Stock Analysis

- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:HFFG

Shareholders in HF Foods Group (NASDAQ:HFFG) have lost 71%, as stock drops 17% this past week

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Imagine if you held HF Foods Group Inc. (NASDAQ:HFFG) for half a decade as the share price tanked 71%. Even worse, it's down 26% in about a month, which isn't fun at all.

If the past week is anything to go by, investor sentiment for HF Foods Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for HF Foods Group

HF Foods Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, HF Foods Group saw its revenue increase by 31% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price has averaged a fall of 11% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

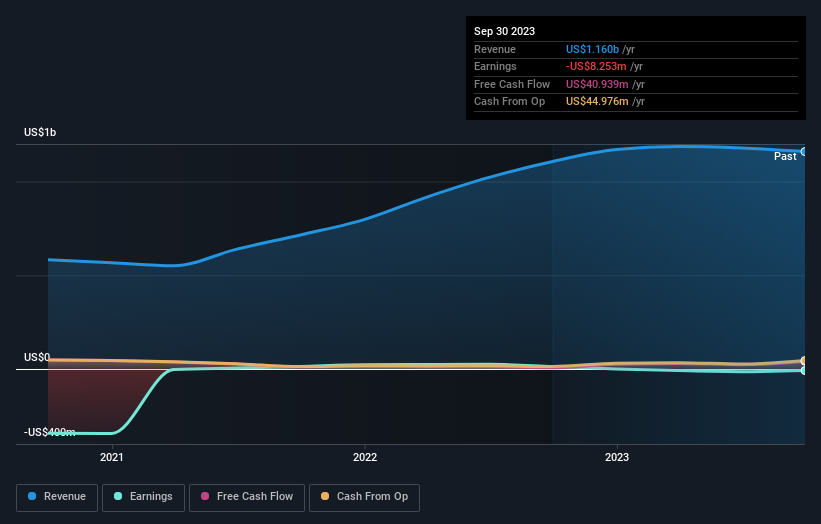

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market gained around 23% in the last year, HF Foods Group shareholders lost 9.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether HF Foods Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HFFG

HF Foods Group

HF Foods Group Inc. operates as a marketer and distributor of fresh produce, frozen and dry food, and non-food products to primarily independently operated Asian restaurants, and other foodservice customers in the United States.

Excellent balance sheet and fair value.