- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

Even With A 27% Surge, Cautious Investors Are Not Rewarding TPG Inc.'s (NASDAQ:TPG) Performance Completely

TPG Inc. (NASDAQ:TPG) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 5.3% isn't as attractive.

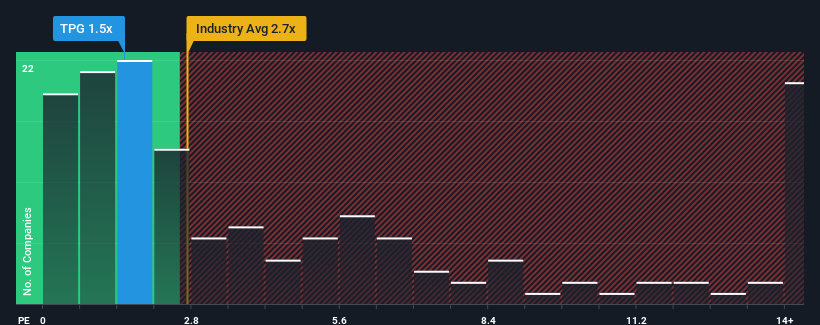

In spite of the firm bounce in price, TPG may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 2.7x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for TPG

How TPG Has Been Performing

While the industry has experienced revenue growth lately, TPG's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TPG.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as TPG's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 6.6% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 5.5% per annum, which is not materially different.

In light of this, it's peculiar that TPG's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does TPG's P/S Mean For Investors?

TPG's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for TPG remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for TPG that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Slight and fair value.