Stock Analysis

- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

United Natural Foods (NYSE:UNFI investor one-year losses grow to 64% as the stock sheds US$58m this past week

The nature of investing is that you win some, and you lose some. And there's no doubt that United Natural Foods, Inc. (NYSE:UNFI) stock has had a really bad year. The share price has slid 64% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 51% lower than three years ago).

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for United Natural Foods

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

United Natural Foods fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. Of course, if the company can turn the situation around, investors will likely profit.

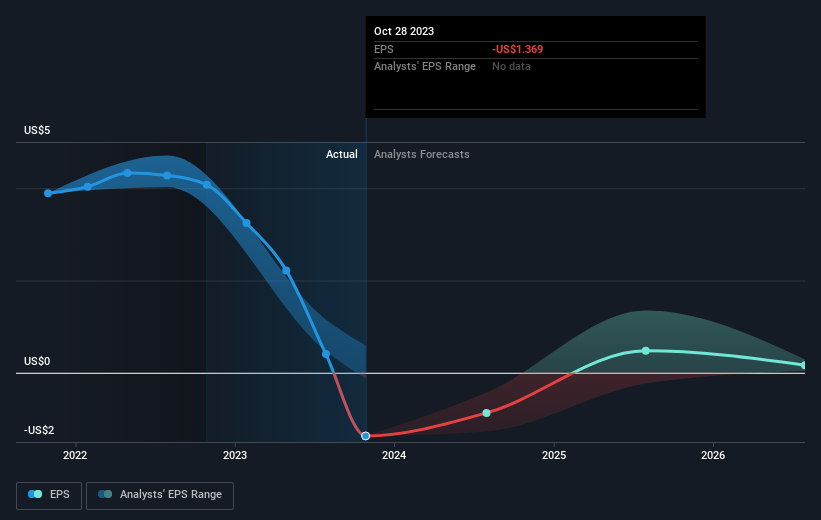

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on United Natural Foods' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 27% in the last year, United Natural Foods shareholders lost 64%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand United Natural Foods better, we need to consider many other factors. Take risks, for example - United Natural Foods has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether United Natural Foods is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UNFI

United Natural Foods

United Natural Foods, Inc., together with its subsidiaries, distributes natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Good value with moderate growth potential.