- United States

- /

- Consumer Services

- /

- NasdaqGS:DRVN

Will Revenue Growth and Upbeat Guidance Reshape Driven Brands Holdings' (DRVN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Driven Brands Holdings Inc. recently reported third quarter results, delivering year-over-year revenue growth to US$535.68 million, a turnaround to net income of US$60.86 million, and raised its full-year earnings guidance for 2025.

- The company's continued expansion of its Take 5 Oil Change segment, alongside organizational changes and improved leverage, signals a focus on strengthening both operational and financial stability.

- Let's examine how Driven Brands' improved profitability and updated outlook may shape its investment narrative moving forward, especially given ongoing momentum in same-store sales growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Driven Brands Holdings Investment Narrative Recap

Investors who see long-term value in Driven Brands Holdings are likely focused on its ability to grow recurring service revenues, expand its Take 5 Oil Change footprint, and deliver improved profitability, even as competition, changing vehicle technology, and slowing same-store sales growth pose pressures. The latest quarterly results highlight continued revenue growth and a significant swing to profitability, but ongoing softness in the Franchise Brands segment remains the most important near-term challenge. Short-term momentum from Take 5 is helping offset these risks for now.

One of the most relevant recent developments is Driven Brands' updated fiscal year 2025 guidance, which confirms revenue expectations between US$2.10 and US$2.12 billion and narrows same-store sales growth to the low end of the initial 1 percent to 3 percent range. This more cautious outlook comes as management sustains its net new store targets, keeping store network growth a key element of the near-term story.

However, even as results improve, investors should be mindful of the persistent weakness in same-store sales for legacy Franchise Brands, since ...

Read the full narrative on Driven Brands Holdings (it's free!)

Driven Brands Holdings' outlook anticipates $2.6 billion in revenue and $250.1 million in earnings by 2028. Achieving this would require 2.8% annual revenue growth and a $556.7 million increase in earnings from the current level of -$306.6 million.

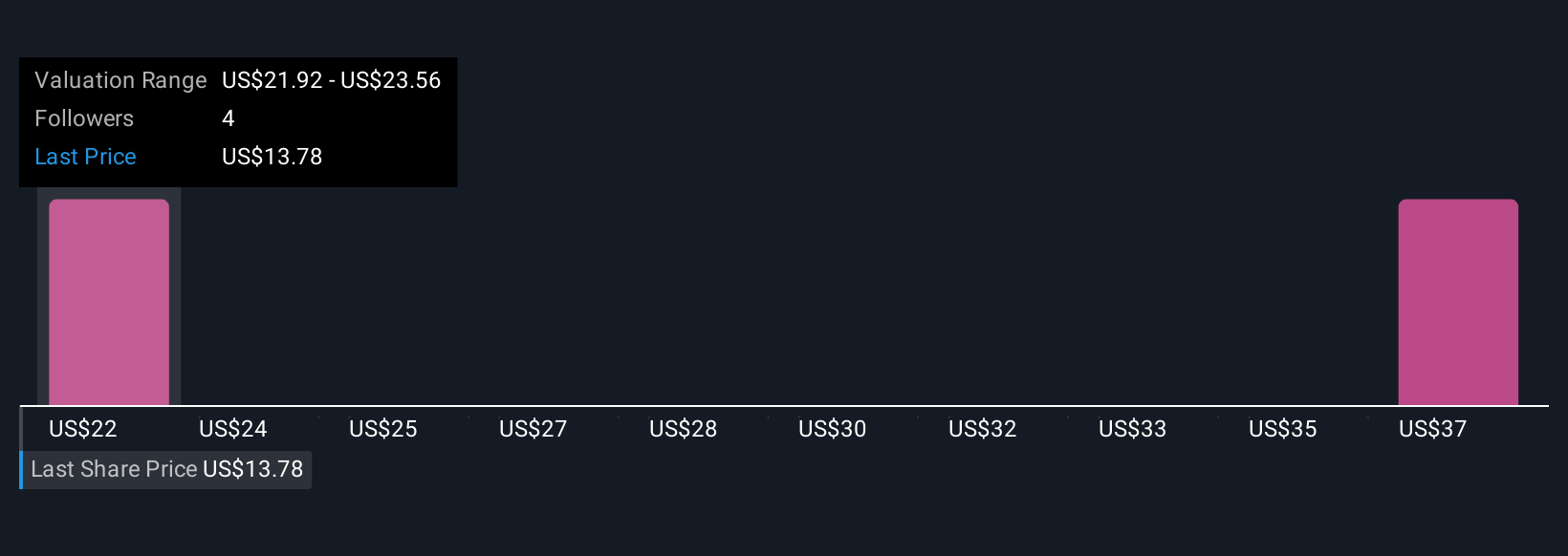

Uncover how Driven Brands Holdings' forecasts yield a $21.92 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community provided fair value estimates for Driven Brands ranging from US$21.92 to US$38.68 based on two distinct forecasts. In contrast, continued soft same-store sales in Franchise Brands may affect the company’s future earnings power, so it is important to explore how various investors are assessing these risks.

Explore 2 other fair value estimates on Driven Brands Holdings - why the stock might be worth just $21.92!

Build Your Own Driven Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Driven Brands Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Driven Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Driven Brands Holdings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRVN

Driven Brands Holdings

Provides automotive services to retail and commercial customers in the United States, Canada, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives