- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

A Fresh Look at Merchants Bancorp (MBIN) Valuation After CEO's Insider Buy and Analyst Support

Reviewed by Simply Wall St

Merchants Bancorp (MBIN) is back in focus after Michael R. Dury, CEO of Merchants Capital, purchased 15,500 shares of the company’s stock. The move comes just after management reported higher third quarter charge-offs and lower earnings, raising questions for investors around the bank’s outlook.

See our latest analysis for Merchants Bancorp.

Despite recent headline-grabbing charge-offs and sliding earnings, Merchants Bancorp’s share price has held up in the short term, closing at $31.45. Over the past year, however, shareholders experienced a total return decline of 21.8%, signaling ongoing uncertainty. The stock’s 30% three-year and impressive 101% five-year total returns show that longer-term momentum remains intact.

If you’re rethinking your approach to finding potential growth stories with strong insider confidence, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading at a notable discount to analyst targets, accompanied by insider buying and analyst optimism, investors are left to consider whether Merchants Bancorp is attractively undervalued or if the market already reflects its true growth trajectory.

Price-to-Earnings of 7.2x: Is it justified?

Merchants Bancorp’s current price-to-earnings ratio of 7.2x stands well below both its industry and peer averages, suggesting an attractive discount at the last close price of $31.45.

The price-to-earnings ratio, or P/E, measures how much investors pay for each dollar of annual profit and is a key yardstick for banks and financial firms. This ratio is especially relevant here because it can reflect market expectations around profit growth, risk, or both.

At 7.2x, Merchants Bancorp is being valued far lower than the U.S. Diversified Financial industry average of 15.2x and also sits well below its estimated fair P/E of 13.8x. This level could highlight market skepticism about near-term growth, but it also means that if earnings improve or sentiment shifts, there is significant room for re-rating. The current multiple looks undervalued against both industry standards and the company’s own fair ratio calculated from core fundamentals.

Explore the SWS fair ratio for Merchants Bancorp

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, ongoing revenue and net income pressures or a shift in investor sentiment could quickly outweigh the apparent value opportunity in Merchants Bancorp shares.

Find out about the key risks to this Merchants Bancorp narrative.

Another View: What Does the DCF Say?

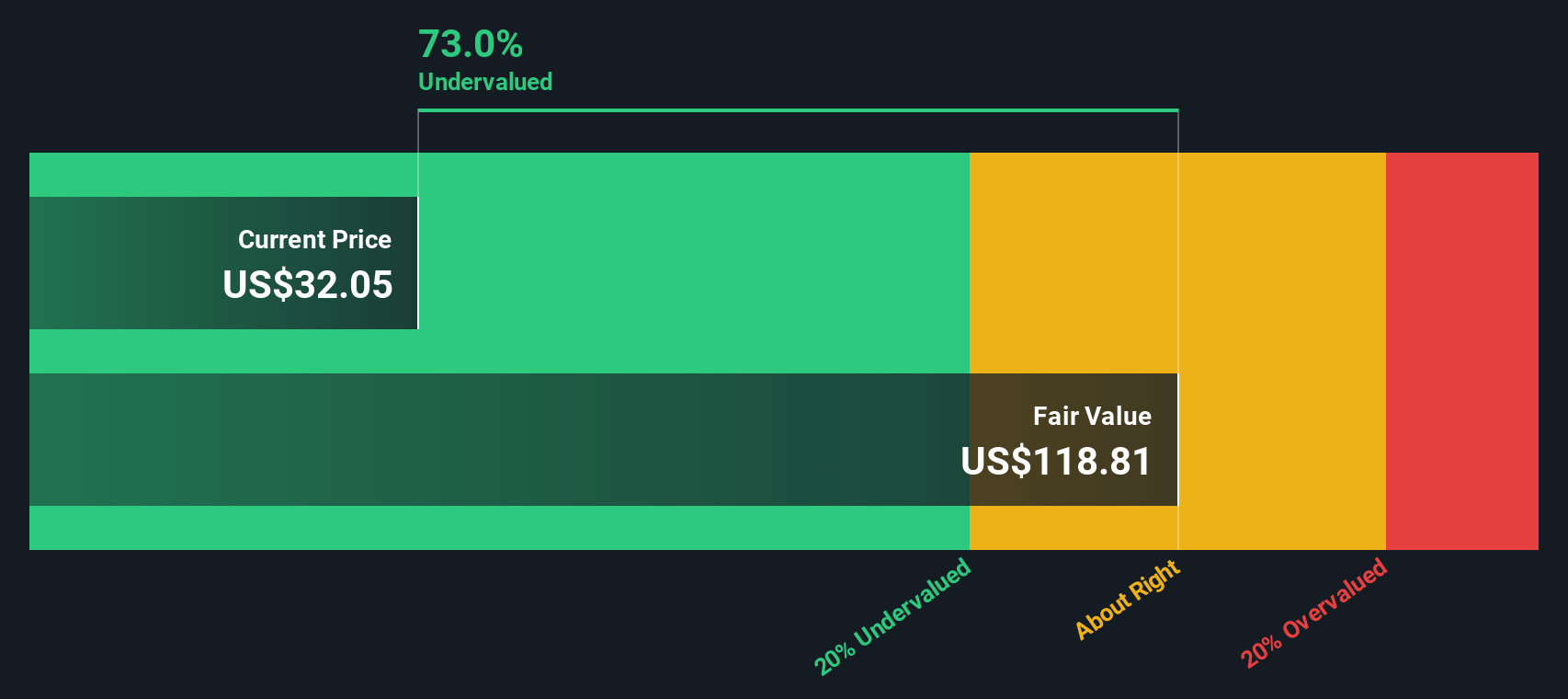

Looking at Merchants Bancorp through the lens of our DCF model tells a different story. According to this approach, the shares are trading a massive 73.9% below fair value. This deep discount is far larger than what the earnings multiple suggests. Could the market be overlooking something major here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Merchants Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Merchants Bancorp Narrative

If you want to form your own view, you can sift through the numbers and build your own storyline for Merchants Bancorp in just a few minutes, so why not Do it your way

A great starting point for your Merchants Bancorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There is no need to stick with the usual picks. You can open up a world of investment opportunities with screener tools designed to spot truly promising trends and outliers.

- Uncover companies making waves in artificial intelligence by checking out these 25 AI penny stocks. Groundbreaking automation and smart tech are shaping tomorrow’s leaders.

- Boost your portfolio’s long-term income by tapping into these 17 dividend stocks with yields > 3%. This features opportunities in stocks offering yields greater than 3% and strong payout records.

- Get ahead of market trends and see what’s next by reviewing these 82 cryptocurrency and blockchain stocks. This screener reveals businesses at the forefront of cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives