In a week marked by investor optimism over potential Federal Reserve rate cuts, small-cap stocks have outperformed their larger counterparts, benefiting from the broad-based gains in the market. With this favorable backdrop, identifying undervalued small-cap stocks with insider buying can be particularly rewarding for investors seeking opportunities in a dynamic economic environment. A good stock to consider in such conditions often exhibits solid fundamentals and strong insider confidence, which may signal potential for growth despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ramaco Resources | 11.5x | 0.9x | 38.57% | ★★★★★★ |

| Bytes Technology Group | 24.4x | 5.5x | 13.33% | ★★★★★☆ |

| Essentra | 848.9x | 1.6x | 47.21% | ★★★★★☆ |

| Norcros | 7.4x | 0.5x | 3.23% | ★★★★☆☆ |

| Trican Well Service | 8.2x | 1.0x | 5.07% | ★★★★☆☆ |

| Sagicor Financial | 1.4x | 0.3x | -45.06% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.3x | 3.0x | 43.84% | ★★★★☆☆ |

| NSI | NA | 4.5x | 44.06% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Titan Machinery | 3.4x | 0.1x | -26.86% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

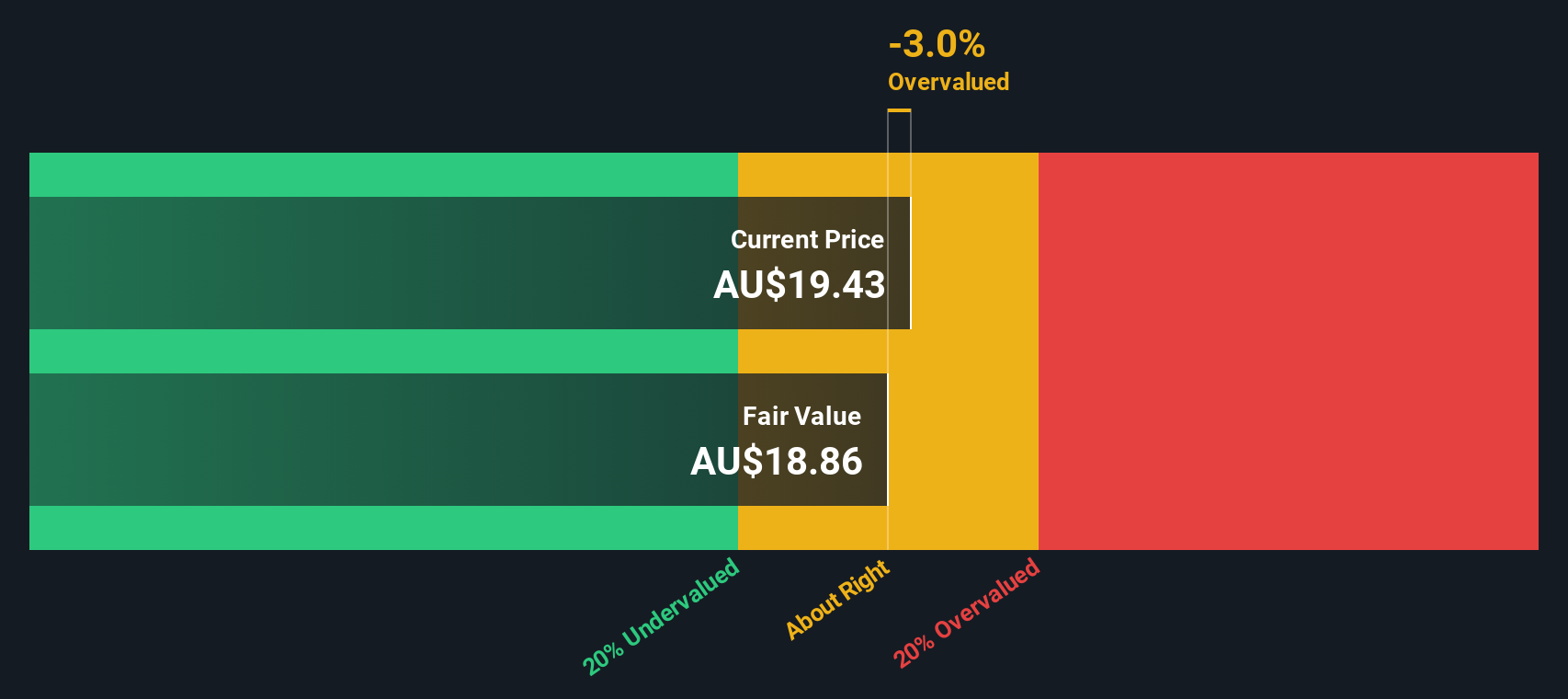

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Codan is a technology company specializing in communications and metal detection solutions, with a market cap of A$1.10 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with the Communications segment contributing A$326.91 million and Metal Detection A$219.85 million. The company's gross profit margin has shown variability, peaking at 60.25% in June 2017 and most recently recorded at 54.55% in March 2024. Operating expenses have consistently included significant allocations to Sales & Marketing and R&D, with recent figures being A$106.68 million and A$35.98 million respectively for June 2024.

PE: 33.1x

Codan's recent financial performance highlights its small cap potential, with sales reaching A$550.46 million for the year ending June 30, 2024, up from A$456.5 million previously. Net income also rose to A$81.39 million from A$67.7 million last year, and basic earnings per share increased to A$0.45 from A$0.375 a year ago. Notably, insider confidence is evident with significant share purchases over the past six months, indicating strong belief in Codan's future growth prospects despite higher risk funding sources.

- Dive into the specifics of Codan here with our thorough valuation report.

Understand Codan's track record by examining our Past report.

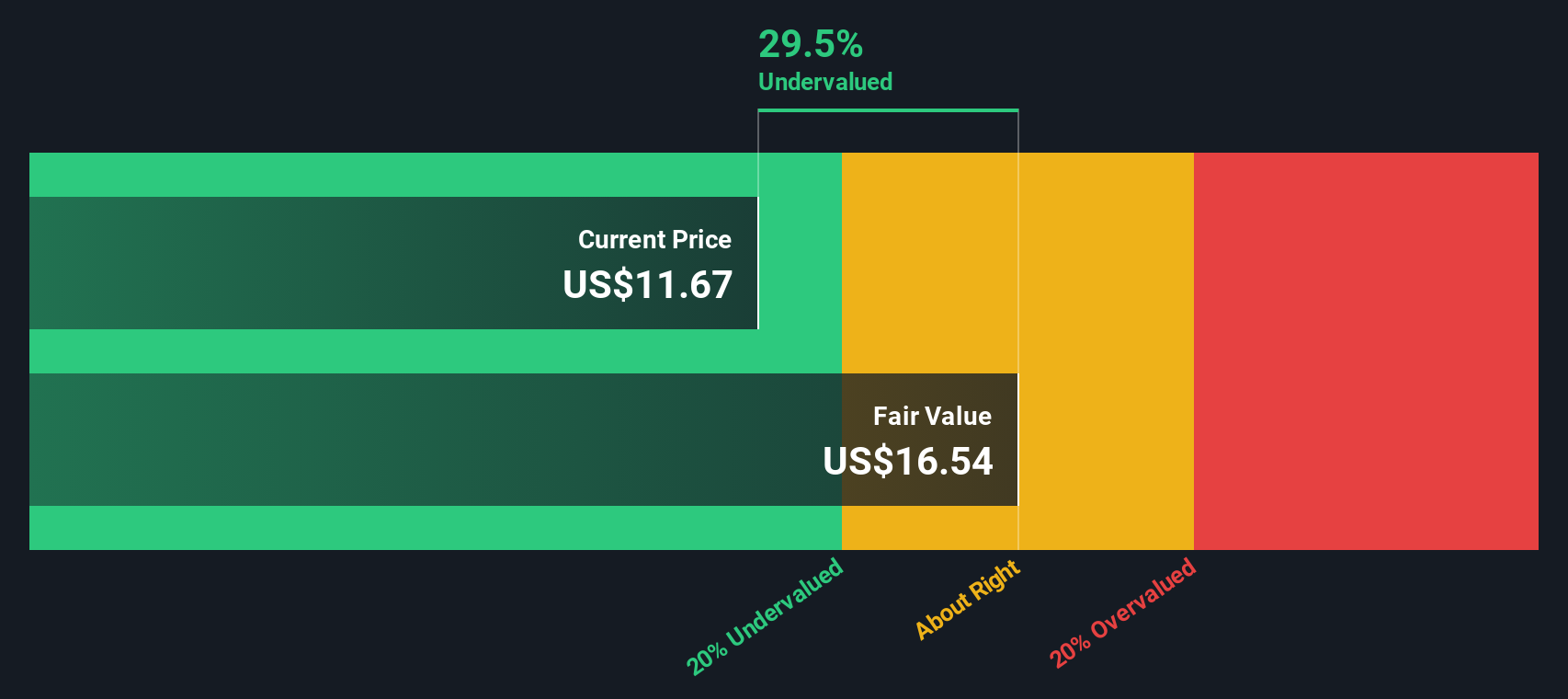

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates expedition cruises and adventure travel experiences, with a market cap of approximately $0.59 billion.

Operations: Lindblad generates revenue primarily from its Lindblad and Land Experiences segments, with recent figures showing $405.86 million and $185.61 million respectively. The company's gross profit margin has seen an upward trend, reaching 44.10% as of June 2024.

PE: -10.1x

Lindblad Expeditions Holdings, known for its niche in expedition cruising, has shown insider confidence with recent share purchases. Despite a net loss of US$24.67 million in Q2 2024, sales increased to US$136.5 million from US$124.8 million a year ago. The company recently closed a Shelf Registration worth nearly US$6 million and is expanding its Galápagos fleet with two new vessels set for revitalization by January 2025, signaling potential future growth.

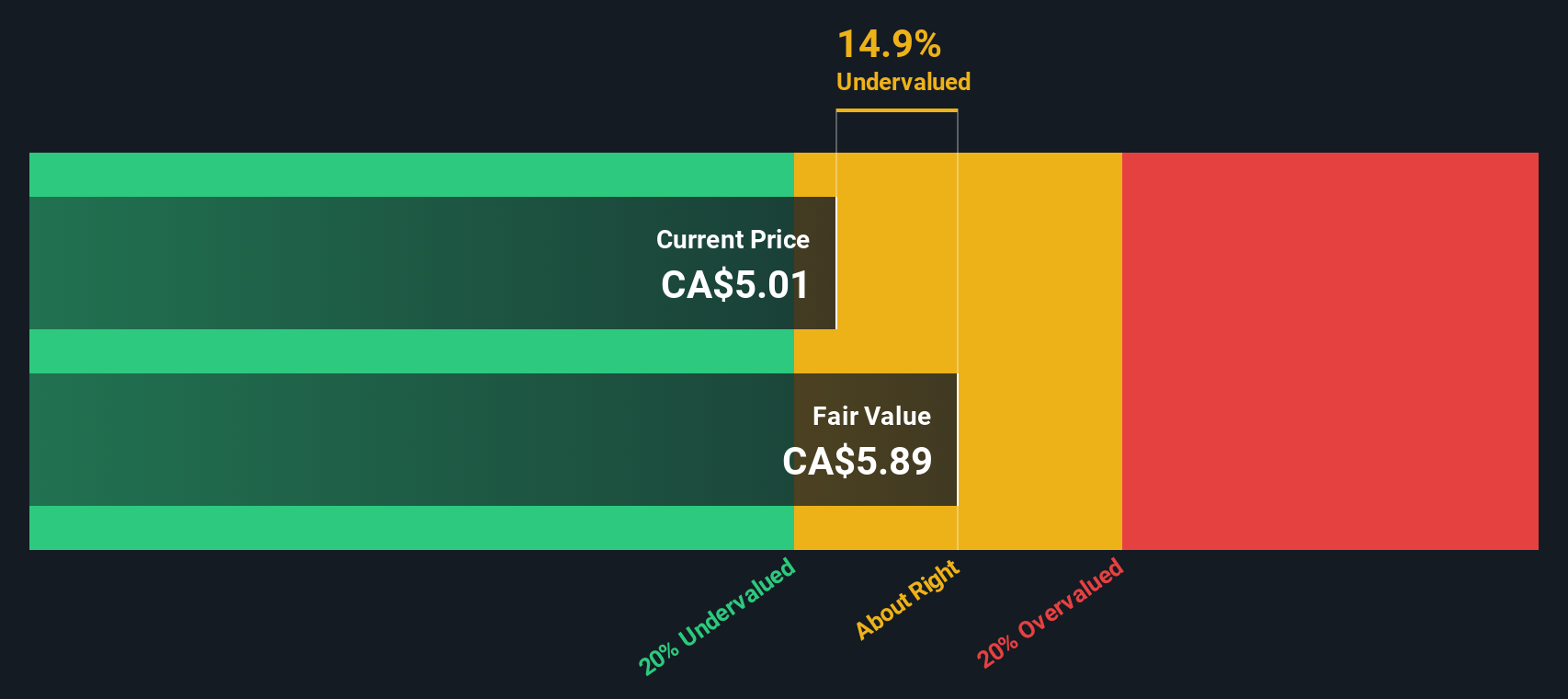

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry with a focus on owning and managing properties, and has a market cap of approximately CA$2.82 billion.

Operations: The company's primary revenue stream is from the healthcare real estate industry, generating CA$523.85 million as of the latest period. Operating expenses and non-operating expenses significantly impact net income, with recent figures showing a net loss of CA$394.40 million against a gross profit of CA$407.60 million. The gross profit margin stands at 77.81%.

PE: -3.3x

NorthWest Healthcare Properties Real Estate Investment Trust, a smaller player in the REIT sector, recently declared a monthly distribution of CAD$0.03 per unit for August 2024. Despite reporting a net loss of CAD$122.34 million for Q2 2024, insiders have shown confidence by purchasing shares over the past few months. The company’s reliance on external borrowing poses some risk, but its consistent dividend payouts and forecasted earnings growth suggest potential resilience and future value for investors seeking undervalued opportunities in healthcare real estate.

- Get an in-depth perspective on NorthWest Healthcare Properties Real Estate Investment Trust's performance by reading our valuation report here.

Learn about NorthWest Healthcare Properties Real Estate Investment Trust's historical performance.

Taking Advantage

- Investigate our full lineup of 218 Undervalued Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners.

Excellent balance sheet with reasonable growth potential.