- United States

- /

- Capital Markets

- /

- NasdaqGM:ASST

Why Strive Asset Management (ASST) Is Up 19.8% After Launching High-Yield Preferred Stock to Fund Bitcoin Expansion

Reviewed by Sasha Jovanovic

- Strive Asset Management recently announced the issuance of 1.25 million shares of a new preferred stock, SATA, offering an initial 12% annual dividend to raise funds for increased Bitcoin purchases and operational expansion.

- This move highlights the company's intent to finance digital asset growth without diluting current shareholders, drawing inspiration from approaches used by other bitcoin-focused firms.

- We’ll explore how Strive’s plan to use preferred stock offerings for bitcoin accumulation could reshape its overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Strive Asset Management's Investment Narrative?

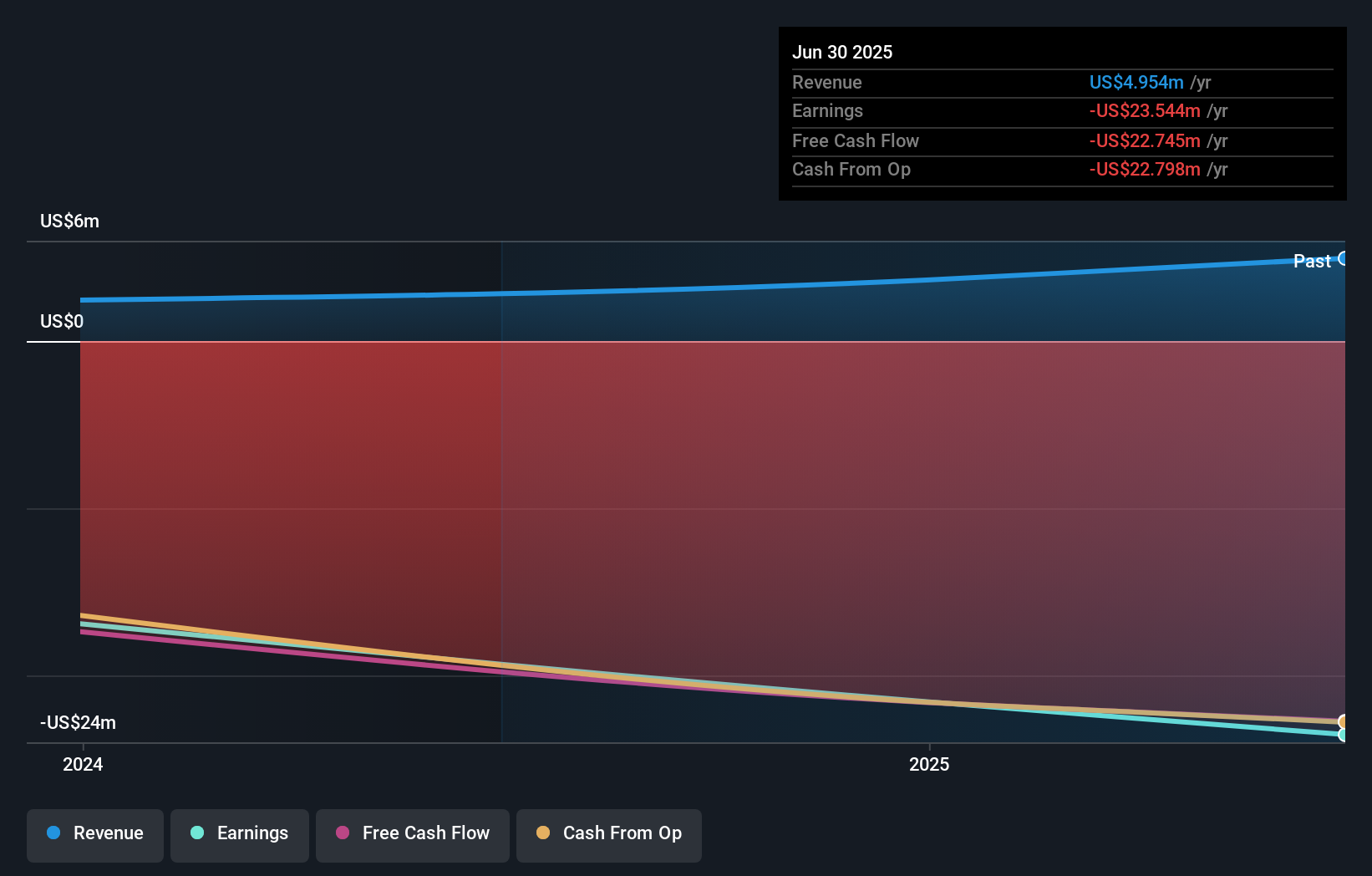

Being a Strive Asset Management shareholder means believing in the firm's bold conviction around Bitcoin accumulation as a core strategy, and being comfortable with the real risks that accompany it. The recent announcement of the 1.25 million SATA preferred share issuance stands out as potentially material for both near-term catalysts and downside risks. Instead of diluting common shareholders, Strive is choosing high-yield preferred shares to fuel further Bitcoin purchases and expand its operations, a move reminiscent of other cryptocurrency-focused companies. This could offer a shot of growth capital, but also commits the firm to substantial dividend obligations at a time when it is still unprofitable, has very limited revenues (US$4,953,567), and has a high share price volatility record. The shift could amplify both the upside if Bitcoin rallies and the financial risk if performance falters. Short-term catalysts, such as increased Bitcoin holdings, new leadership appointments, and recent index inclusion, now mix with heightened funding costs and ongoing legal disputes, making risk management and execution even more critical for forward progress. For those tracking Strive, the SATA news amplifies both the stakes and the potential rewards.

But what happens if Bitcoin prices stagnate or decline, are Strive’s new obligations sustainable?

Exploring Other Perspectives

Explore 2 other fair value estimates on Strive Asset Management - why the stock might be worth over 8x more than the current price!

Build Your Own Strive Asset Management Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strive Asset Management research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Strive Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strive Asset Management's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ASST

Adequate balance sheet with slight risk.

Market Insights

Community Narratives