- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

Should MarketAxess Holdings’ (MKTX) New Credit Auctions and Dividend Boost Prompt Investor Moves?

Reviewed by Sasha Jovanovic

- MarketAxess Holdings recently reported third quarter revenue of US$208.82 million, surpassing analyst expectations, and announced a quarterly dividend of US$0.76 per share, payable on December 3, 2025.

- The company also unveiled plans to launch standardized Opening and Closing Auctions for U.S. credit, partnering with major industry participants to enhance price discovery and liquidity.

- We will examine how the launch of Opening and Closing Auctions may influence MarketAxess’s long-term growth outlook and competitive position.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MarketAxess Holdings Investment Narrative Recap

To be a MarketAxess shareholder, you need confidence in the ongoing digitization of bond markets, and the company’s ability to expand beyond its core US high-grade segment. The latest earnings beat and the planned launch of Opening and Closing Auctions may provide a short-term boost in market confidence, but the biggest risk, shifting large block trades to non-electronic channels, remains unchanged and could continue to pressure market share and fee growth. In the near term, this risk outweighs the impact of the recent product innovations. Among recent announcements, the rollout of Opening and Closing Auctions is the most relevant, as it signals MarketAxess’s ongoing investment in improving US credit market transparency and execution. This initiative is designed to address industry calls for better price discovery and liquidity, directly linking to both the company’s core catalyst of electronic migration and the competitive pressures it faces from established and emerging rivals. Yet, despite visible innovation, investors should also remain aware of what could happen if ...

Read the full narrative on MarketAxess Holdings (it's free!)

MarketAxess Holdings is projected to deliver $1.1 billion in revenue and $370.5 million in earnings by 2028. This requires 7.9% annual revenue growth and a $147.7 million increase in earnings from the current $222.8 million.

Uncover how MarketAxess Holdings' forecasts yield a $202.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

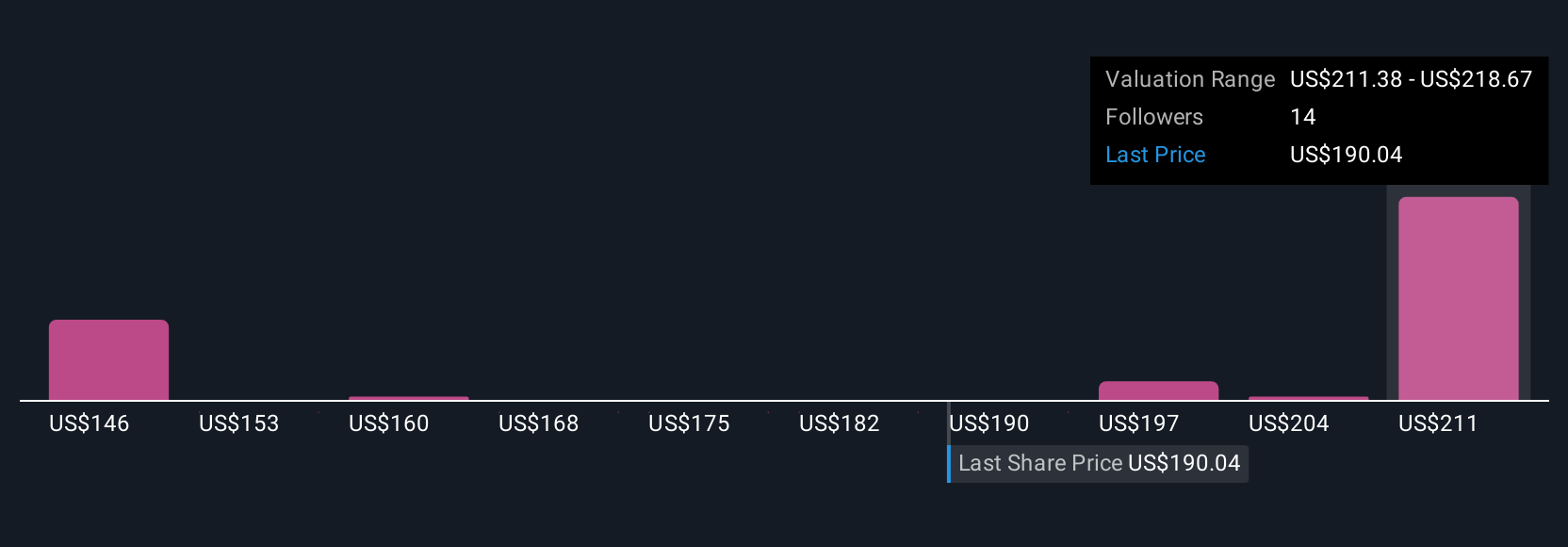

Five fair value opinions from the Simply Wall St Community range from US$140.77 to US$206.63. While some expect upside, fee compression and competition could limit how much profit growth MarketAxess ultimately realizes.

Explore 5 other fair value estimates on MarketAxess Holdings - why the stock might be worth 16% less than the current price!

Build Your Own MarketAxess Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MarketAxess Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MarketAxess Holdings' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives