- United States

- /

- Capital Markets

- /

- NasdaqGM:RILY

Chairman & Co-CEO Bryant Riley Just Bought 2.0% More Shares In B. Riley Financial, Inc. (NASDAQ:RILY)

Those following along with B. Riley Financial, Inc. (NASDAQ:RILY) will no doubt be intrigued by the recent purchase of shares by Bryant Riley, Chairman & Co-CEO of the company, who spent a stonking US$4.6m on stock at an average price of US$46.00. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 2.0%.

View our latest analysis for B. Riley Financial

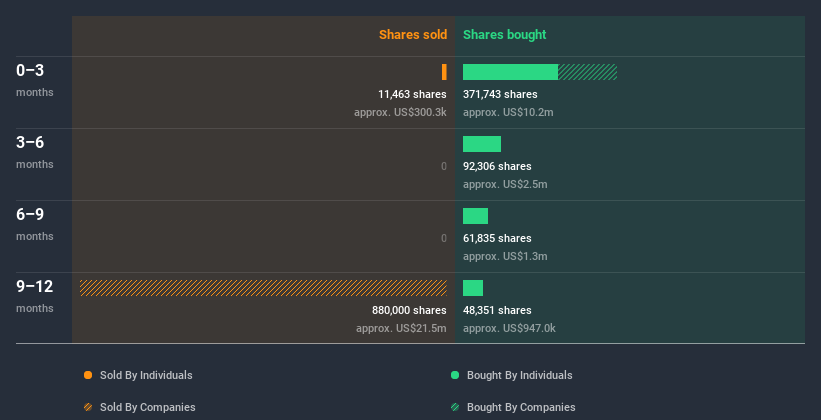

B. Riley Financial Insider Transactions Over The Last Year

Notably, that recent purchase by Bryant Riley is the biggest insider purchase of B. Riley Financial shares that we've seen in the last year. That means that an insider was happy to buy shares at around the current price of US$51.05. Of course they may have changed their mind. But this suggests they are optimistic. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. Happily, the B. Riley Financial insiders decided to buy shares at close to current prices.

Over the last year, we can see that insiders have bought 554.11k shares worth US$17m. But they sold 11.46k shares for US$347k. In the last twelve months there was more buying than selling by B. Riley Financial insiders. Their average price was about US$30.41. It is certainly positive to see that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

B. Riley Financial is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership of B. Riley Financial

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. B. Riley Financial insiders own about US$579m worth of shares (which is 45% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About B. Riley Financial Insiders?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. Once you factor in the high insider ownership, it certainly seems like insiders are positive about B. Riley Financial. That's what I like to see! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 4 warning signs for B. Riley Financial you should be aware of, and 2 of these are a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading B. Riley Financial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if B. Riley Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:RILY

B. Riley Financial

Through its subsidiaries, provides financial services in North America, Australia, the Asia Pacific, and Europe.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives