- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Is Tradeweb Markets a Smart Bet After This Year’s 21% Slide?

Reviewed by Bailey Pemberton

If you are standing at the crossroads with Tradeweb Markets stock, you are not alone. Many investors are asking whether now is the time to take a fresh look at TWEB or move on. After all, the recent numbers have not inspired confidence. The stock is down 7% over the past week, off 13% over the past month, and sits at a discouraging 21.1% loss for the year to date. Long-term holders have also felt the sting, with a 21.6% decline over the last year. Still, even with these short-term setbacks, a broader perspective reveals a nearly doubling of the share price over three years and 77.1% gains over five. So, is this the dip savvy investors wait for or a warning sign to tread carefully?

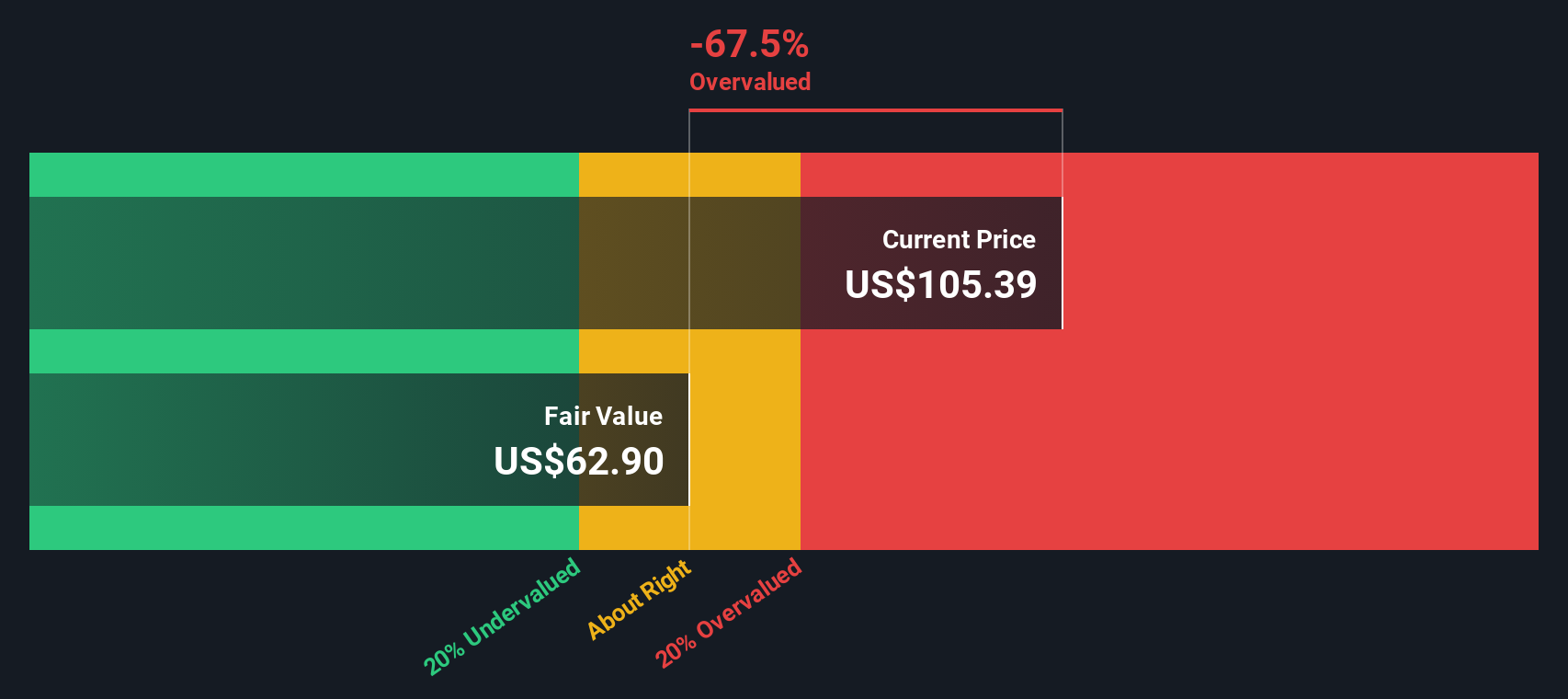

Several shifts in the broader market sector have influenced Tradeweb’s recent price action. Interest rate volatility and evolving trading dynamics have pushed market participants to rethink risk and potential in platform-based financial businesses. Despite this backdrop, Tradeweb’s value score paints a telling picture. The company is not undervalued according to any of the six key metrics typically used by analysts, scoring 0 out of 6. But what does that really mean for your investing decision?

Let’s break down how valuation is typically measured, and see exactly where Tradeweb lands on the major methods investors care about. And before we wrap up, I’ll show you an approach to valuation that cuts through the noise and may give you a more telling read than the usual checklist.

Tradeweb Markets scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tradeweb Markets Excess Returns Analysis

The Excess Returns model focuses on how much value a company generates above its cost of equity. In essence, this method evaluates whether Tradeweb Markets is making more money from its investments than it costs to fund them. The core question is whether the company is turning a real profit on each dollar of shareholder equity after accounting for the expected return those investors demand.

For Tradeweb Markets, the picture looks like this:

- Book Value: $28.58 per share

- Stable EPS: $4.83 per share (Source: Weighted future Return on Equity estimates from 6 analysts.)

- Cost of Equity: $3.07 per share

- Excess Return: $1.75 per share

- Average Return on Equity: 12.69%

- Stable Book Value: $38.04 per share (Source: Weighted future Book Value estimates from 4 analysts.)

According to this model, the estimated intrinsic value for Tradeweb Markets sits at $73.11 per share. Given that the stock is trading a significant 41.7% above this intrinsic value, the market price suggests investors are paying well more than what the underlying business is worth on an excess returns basis.

Result: OVERVALUED

Our Excess Returns analysis suggests Tradeweb Markets may be overvalued by 41.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tradeweb Markets Price vs Earnings

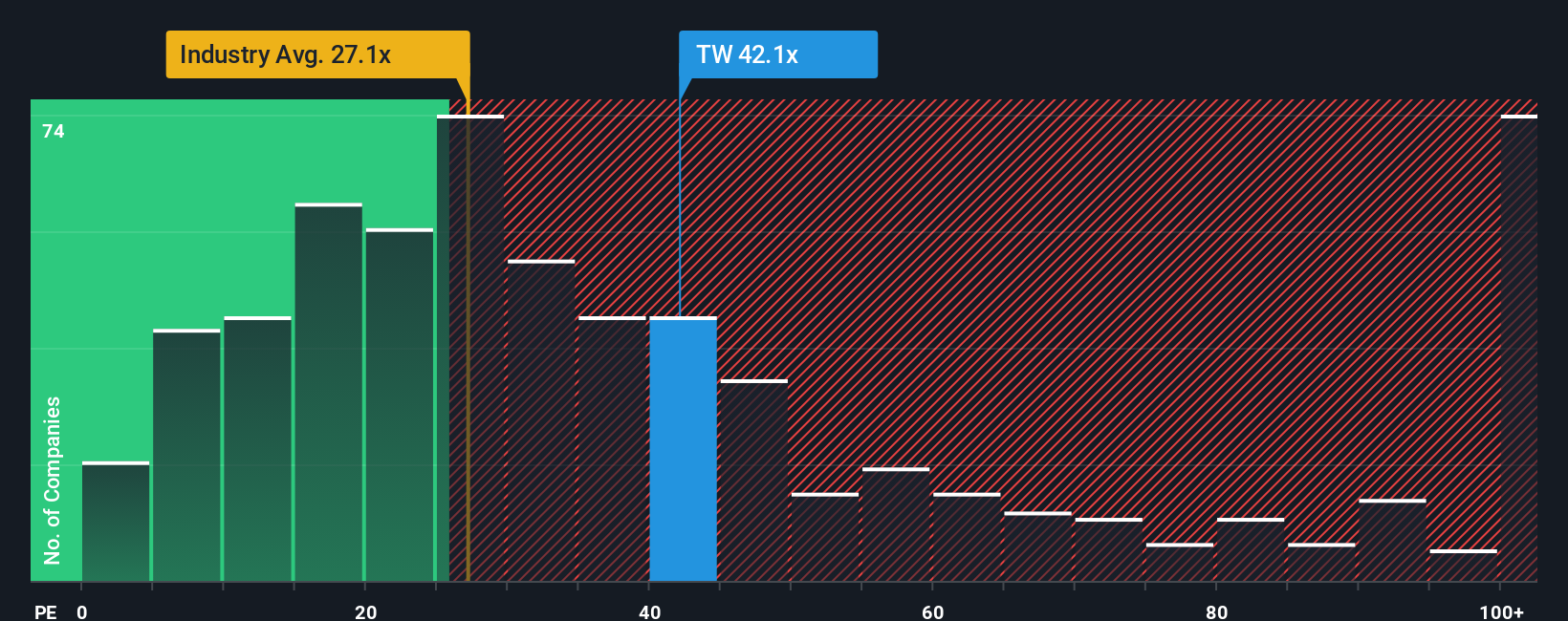

For profitable companies like Tradeweb Markets, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. The PE ratio tells investors how much they are paying for a dollar of the company’s earnings, making it straightforward to compare value across similar businesses. However, not all PE ratios are created equal. Higher growth prospects or lower risk usually justify a higher PE multiple, while slower growth or more uncertainty warrant a lower one.

Right now, Tradeweb Markets is trading at a PE ratio of 39.6x. That is noticeably higher than the Capital Markets industry average of 27.0x and the peer group average of 28.9x. On the surface, this premium might raise eyebrows, especially if investors are comparing Tradeweb directly to its sector peers.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. Unlike simple comparisons to industry or peer averages, the Fair Ratio digs deeper by accounting for Tradeweb’s unique earnings growth outlook, profit margins, market capitalization, risks, and industry dynamics. For Tradeweb, the Fair Ratio is estimated at 18.5x, which is substantially lower than both its current PE and the external benchmarks.

This large gap suggests the stock’s price is ahead of what would be expected based on its fundamentals and risk profile. According to the Fair Ratio framework, Tradeweb Markets appears overvalued on a PE basis at today’s prices.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tradeweb Markets Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, the perspective you bring to a company like Tradeweb Markets. It shapes how you see its future potential, challenges, and the financial outcomes you expect. Narratives link your business outlook (such as growth in digital assets or competition threats), financial forecasts (like future revenue, earnings, and margins), and your calculated fair value. This approach allows you to move beyond simple ratios and see the whole investment picture.

On Simply Wall St's Community page, Narratives are a free, easy-to-use tool trusted by millions of investors. They help you quickly compare your fair value with the current market price, offering clear guidance on whether now looks like a buying or selling opportunity. Narratives automatically update when new news or earnings are released, keeping your analysis in step with real-world events.

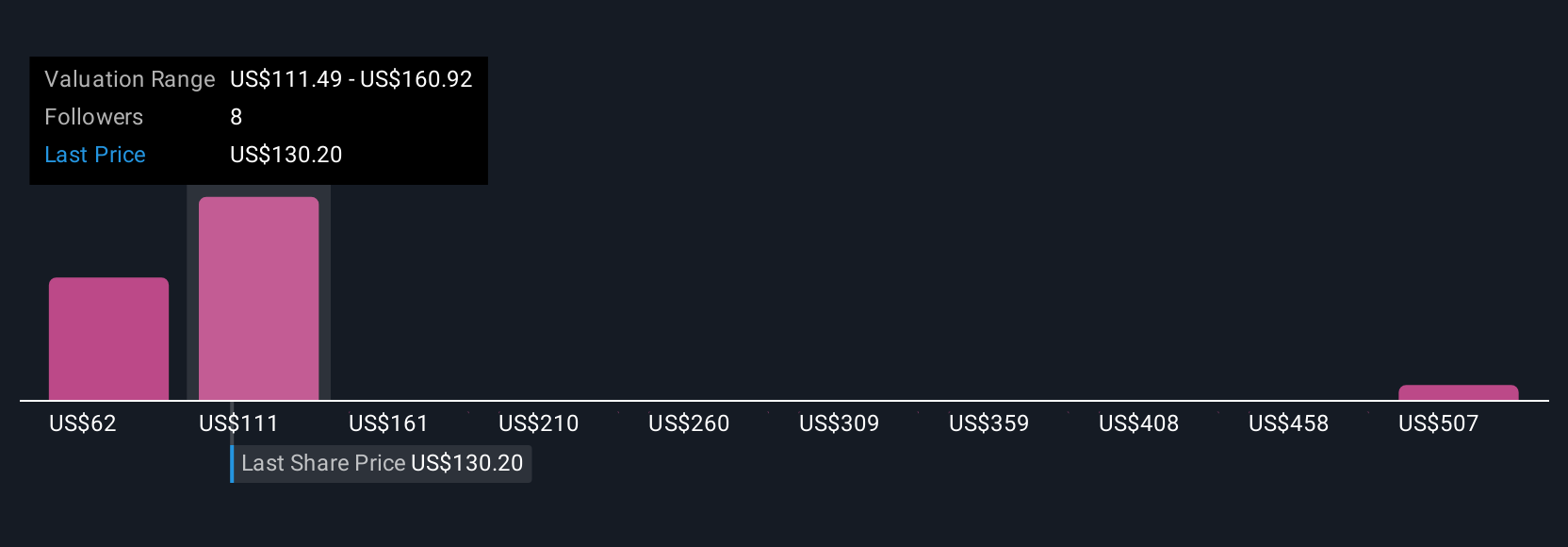

For example, some investors see Tradeweb Markets capturing global connectivity and surging electronic trading volumes, leading to fair value estimates as high as $210 per share. More cautious investors focus on competition and margin pressure, with estimates as low as $118. Narratives give you the framework to form your own view and decide with confidence.

Do you think there's more to the story for Tradeweb Markets? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives