- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Tradeweb's On-Chain Treasury Benchmarks via Chainlink Might Change the Case for Investing in TW

Reviewed by Sasha Jovanovic

- Chainlink and Tradeweb announced in early November 2025 that they are partnering to publish the Tradeweb FTSE U.S. Treasury Benchmark Closing Prices on-chain via Chainlink's DataLink, making institutional-grade benchmark data available in real time to blockchain ecosystems and financial market participants.

- This collaboration highlights a significant step toward integrating traditional financial benchmarks with blockchain technology, potentially accelerating the development of tokenized funds and enhancing transparency and access in U.S. Treasury markets.

- We'll explore how Tradeweb's move to deliver benchmark U.S. Treasury data on-chain could influence its long-term platform scalability and market positioning.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tradeweb Markets Investment Narrative Recap

To invest in Tradeweb Markets, you need confidence in the continued growth of electronic trading and the company’s ability to expand its platform across asset classes and geographies. The recent Chainlink partnership supports Tradeweb’s push into digital assets, potentially making electronic U.S. Treasury data more accessible, but it does not appear likely to meaningfully shift the immediate risk posed by persistent voice trading in complex and volatile Treasury markets, which remains a key concern for market share retention.

Another newsworthy development is Tradeweb’s launch of fully electronic request-for-market swaption trading, confirming a pattern of innovation. This ties in closely with the main catalyst for the stock: accelerating adoption of electronic protocols and automation, which help drive growth in transaction volumes and fee revenues across fixed income derivatives.

However, investors should also be aware that, in contrast to these advancements, Tradeweb’s reliance on voice trading for complex risk trades still poses...

Read the full narrative on Tradeweb Markets (it's free!)

Tradeweb Markets' outlook anticipates $2.6 billion in revenue and $917.7 million in earnings by 2028. This scenario is based on a 10.6% annual revenue growth rate and an increase in earnings of $359.9 million from current earnings of $557.8 million.

Uncover how Tradeweb Markets' forecasts yield a $131.87 fair value, a 21% upside to its current price.

Exploring Other Perspectives

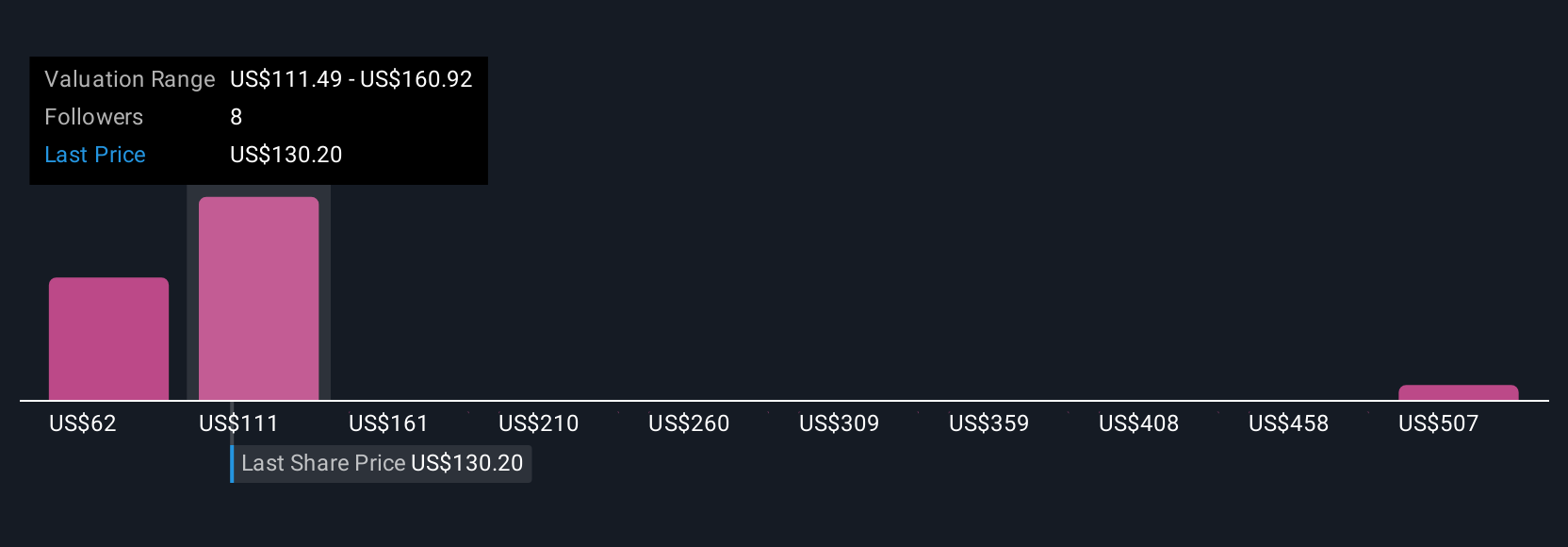

Community members from Simply Wall St provided three distinct fair value estimates for Tradeweb ranging from US$61 to US$556 per share. While opinions differ, the persistent risk of market share loss to non-electronic channels reminds us there are many factors to weigh before making a decision.

Explore 3 other fair value estimates on Tradeweb Markets - why the stock might be worth 44% less than the current price!

Build Your Own Tradeweb Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tradeweb Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Tradeweb Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tradeweb Markets' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives