- United States

- /

- Capital Markets

- /

- NasdaqCM:BULL

Is Webull’s Recent Fintech Partnership a Sign the Market Is Missing Its Real Value?

Reviewed by Bailey Pemberton

- Ever wondered if Webull is priced for a breakout, or if the market is missing something about its real value? You are definitely not alone.

- The stock has had a bumpy ride lately, sliding 10.9% over the past week and now down 17.0% for the year to date. This could signal shifting views about its growth outlook or risk.

- Many investors are still digesting Webull’s recent expansion into new financial products, as well as a high-profile partnership with a major fintech firm announced earlier this month. These moves have stirred up fresh conversation around the stock and have clearly influenced its recent price swings.

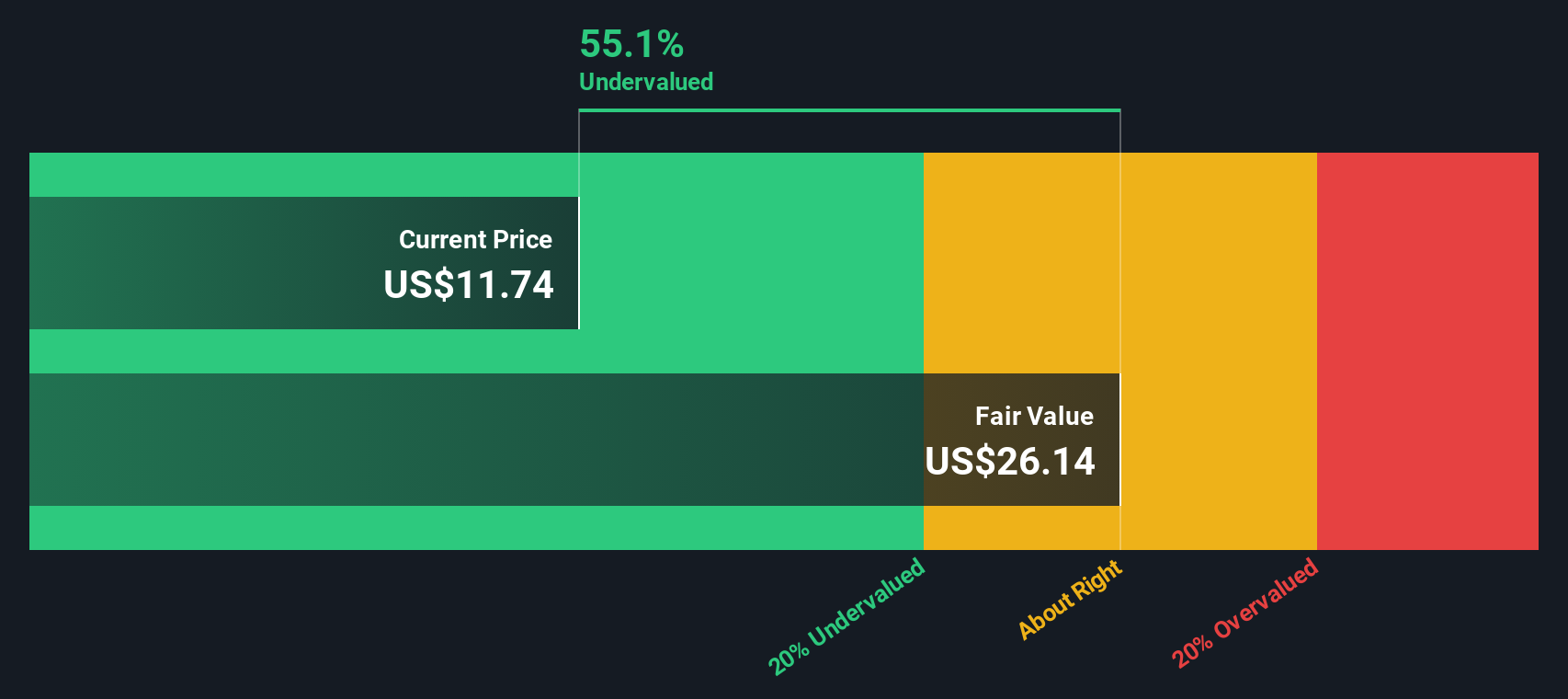

- Currently, Webull earns a valuation score of 3 out of 6, meaning it appears undervalued by half of the typical checks analysts use. Next, we will walk through the main valuation methods and, at the end, reveal a more holistic way to think about a stock's true worth.

Find out why Webull's -16.0% return over the last year is lagging behind its peers.

Approach 1: Webull Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This gives investors a present-day estimate of what the company's future profits are worth.

For Webull, the latest reported Free Cash Flow (FCF) stands at $385.5 million. Over the next decade, analysts and projection methods anticipate steady increases, with estimated FCF reaching $899.2 million by 2035. Growth rates begin above 20% and gradually slow to around 4% as time goes on. These forecasts combine analysts' estimates for the early years and extrapolated data for later periods.

Applying the DCF model, the fair value per share for Webull comes to $26.43. Compared to its recent trading price, this implies the stock is trading at a 63.5% discount to its intrinsic value. In other words, DCF analysis suggests Webull is considerably undervalued at current market levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Webull is undervalued by 63.5%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Webull Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted valuation metric for profitable companies like Webull, as it ties a company's market price directly to its ability to generate earnings. This makes it a clear, straightforward benchmark for comparing how the market values a company relative to its profits.

However, what counts as a "normal" or "fair" PE ratio can vary greatly depending on expectations for future growth and the perceived level of risk. Companies expected to grow faster or carry less risk usually warrant higher PE multiples, while those with slower growth or more uncertainty typically trade at lower ratios.

Webull currently trades at a PE ratio of 63.68x. For context, the average PE ratio among similar peers is 10.12x, and the broader Capital Markets industry average stands at 24.10x. At first glance, this suggests Webull is priced far above both its direct competition and its broader industry.

Simply Wall St's proprietary “Fair Ratio” adds another layer to this analysis. Unlike a simple comparison with peers or industry averages, the Fair Ratio considers Webull’s specific growth prospects, profit margins, size and risk profile. For Webull, the Fair Ratio is calculated at 268.63x, much higher than its current PE. This more customized benchmark indicates what an adjusted, justified multiple should be for Webull’s unique situation, making it a more reliable valuation reference.

Given Webull’s current PE ratio of 63.68x is well below its Fair Ratio of 268.63x, this analysis suggests the stock is undervalued on a PE basis, despite looking expensive relative to its peers and industry.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Webull Narrative

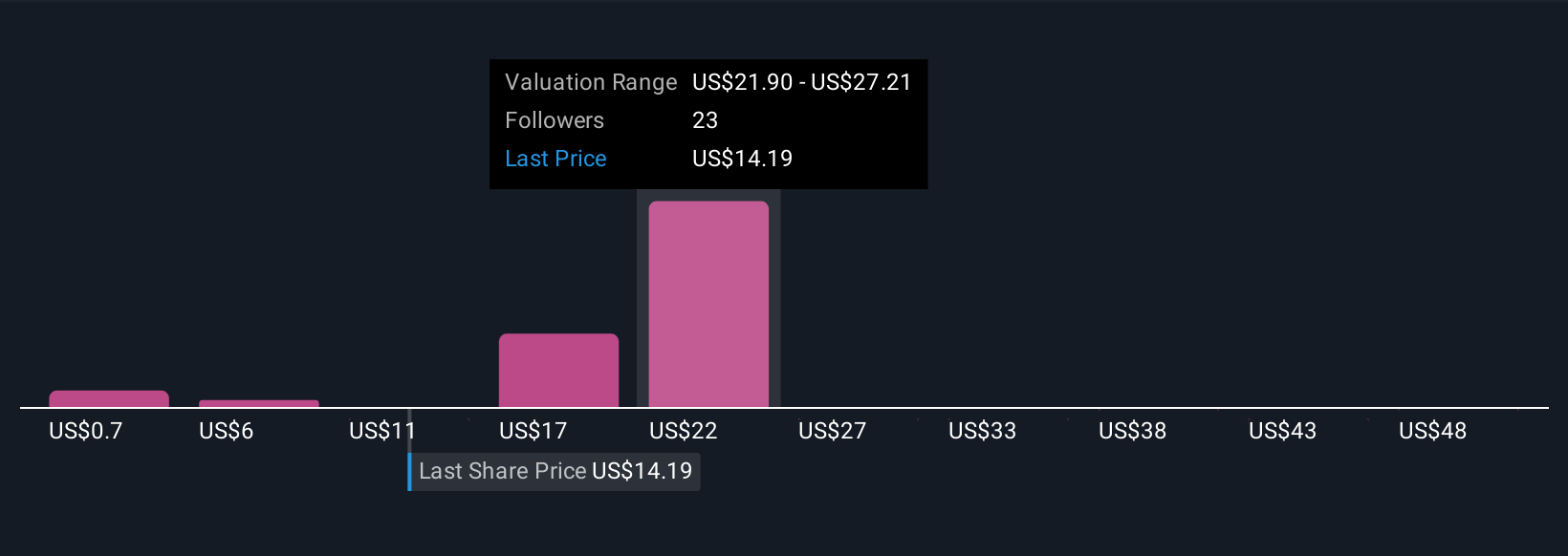

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company. It connects your perspective on Webull's business (like where you think its revenue, earnings, and margins are headed) to a financial forecast and a fair value, going beyond just the numbers on a page.

With Narratives, you do not just see a number. You make your own forecast and then compare it to what other investors believe, all within the Community page on Simply Wall St's platform. Narratives make investing accessible and actionable, as millions of users share their reasoning and projections, updating dynamically as news and earnings reports break.

Using Narratives, you can decide if now is the right time to buy, hold or sell by comparing your estimate of Fair Value with today's Price. This sharpens your decision-making process and helps you cut through market noise.

For example, the most bullish Narrative for Webull expects overseas expansion and crypto trading to drive 30.7% annual revenue growth and a future Fair Value of $18.50 per share, while the most cautious views focus on tougher competition and pricing pressure to justify values much lower. The story you believe will shape your investment decisions.

Do you think there's more to the story for Webull? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webull might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BULL

High growth potential with adequate balance sheet.

Market Insights

Community Narratives