- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

Should BJ’s New Tennessee Store and Community Initiatives Influence Decisions for BJ's Wholesale Club (BJ) Investors?

Reviewed by Sasha Jovanovic

- BJ’s Wholesale Club Holdings recently opened its fifth Tennessee location in Sevierville, providing members with a one-stop shop and expanded fuel savings options through a new on-site BJ’s Gas station.

- In addition to its business expansion, BJ’s deepened its community engagement by partnering with Second Harvest Food Bank and awarding a US$75,000 grant to support local food distribution efforts.

- We’ll explore how BJ’s focus on new store launches and community partnerships could impact its long-term growth outlook and membership appeal.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BJ's Wholesale Club Holdings Investment Narrative Recap

BJ’s Wholesale Club Holdings’ investment thesis centers on the belief that ongoing expansion and community ties will fuel membership growth and offer some resilience despite volatile consumer spending patterns. While the recent Sevierville club opening and food bank partnership reinforce the brand presence in secondary markets, they do not materially alter the short-term catalyst: accelerating membership growth remains most dependent on consistent new store performance. Risks around margin pressure from expansion and pricing actions continue to be highly relevant.

Among recent developments, BJ’s commitment to open 25–30 new clubs across underpenetrated markets in the coming years stands out, as this initiative ties directly to the membership-driven revenue catalyst highlighted by the Sevierville launch. Broadening their geographic reach through such expansion could help offset risks linked to concentrated revenue streams and market maturity.

However, investors should be aware, contrary to the headline growth narrative, a persistent risk remains if over-prudent inventory management limits...

Read the full narrative on BJ's Wholesale Club Holdings (it's free!)

BJ's Wholesale Club Holdings' outlook anticipates $25.2 billion in revenue and $683.1 million in earnings by 2028. This is based on an annual revenue growth rate of 6.5% and represents a $104.2 million increase in earnings from the current level of $578.9 million.

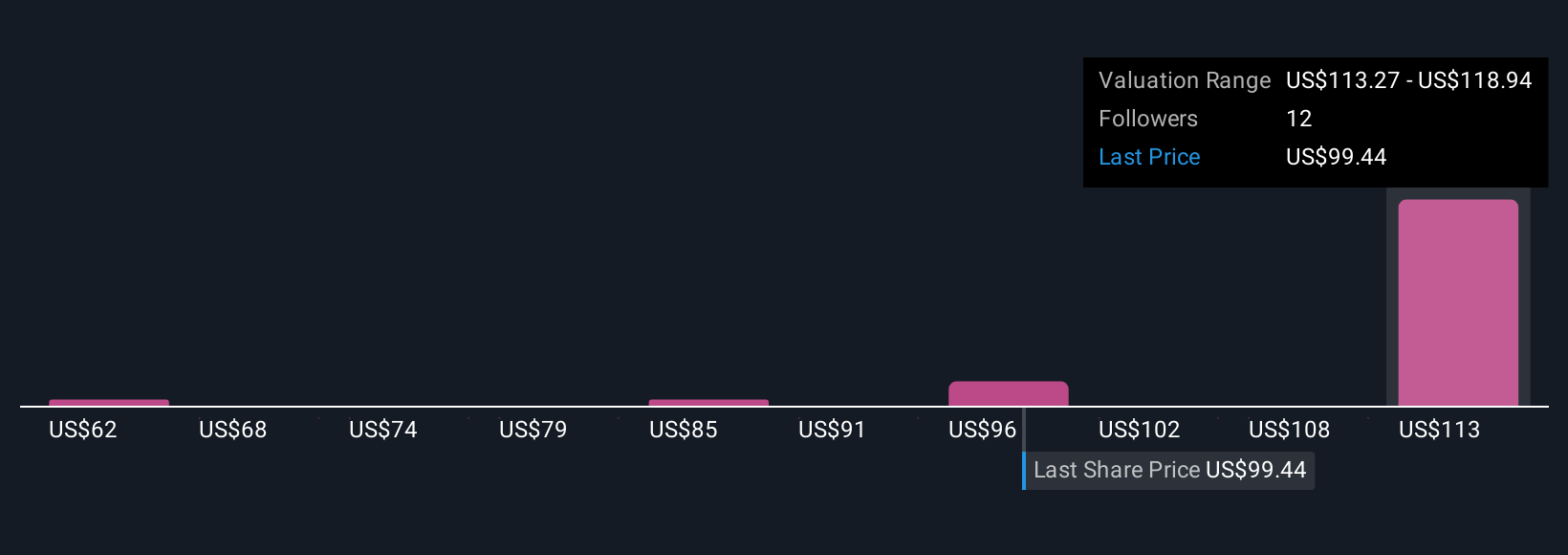

Uncover how BJ's Wholesale Club Holdings' forecasts yield a $115.63 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span from US$54.94 to US$144.70 per share. With expansion driving membership as a key catalyst, reader perspectives can widely differ, explore several viewpoints below.

Explore 8 other fair value estimates on BJ's Wholesale Club Holdings - why the stock might be worth 40% less than the current price!

Build Your Own BJ's Wholesale Club Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BJ's Wholesale Club Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BJ's Wholesale Club Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives