- United States

- /

- Consumer Services

- /

- NYSE:BFAM

Assessing Bright Horizons Family Solutions (BFAM) Valuation Following Strong Q3 Results and 2025 Guidance Update

Reviewed by Simply Wall St

Bright Horizons Family Solutions (BFAM) just delivered its third quarter earnings and updated outlook for 2025, showing higher revenue and net income compared to last year. The results have drawn fresh attention from investors who are interested in the company’s financial trajectory.

See our latest analysis for Bright Horizons Family Solutions.

Following its upbeat earnings and new 2025 guidance, Bright Horizons Family Solutions has attracted fresh attention, yet momentum in the stock has faded in recent months. Despite higher revenue and a buyback completion, the 1-year total shareholder return is down 13.5%, contrasting with a robust 3-year total return of 32.5%. This highlights a mix of short-term pressure and longer-term value for patient investors.

If you’re weighing what else might offer promising upside, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets and robust earnings growth in hand, the big question remains: is Bright Horizons truly undervalued, or has the market already accounted for its future gains?

Most Popular Narrative: 23.9% Undervalued

Bright Horizons Family Solutions trades at $98.46, while the most closely followed narrative pegs its fair value significantly higher. The community’s focus is on the company’s next stage of growth and an earnings outlook that challenges prevailing market sentiment.

The expansion of employer-sponsored childcare and growing demand from large corporate clients such as McKesson and Centene point to a resilient pipeline for Bright Horizons, as employers increasingly view high-quality childcare as a critical employee benefit to attract and retain talent. This is likely to drive recurring B2B revenue growth and improve customer retention, positively impacting the company's top-line and earnings visibility.

Why do analysts see so much more upside for this stock? The answer lies in bold, long-term projections for revenue and earnings, plus a profit margin leap that could surprise even bullish investors. These high expectations form the basis for an aggressive fair value. This hints at financial trends you may not see coming in the headline numbers.

Result: Fair Value of $129.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing enrollment challenges and persistent center underperformance could limit margin recovery and reduce the case for sustained valuation upside.

Find out about the key risks to this Bright Horizons Family Solutions narrative.

Another View: What Market Ratios Are Saying

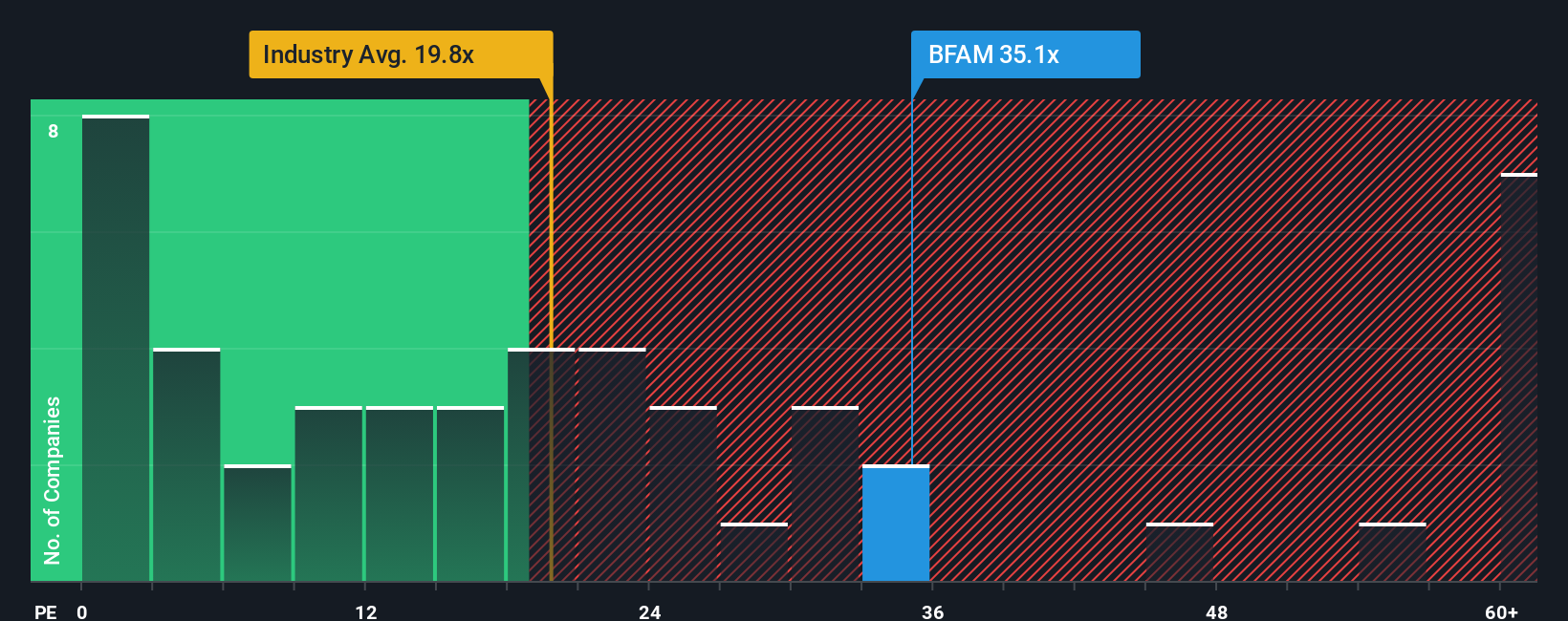

Looking at valuation through market ratios, Bright Horizons trades at a price-to-earnings ratio of 27.8x, which is not only higher than the US Consumer Services industry average of 15.9x, but also above the average of its peers at 22.9x and the fair ratio of 23.4x. This premium suggests investors expect above-average growth, but it also raises the risk that the market could correct if growth disappoints. Is this optimism justified, or a sign to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bright Horizons Family Solutions Narrative

If you want to challenge the consensus or dig into the details yourself, it’s quick and simple to craft your own analysis to see how your view stacks up. Do it your way

A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There’s a world of potential beyond Bright Horizons. Expand your watchlist and increase your chances of success by targeting proven strategies in today’s market.

- Boost your income potential and stability with high-yield picks by securing positions among these 16 dividend stocks with yields > 3% offering yields above 3%.

- Tap into tomorrow’s tech breakthroughs as you join the race for innovation with these 28 quantum computing stocks focused on quantum computing advancements.

- Ride the next wave of financial disruption by grabbing your seat early with these 82 cryptocurrency and blockchain stocks leading the charge in crypto and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bright Horizons Family Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives