- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Will Duolingo's (DUOL) User Growth Focus Delay the Path to Sustainable Monetization?

Reviewed by Sasha Jovanovic

- Duolingo reported third-quarter 2025 results, delivering US$271.71 million in sales and net income of US$292.2 million, both exceeding analyst expectations and representing substantial year-on-year growth.

- Despite the stronger financial performance, management revealed a focus on long-term user growth and educational quality, which may postpone near-term profit expansion and monetization.

- We’ll examine how Duolingo's decision to prioritize user base growth over immediate monetization impacts its overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Duolingo Investment Narrative Recap

To be a Duolingo shareholder today, you have to believe in the company’s ability to turn strong user growth and ongoing investments in educational quality into long-term earnings power. While the recent earnings beat highlighted Duolingo’s robust top-line and profit expansion, stock performance has been hit by softer-than-expected fourth-quarter guidance and slower active user growth, making the near-term outlook for both revenue acceleration and margin expansion less clear. The main risk for the business right now is that decelerating daily and monthly active user growth in core markets may limit future revenue gains; this is still highly relevant following the latest results.

Of the recent announcements, the launch of the Duolingo Score integration with LinkedIn stands out. By allowing users to showcase their language proficiency directly to potential employers, Duolingo strengthens the platform’s practical value, supporting greater user engagement and possibly helping to offset short-term user growth concerns by making its ecosystem more indispensable.

Yet, despite impressive quarterly earnings, investors should be mindful that slowing user growth in mature markets could mean...

Read the full narrative on Duolingo (it's free!)

Duolingo's narrative projects $1.7 billion revenue and $368.7 million earnings by 2028. This requires 23.7% yearly revenue growth and a $251.5 million earnings increase from $117.2 million today.

Uncover how Duolingo's forecasts yield a $442.74 fair value, a 130% upside to its current price.

Exploring Other Perspectives

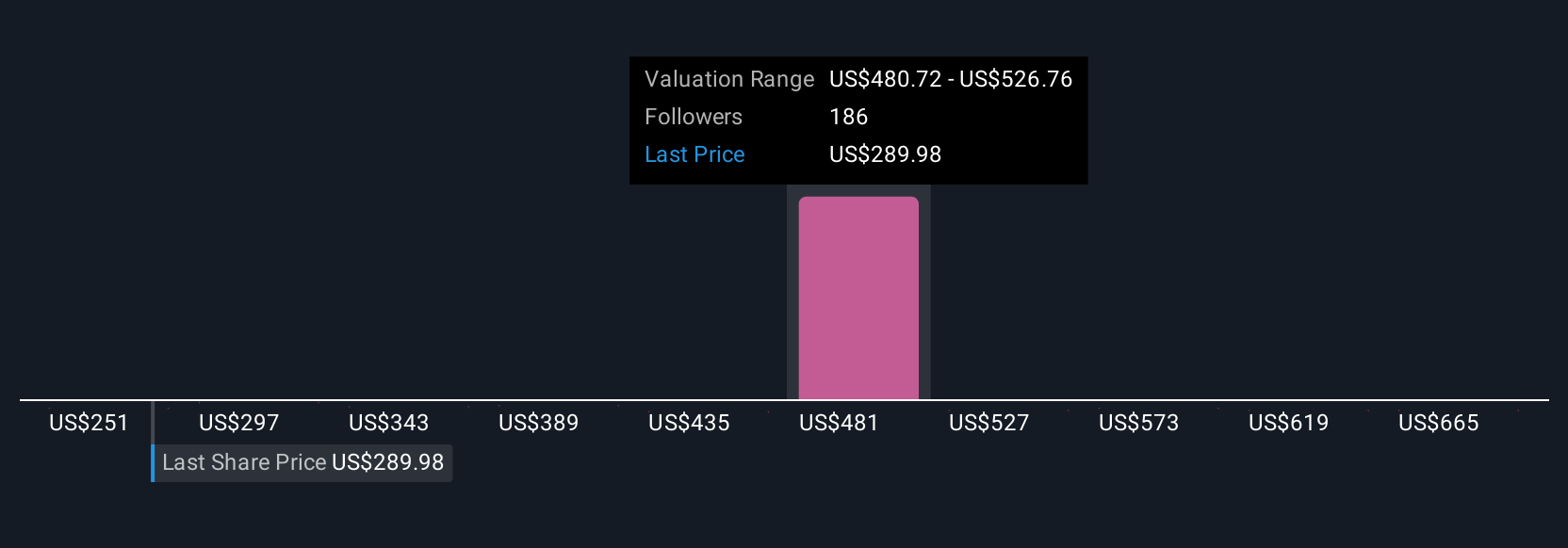

Simply Wall St Community members submitted 24 fair value estimates for Duolingo, ranging from US$250.52 to US$680.60 per share. This diversity of investor views highlights why potential slowing user growth in key regions remains important for you to consider in assessing Duolingo’s future direction.

Explore 24 other fair value estimates on Duolingo - why the stock might be worth just $250.52!

Build Your Own Duolingo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Duolingo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duolingo's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives