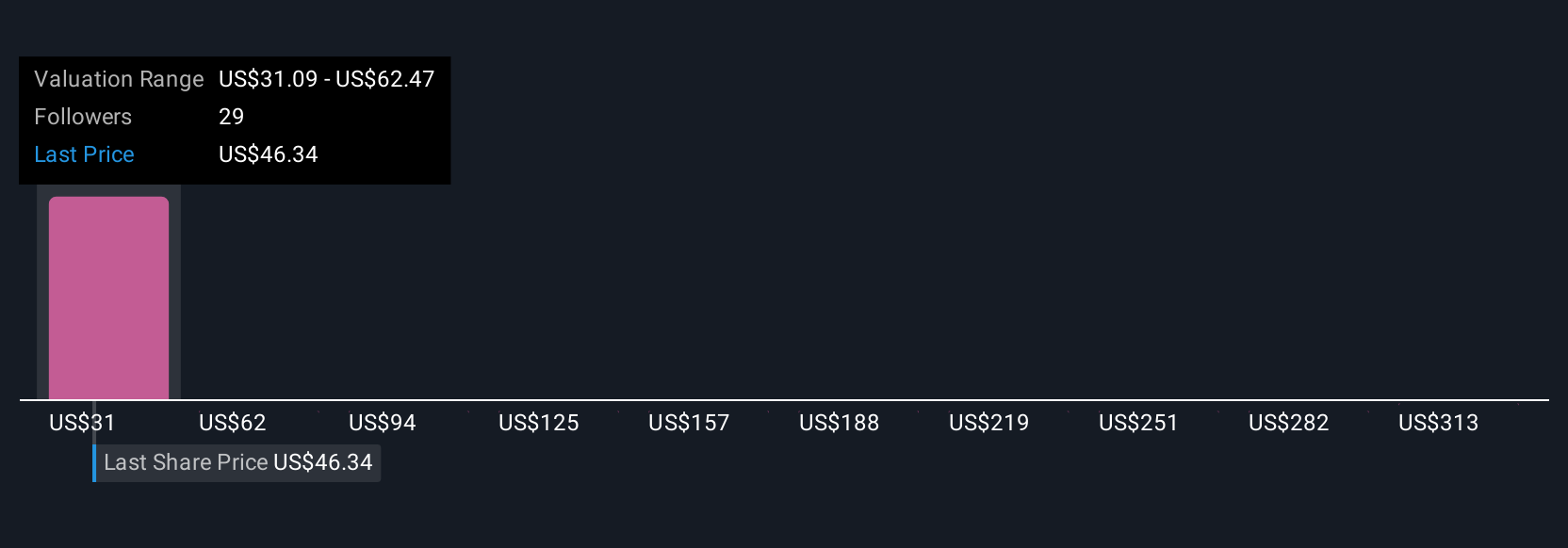

Six fair value estimates from the Simply Wall St Community stretch from US$31.09 up to US$344.87 per share. Many see strong growth potential, but with expanding product lines adding costs, your own outlook on profit margins could significantly influence your view of the stock’s future.

Explore 6 other fair value estimates on Artisan Partners Asset Management - why the stock might be worth 31% less than the current price!

Build Your Own Artisan Partners Asset Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Artisan Partners Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artisan Partners Asset Management's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APAM

Artisan Partners Asset Management

Artisan Partners Asset Management Inc. is publicly owned investment manager.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives