- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Should Target's (TGT) 1,800 Job Cuts Prompt Action From Investors?

Reviewed by Sasha Jovanovic

- Earlier this week, Target Corporation announced plans to streamline operations by cutting 1,800 jobs in an effort to enhance efficiency and profitability amid challenging retail conditions.

- This move reflects Target’s response to ongoing industry pressures, with analysts expressing mixed opinions on its potential impact for the company’s long-term prospects.

- We’ll examine how Target’s significant workforce reduction is influencing its investment narrative and outlook for operational improvement.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Target Investment Narrative Recap

In order to own Target shares, you have to believe the company can improve efficiency and profitability despite softening consumer demand and stiff industry competition. While the recent workforce reduction of 1,800 jobs signals an effort to preserve margins, it is not likely to meaningfully change near-term sales trends or address the main risk, declining store traffic and the slow pace of digital transformation.

Among the recent announcements, Target’s under-$20 Thanksgiving meal stands out as a clear attempt to highlight value and drive foot traffic, but such promotions alone may not offset lingering challenges in capturing consumer wallet share or boosting digital engagement. Investors will still want to monitor whether operational efficiencies from job cuts materialize alongside these consumer-oriented initiatives as the holiday season unfolds.

However, what shouldn’t be overlooked is the risk that increasing online competition and slow digital progress could impact Target’s longer-term profitability...

Read the full narrative on Target (it's free!)

Target's outlook anticipates $110.5 billion in revenue and $3.7 billion in earnings by 2028. This projection reflects annual revenue growth of 1.4% and a decrease in earnings of $0.5 billion from the current $4.2 billion.

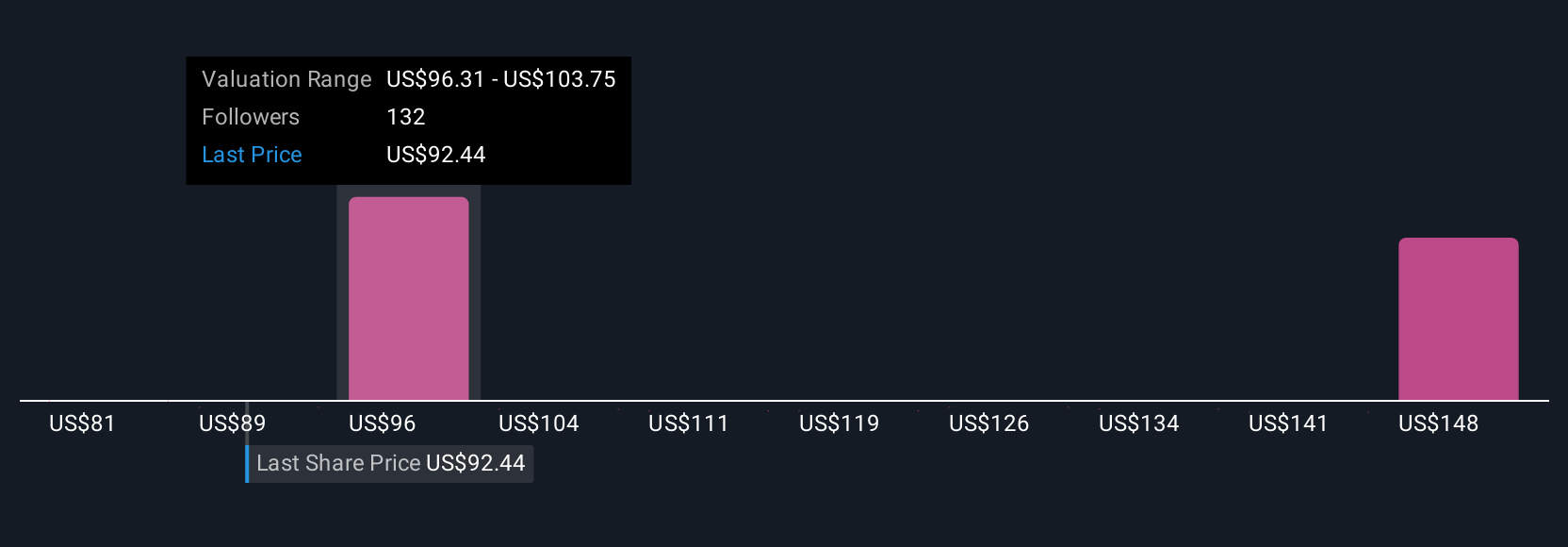

Uncover how Target's forecasts yield a $101.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published 23 fair value estimates for Target, ranging from US$80.46 to US$161.09 per share. Despite varying opinions, many are focused on the company’s ongoing investments in digital and supply chain modernization, which raises important questions about future margin support and sales growth.

Explore 23 other fair value estimates on Target - why the stock might be worth as much as 81% more than the current price!

Build Your Own Target Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Target research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Target research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Target's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives