- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Will SEI Investments’ (SEIC) Smaller Bank Focus Shape Its Long-Term Revenue Mix?

Reviewed by Sasha Jovanovic

- SEI Investments announced that Clermont Trust USA has gone live on the SEI Wealth Platform, using a new configuration tailored for community banks and trust companies managing less than US$1 billion in assets.

- This development points to SEI’s ongoing push to simplify wealth management technology and expand its reach among smaller financial institutions.

- We'll explore how SEI’s streamlined platform for community banks could influence its future growth trajectory and recurring revenue mix.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SEI Investments Investment Narrative Recap

To be a shareholder in SEI Investments, I believe investors need confidence that the company’s technology-driven solutions can enhance scale and profitability, even as it faces ongoing margin pressure from investments in talent and digital platforms. The recent Clermont Trust USA launch demonstrates traction in the community bank market, but its direct impact on near-term earnings and margin trajectory is likely limited given the deal size; the company’s most important short-term catalyst remains execution on higher-margin, larger client conversions, while the biggest risk is delayed onboarding or revenue realization from these accounts.

Among SEI's latest updates, the partnership with H.I.G. Capital to provide fund administration and depositary services for international assets stands out. This announcement, like the Clermont Trust win, highlights SEI’s push to broaden its client base, but it is the pace and scale of new, larger mandates that will drive meaningful shifts in recurring revenue mix.

On the other hand, investors should be aware that continued growth-oriented investments without timely sales conversion could result in...

Read the full narrative on SEI Investments (it's free!)

SEI Investments' outlook forecasts revenue of $2.5 billion and earnings of $733.0 million by 2028. This reflects a 4.8% annual revenue growth and an earnings increase of $43.7 million from current earnings of $689.3 million.

Uncover how SEI Investments' forecasts yield a $96.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

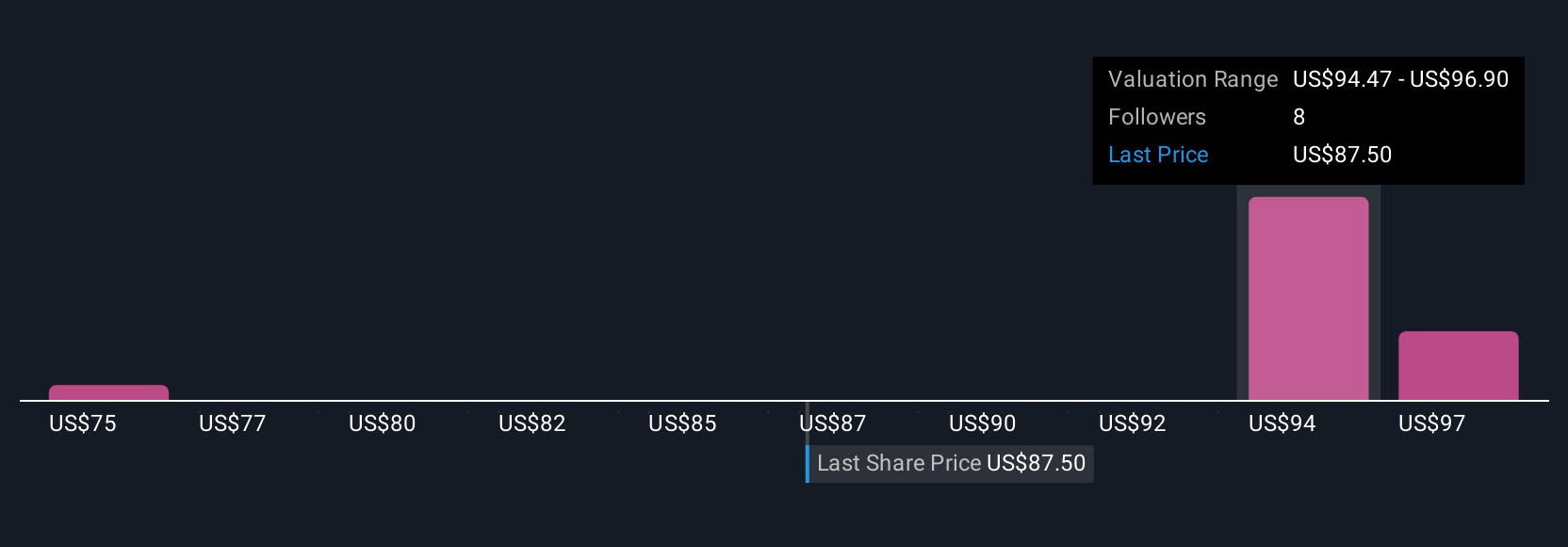

The Simply Wall St Community submitted three fair value estimates for SEI Investments, ranging from US$75 to US$101.68 per share. While several participants see significant potential, keep in mind that ongoing margin pressure from upfront investments remains a central theme for SEI’s near-term financial performance, explore how these differing opinions could reshape your view.

Explore 3 other fair value estimates on SEI Investments - why the stock might be worth 10% less than the current price!

Build Your Own SEI Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SEI Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEI Investments' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives