- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS): Reviewing Valuation After Key Singapore Mandate and Strategic Expansion

Reviewed by Simply Wall St

Northern Trust (NTRS) has expanded its partnership with Avanda Investment Management, taking on a key role in Singapore’s Equity Market Development Programme mandated by local regulators. This move highlights Northern Trust’s ongoing growth in global fund services.

See our latest analysis for Northern Trust.

Momentum has been building for Northern Trust, with the share price climbing 4.2% over the past month and delivering an impressive 26.2% year-to-date share price return. Along with high-profile mandates like the one from Avanda, the three-year total shareholder return of 58.6% underscores that recent deals are translating into sustainable long-term growth.

If Northern Trust’s global moves caught your attention, it could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares near all-time highs and a track record of outperformance, investors might be wondering if Northern Trust still offers upside or if the recent momentum has already priced in the future growth story.

Most Popular Narrative: 3.4% Undervalued

With Northern Trust shares last closing at $129.96 and the most widely followed narrative assigning a fair value of $134.50, sentiment suggests the market is leaning slightly below what consensus sees as justified. The stage is set for deeper discussion about whether this modest discount reflects optimism or restraint regarding future performance.

Strategic investment in AI, technology automation, and operational restructuring (centralization, standardization, and automation of core processes) is delivering improved operating leverage, declining headcount, and margin expansion. This process bends the cost curve and frees resources for growth investments, strengthening both net margins and profitability over time.

Curious what’s fueling this bullish stance? The narrative spotlights ambitious operating targets and a future profit multiple that breaks the industry mold. Want to know which assumptions about margin power and innovation have consensus betting on a premium valuation? Peek under the hood to uncover what drives these bold projections.

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust growth in alternatives or ongoing tech investment outperformance could still drive stronger earnings and challenge cautious projections for Northern Trust.

Find out about the key risks to this Northern Trust narrative.

Another View: A Multiples-Based Check

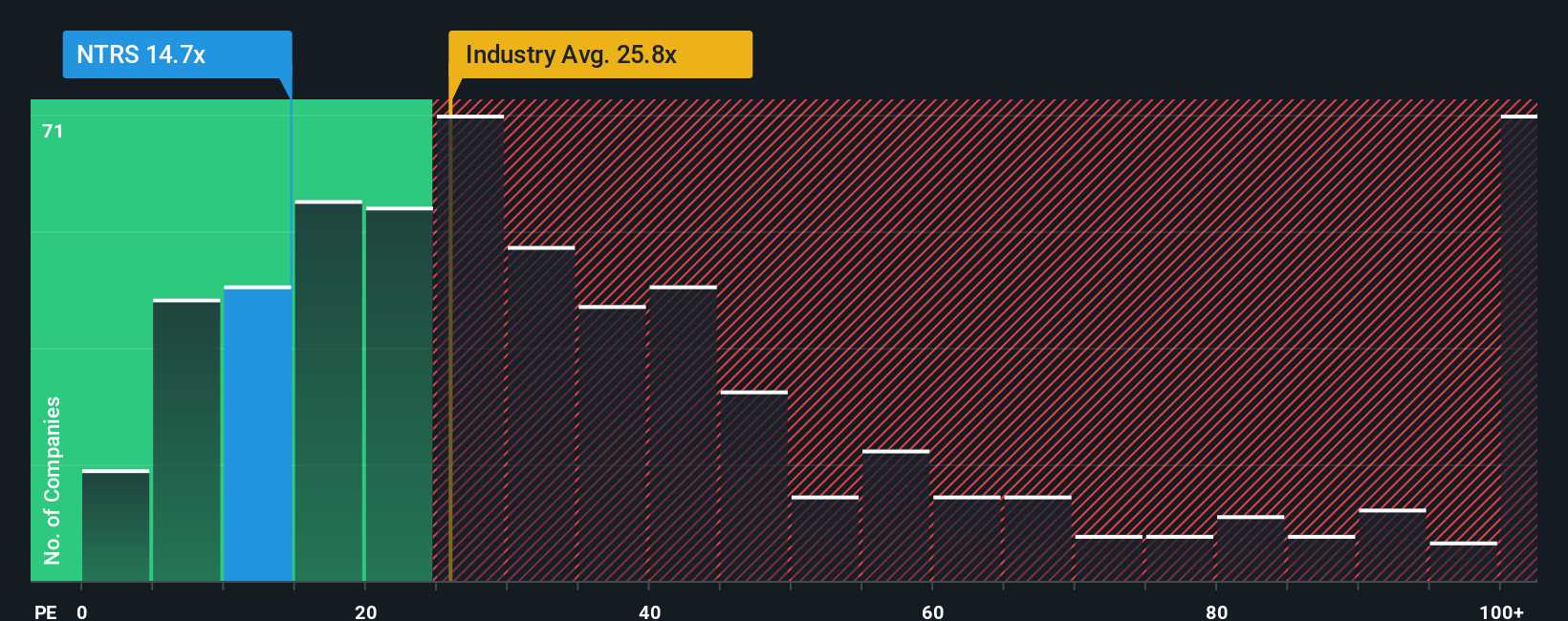

While consensus fair value estimates point to Northern Trust being slightly undervalued, a look at its price-to-earnings ratio of 14.7x shows it is cheaper than the US capital markets industry average of 24.2x, and even sits just above its fair ratio of 14.6x. That makes it reasonably priced compared to the wider market and its peers, but leaves little margin for error. Could further outperformance be required to justify this level?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northern Trust Narrative

If you want to challenge the consensus or run your own analysis, it takes just a few minutes to craft your unique Northern Trust story. Do it your way

A great starting point for your Northern Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities slip through your fingers. The right screen could reveal your next big winner. Discover strategies beyond the headlines with the tools below:

- Grow your passive income by checking out these 16 dividend stocks with yields > 3% offering stable yields that can boost your returns in any market.

- Step ahead of future trends by tracking these 28 quantum computing stocks set to transform industries with breakthroughs in computational power and security.

- Unlock overlooked gems with these 876 undervalued stocks based on cash flows that may be flying under the radar but offer compelling value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives