- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Instacart (CART): Evaluating Valuation as Q3 Earnings Near and New AI Alliances Drive Investor Focus

Reviewed by Simply Wall St

Maplebear (CART) is drawing increased attention from investors as its Q3 2025 earnings release approaches. This comes as a result of updated revenue and earnings forecasts, as well as a series of major strategic moves in recent weeks.

See our latest analysis for Maplebear.

A string of high-profile launches and retail partnerships has kept Maplebear in the spotlight lately. Even so, momentum has been under pressure, with the stock’s 1-year total shareholder return down 23% and the 90-day share price return off nearly 28%. This comes despite a short-term bounce after recent positive news. The stock’s longer-term direction will hinge on whether its bold AI moves and expanding alliances can translate into sustainable growth and improved sentiment.

If Maplebear’s big strategic pushes have you thinking about where the next winners might emerge, now’s the perfect moment to broaden your horizon and discover fast growing stocks with high insider ownership

With expectations running high and the stock trading at a notable discount to analyst price targets, the big question now is whether Maplebear is truly undervalued or if the market has already factored the company’s future growth into the current price.

Most Popular Narrative: 33.8% Undervalued

Maplebear’s most widely discussed narrative points to a fair value that is a significant step above the current $36.75 share price. This makes the recent valuation seem unusually low by historical standards and analyst forecasts. This setup puts extra pressure on the company’s growth plan to deliver the results expected in the narrative.

Deepening enterprise partnerships and a growing suite of omnichannel retailer integrations (such as Storefront, Carrot Ads, Caper Carts, Carrot Tags) are increasing stickiness with major retail chains, creating new recurring revenue streams and driving higher-margin, non-transaction-based revenues (for example, advertising and in-store tech). This makes the business model less volatile and supports sustainable margin expansion and earnings resilience.

Want to know the secret behind this aggressive price target? The math here relies on surprisingly strong improvements in profit margins and a future earnings multiple that would stand out among retailers. Curious about the ambitious projections and what could make or break this fair value? The full narrative lays out the bold assumptions underpinning this valuation call.

Result: Fair Value of $55.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs and intensifying competition could threaten Maplebear’s margins and challenge the optimistic growth expectations that are factored into today’s narrative.

Find out about the key risks to this Maplebear narrative.

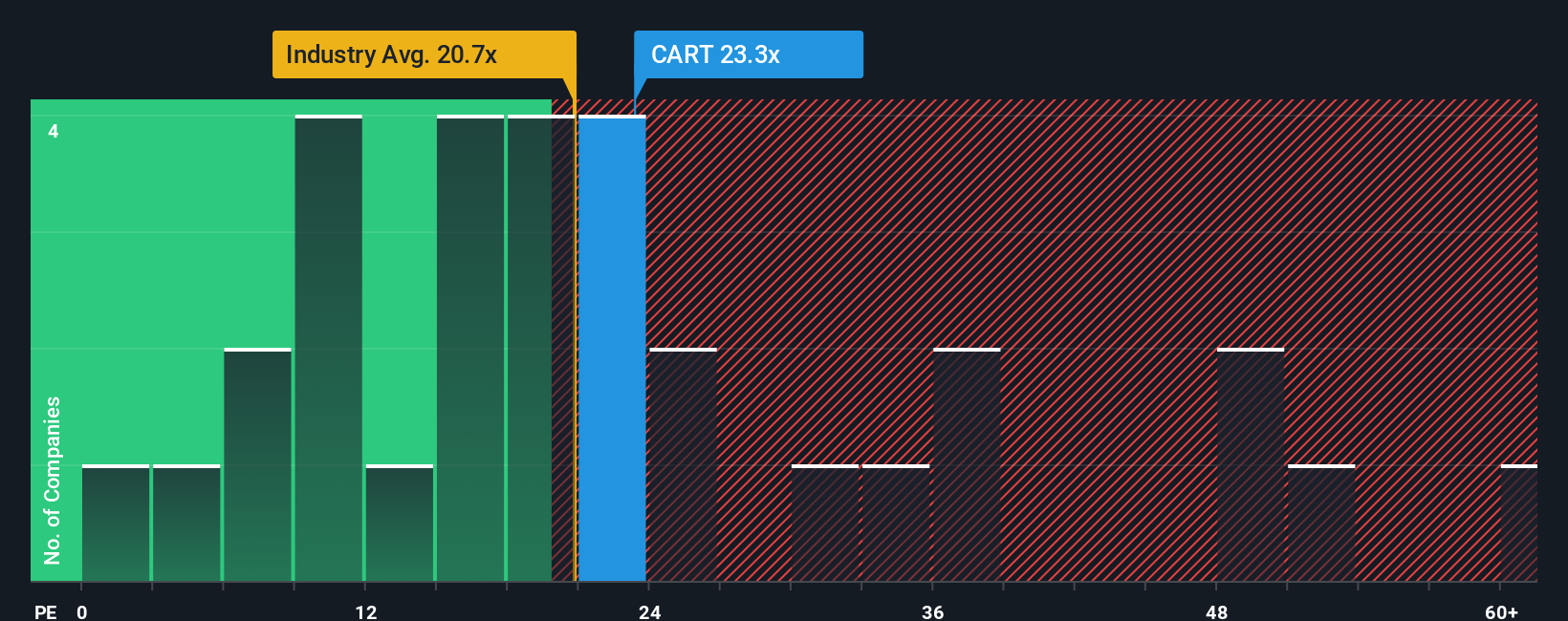

Another View: Are Multiples Rating CART Too High?

Looking beyond fair value estimates, Maplebear’s price-to-earnings ratio stands at 20.2x. This is higher than the US Consumer Retailing industry average of 19.4x and above the peer average of 18.7x. The fair ratio for the company is also 18.7x, suggesting the stock is sitting at a premium.

This gap hints at a valuation risk that could lead to a correction if earnings growth does not live up to expectations. Are investors relying too much on the company’s growth narrative, or could the stock’s premium hold if the roadmap is delivered?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Maplebear Narrative

If you’d rather draw your own conclusions or take a different angle on Maplebear’s story, the platform lets you build a personalized narrative in just a few minutes, your way. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Maplebear.

Looking for more investment ideas?

Want to get ahead of the curve? Open up new opportunities by checking out exciting sectors and themes that most investors overlook. Missing these could mean missing tomorrow's biggest winners.

- Capture the upswing with technology leaders making headlines in artificial intelligence by checking out these 25 AI penny stocks.

- Target strong cash flow opportunities often trading below their true value when you scan these 876 undervalued stocks based on cash flows.

- Secure stable income from reliable payers by reviewing these 16 dividend stocks with yields > 3% to find stocks offering attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives