- United States

- /

- Capital Markets

- /

- NYSE:AMG

Is Now The Time To Put Affiliated Managers Group (NYSE:AMG) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Affiliated Managers Group (NYSE:AMG), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Affiliated Managers Group

How Fast Is Affiliated Managers Group Growing Its Earnings Per Share?

In the last three years Affiliated Managers Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Affiliated Managers Group's EPS shot from US$8.13 to US$14.53, over the last year. Year on year growth of 79% is certainly a sight to behold.

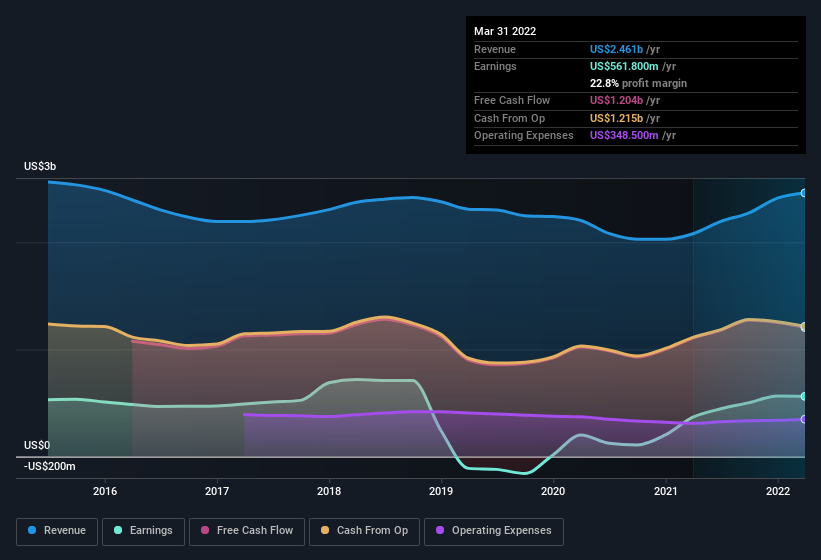

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Affiliated Managers Group is growing revenues, and EBIT margins improved by 6.9 percentage points to 38%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Affiliated Managers Group's future profits.

Are Affiliated Managers Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Affiliated Managers Group insiders spent a whopping US$3.0m on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Head of Affiliate Investments Rizwan Jamal for US$514k worth of shares, at about US$171 per share.

On top of the insider buying, it's good to see that Affiliated Managers Group insiders have a valuable investment in the business. To be specific, they have US$45m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 1.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Affiliated Managers Group Worth Keeping An Eye On?

Affiliated Managers Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Affiliated Managers Group deserves timely attention. We should say that we've discovered 1 warning sign for Affiliated Managers Group that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Affiliated Managers Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Undervalued with adequate balance sheet.