- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

Hamilton Lane (HLNE): Valuation Insights Following Landmark Guardian Partnership and Strong Earnings Growth

Reviewed by Simply Wall St

Hamilton Lane (HLNE) is making headlines after securing a major long-term strategic partnership with The Guardian Life Insurance Company. The agreement involves managing Guardian’s large private equity portfolio and facilitating ongoing annual investment commitments.

See our latest analysis for Hamilton Lane.

Momentum is building for Hamilton Lane after a flurry of positive headlines, including robust earnings growth, a sizable dividend hike, and several key senior appointments announced over recent weeks. The share price bounced back 13.4% in the past week and remains up 10.2% over the past month. However, the one-year total shareholder return is still down 34%. Over the longer term, Hamilton Lane boasts a strong 89% total shareholder return across three years, reflecting the company’s growing relevance and the long-term payoff of its strategic initiatives.

If the surge in activity at Hamilton Lane has you searching for your next opportunity, now could be the perfect time to broaden your focus and discover fast growing stocks with high insider ownership

With shares still far below their peak, fundamentals improving, and analysts seeing notable upside, the question now is whether Hamilton Lane is truly undervalued or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 17.1% Undervalued

Hamilton Lane’s most widely followed valuation narrative points to a fair value of $157.17 per share, which represents a significant premium to the last close of $130.35. This sets the stage for debate over whether the market is missing the scale of expected growth or pricing in too much caution.

“Healthy pipeline/backlog in customized separate accounts and perpetual fundraising strategies creates forward visibility into recurring revenue streams and earnings growth, while the high unrealized carry balance (~$1.3 billion) points to potential for strong incentive fee income as more favorable macro conditions enable exits and crystallization of performance fees.”

How does this narrative justify such a premium? There is a bold call on the power of recurring revenues and incentive fees hiding in the details. The real story here is driven by aggressive assumptions about future profitability and long-term pipeline strength. Want to see the quantitative growth drivers that fuel this target? The full narrative breaks down exactly what is built into that higher fair value.

Result: Fair Value of $157.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures and intensifying competition could quickly erase the expected upside if margins compress or fee growth slows unexpectedly.

Find out about the key risks to this Hamilton Lane narrative.

Another View: What Do Market Multiples Say?

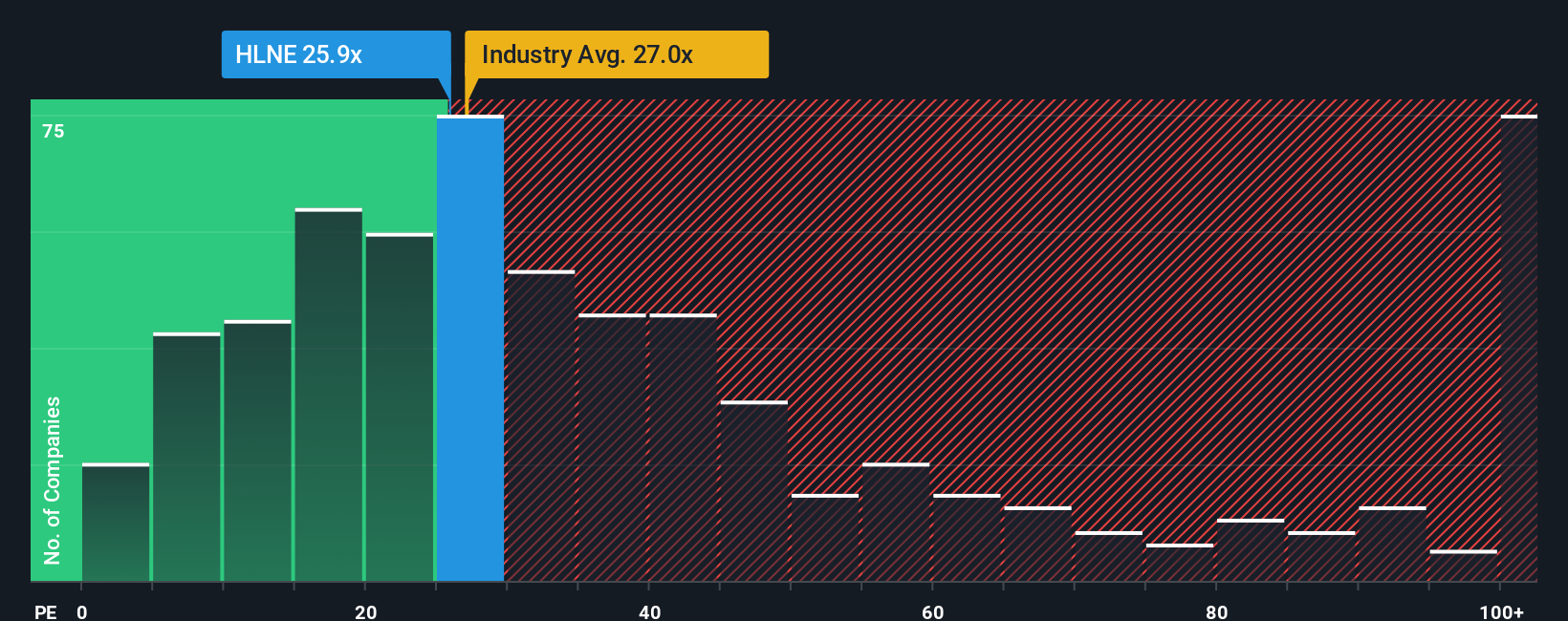

While analyst narratives point to Hamilton Lane being undervalued, a look at the price-to-earnings ratio tells a different story. The stock trades at 25.1 times earnings, which is noticeably higher than its peers averaging 12.7 times and above the industry’s 24.2 average. This signals investors are already paying a premium, raising questions about how much upside remains if growth expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hamilton Lane Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own take on Hamilton Lane’s outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hamilton Lane.

Looking for More Investment Ideas?

Expand your watchlist with unique, high-potential opportunities. Missing out could mean passing up on tomorrow’s breakout performers. Try these handpicked investing angles recommended by Simply Wall Street:

- Snag recurring income by targeting strong payers with these 16 dividend stocks with yields > 3% that boast yields over 3 percent.

- Catch the next big trend in technology by jumping into these 24 AI penny stocks featuring innovators at the forefront of artificial intelligence.

- Position yourself ahead of the curve by reviewing these 863 undervalued stocks based on cash flows now poised for future upside based on their robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives