- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

Marqeta (MQ): Assessing Valuation Following Strong Q3 Growth and Upbeat Guidance

Reviewed by Simply Wall St

Marqeta (MQ) made headlines after delivering strong third-quarter results, showing a sizable drop in net losses and revenue growth fueled by higher transaction volumes and expanding partnerships. The company’s latest guidance signals further improvements ahead.

See our latest analysis for Marqeta.

Marqeta’s shares have been on a volatile ride, spiking over 14% after its Q3 results thanks to surging revenues and positive future guidance, but subsequently giving back some gains amid market scrutiny and wider sector pressures. The one-year total shareholder return of nearly 24% puts the recent pullback into context and hints at building long-term momentum as growth trends in digital payments and new partnerships continue to fuel optimism.

If the latest fintech results have you curious, it could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with shares pulling back after their initial surge, investors are left to wonder whether Marqeta is still flying under the radar or if expectations for future growth have already been fully built into the price.

Most Popular Narrative: 25% Undervalued

With the narrative fair value implying a notable upside versus Marqeta’s last close, attention is now squarely on the company’s ability to deliver on bold growth expectations and margin improvement in the coming years. The story behind this valuation is driven by a mix of rapid product innovation, financial technology expansion, and regulatory tailwinds.

The proliferation of gig economy, lending (including BNPL), and expense management use cases—areas where Marqeta specializes and is achieving triple-digit growth abroad—continues to accelerate, driving higher volume and supporting both top-line and bottom-line growth as these verticals mature. Secular regulatory tailwinds, such as moves toward open banking and interoperability in key markets, are lowering barriers to entry and enabling faster international expansion for Marqeta. This provides an avenue for diversified and resilient revenue growth as legacy financial infrastructure is disrupted.

Want to see what’s fueling this optimistic narrative? The profit blueprint hints at unusually high future earnings, ambitious revenue goals, and bold profit margins. Craving the exact numbers and the logic behind that headline discount to fair value? Find out what’s driving Wall Street’s excitement and discover the surprises that await those who look beyond the surface.

Result: Fair Value of $6.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Marqeta’s heavy reliance on a handful of major customers and the rapidly shifting payments landscape could quickly reshape its growth outlook.

Find out about the key risks to this Marqeta narrative.

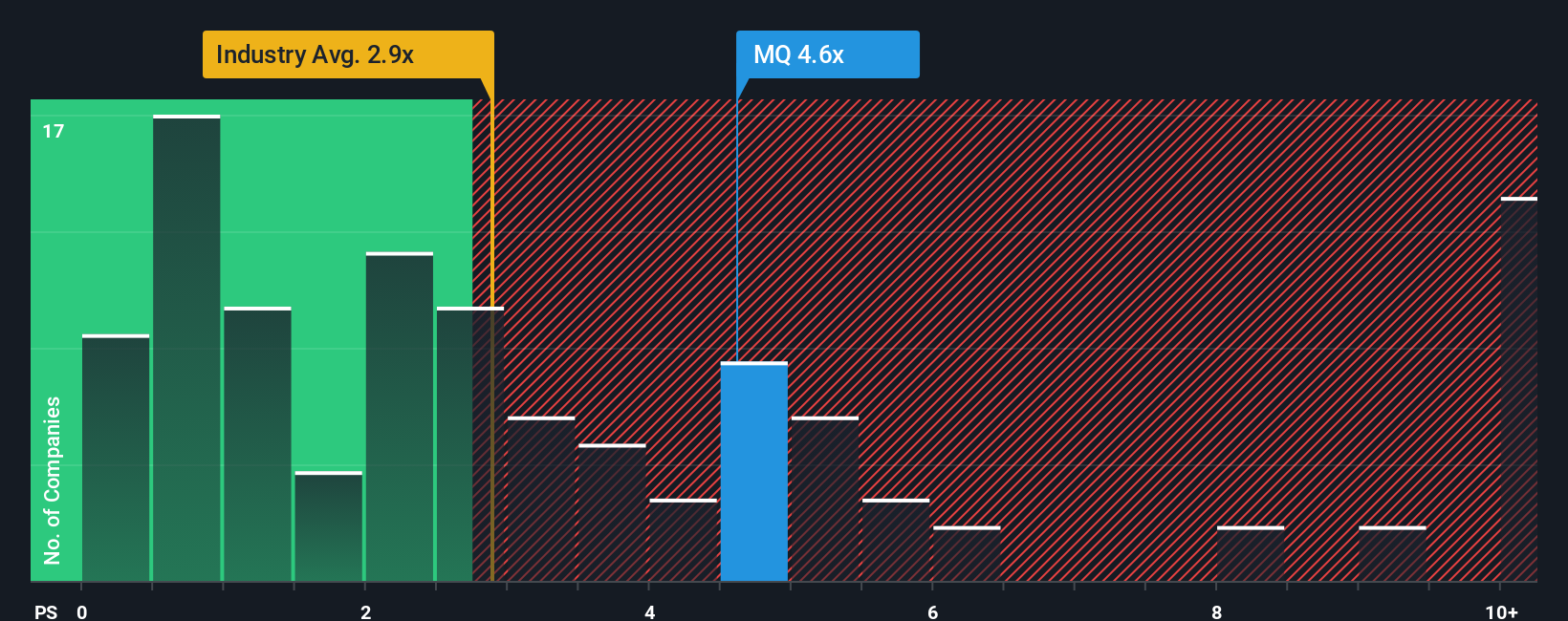

Another View: Market Multiple Says Caution

While a narrative-based fair value points to upside, a look at Marqeta’s price-to-sales ratio tells a different story. At 3.5x, it is not only higher than the US Diversified Financials industry average of 2.4x, but it also sits well above the peer group average of just 0.7x. The fair ratio, calculated at 2.6x, suggests the stock could still have room to fall if the market normalizes. The gap highlights valuation risk that investors should consider before assuming the discount to fair value is a green light.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you see things differently or want to dig into the numbers yourself, creating your own perspective takes just a few minutes. Do it your way.

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Your next big win could be waiting. Unlock the potential of tomorrow’s market leaders using our powerful stock screeners today.

- Uncover strong income streams by targeting these 16 dividend stocks with yields > 3% with reliable yields above 3% to balance your portfolio.

- Spot trailblazers at the intersection of healthcare and artificial intelligence and tap into the future of medicine with these 32 healthcare AI stocks.

- Capitalize on market mispricing and seek long-term value with these 876 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives