- United States

- /

- Capital Markets

- /

- NYSE:AB

AllianceBernstein Holding (AB): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for AllianceBernstein Holding.

Despite a brief dip in the latest trading session, AllianceBernstein Holding’s share price has enjoyed a gradual uptrend so far this year. Momentum is supported by an impressive 16.5% total shareholder return over the past twelve months, with the company also delivering strong multi-year results that signal resilience beyond short-term fluctuations.

If you’re looking for more discovery opportunities, consider broadening your search and see what stands out among the fast growing stocks with high insider ownership.

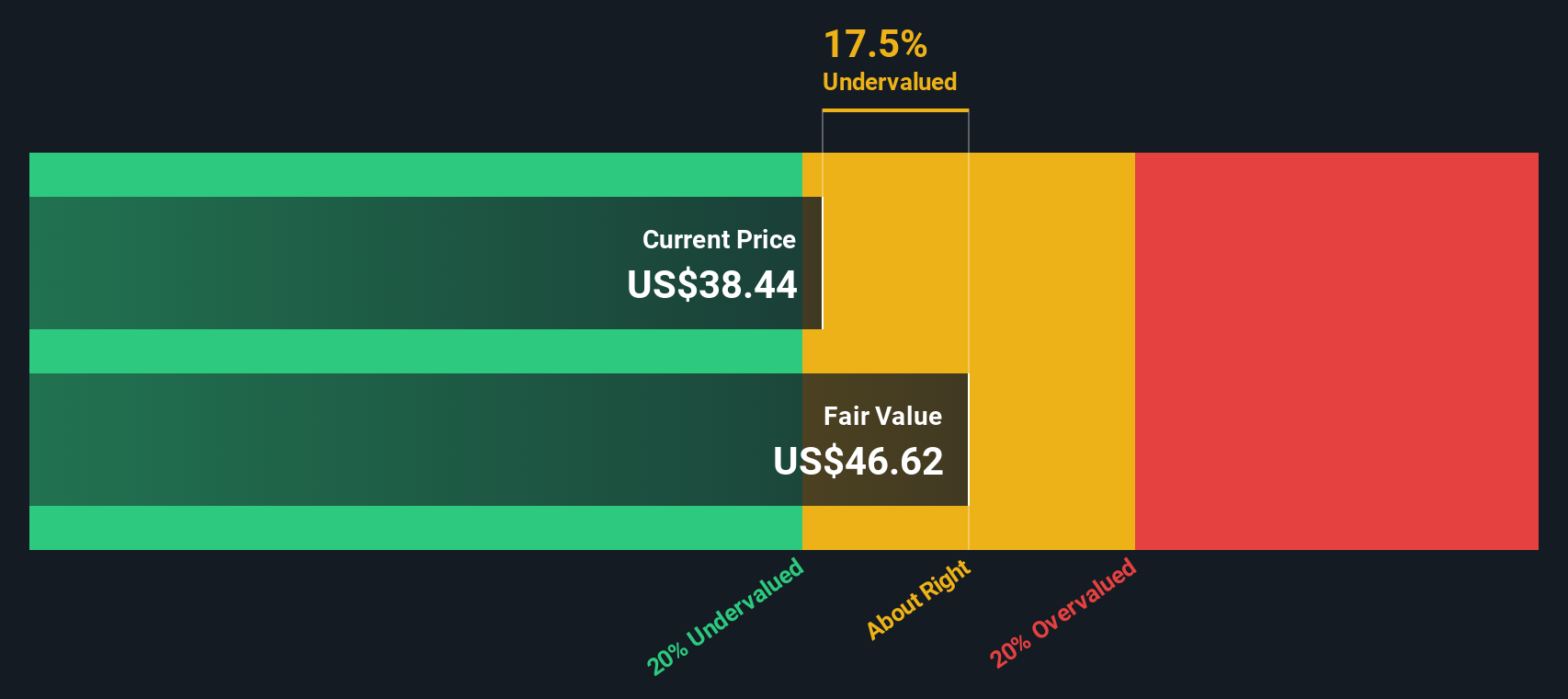

With shares showing solid gains but only a modest discount to analyst targets, the key question remains: is AllianceBernstein still trading below its fair value, or has the market already priced in expectations for future growth?

Price-to-Earnings of 11x: Is it justified?

AllianceBernstein’s shares are trading at a price-to-earnings (P/E) ratio of 11x, reflecting a notable discount compared to both industry peers and the broader market. This relatively low valuation suggests the stock may be undervalued given its current earnings power.

The price-to-earnings ratio indicates how much investors are willing to pay for a dollar of company earnings and serves as a key gauge for comparing financial health and growth expectations. In the financial sector, the P/E is widely followed because it reflects market sentiment about sustainable profit streams and business quality.

AllianceBernstein’s current P/E of 11x stands in sharp contrast to the US Capital Markets industry average of 24.4x and a peer average of 34.7x. Compared to the estimated fair P/E ratio of 11.8x, there is still a modest margin for valuation to rise if the company continues to perform. This attractive gap could close should results surpass current expectations or if sentiment shifts back toward the sector.

Explore the SWS fair ratio for AllianceBernstein Holding

Result: Price-to-Earnings of 11x (UNDERVALUED)

However, lingering concerns around revenue volatility and modest net income growth could challenge the case for continued outperformance in the months ahead.

Find out about the key risks to this AllianceBernstein Holding narrative.

Another View: What Does Discounted Cash Flow Suggest?

Switching perspectives, our SWS DCF model values AllianceBernstein at $46.51 per share, roughly 15.8% above its current price. This suggests that, based on projected future cash flows, the stock may be even more undervalued than what earnings multiples indicate. However, do these optimistic projections hold up under scrutiny, or is the market seeing something the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AllianceBernstein Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AllianceBernstein Holding Narrative

If you want to draw your own conclusions or double-check these findings, it only takes a few minutes to develop your own view. Do it your way.

A great starting point for your AllianceBernstein Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by checking stocks handpicked for their growth, innovation, or income. Don't let unique opportunities pass by while others get ahead.

- Tap into tomorrow’s technology by scanning these 25 AI penny stocks, a list of companies advancing artificial intelligence and changing the face of entire industries.

- Catch attractive yields as you browse these 16 dividend stocks with yields > 3%, which features payouts above 3% and could help boost your portfolio’s cash flow.

- Ride the next crypto trend by searching these 82 cryptocurrency and blockchain stocks, where visionary businesses are building the next era of blockchain and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives