- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Will Whirlpool’s (WHR) New Leadership Team Reshape Its Global Ambitions or Reinforce What Works?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Whirlpool Corporation announced a comprehensive senior leadership restructuring, naming new executive officers including a Chief Financial Officer and creating several expanded executive roles, effective January 1, 2026.

- This extensive leadership transition aims to support the company’s ongoing talent planning process, reflecting Whirlpool’s intent to align its management structure with future operational priorities and international growth plans.

- We will explore how the appointment of a new CFO and executive team could influence Whirlpool's longer-term financial direction and outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Whirlpool Investment Narrative Recap

To be a Whirlpool shareholder today, you need conviction in the company’s ability to unlock new opportunities beyond its core mature markets and deliver on international growth ambitions, despite persistent industry and macroeconomic headwinds. The latest leadership overhaul is unlikely to bring an immediate shift to 2025’s biggest catalyst, international initiatives designed to reignite top-line momentum, nor does it materially reduce the main risk, which remains muted sales growth and margin pressure from competitive and economic challenges.

Among recent announcements, Whirlpool’s updated guidance for 2025, forecasting flat net sales and ongoing EBIT, stands out as particularly relevant to the new leadership transition. Management’s outlook signals an immediate environment defined by difficult revenue and margin trends, underscoring how much hinges on the success of upcoming executive initiatives to change this trajectory.

By contrast, one risk that investors should watch closely is how Whirlpool’s continued reliance on mature markets leaves it exposed if...

Read the full narrative on Whirlpool (it's free!)

Whirlpool's narrative projects $15.8 billion revenue and $741.4 million earnings by 2028. This requires a 0.6% annual revenue decline and a $887.4 million increase in earnings from -$146.0 million currently.

Uncover how Whirlpool's forecasts yield a $86.78 fair value, a 28% upside to its current price.

Exploring Other Perspectives

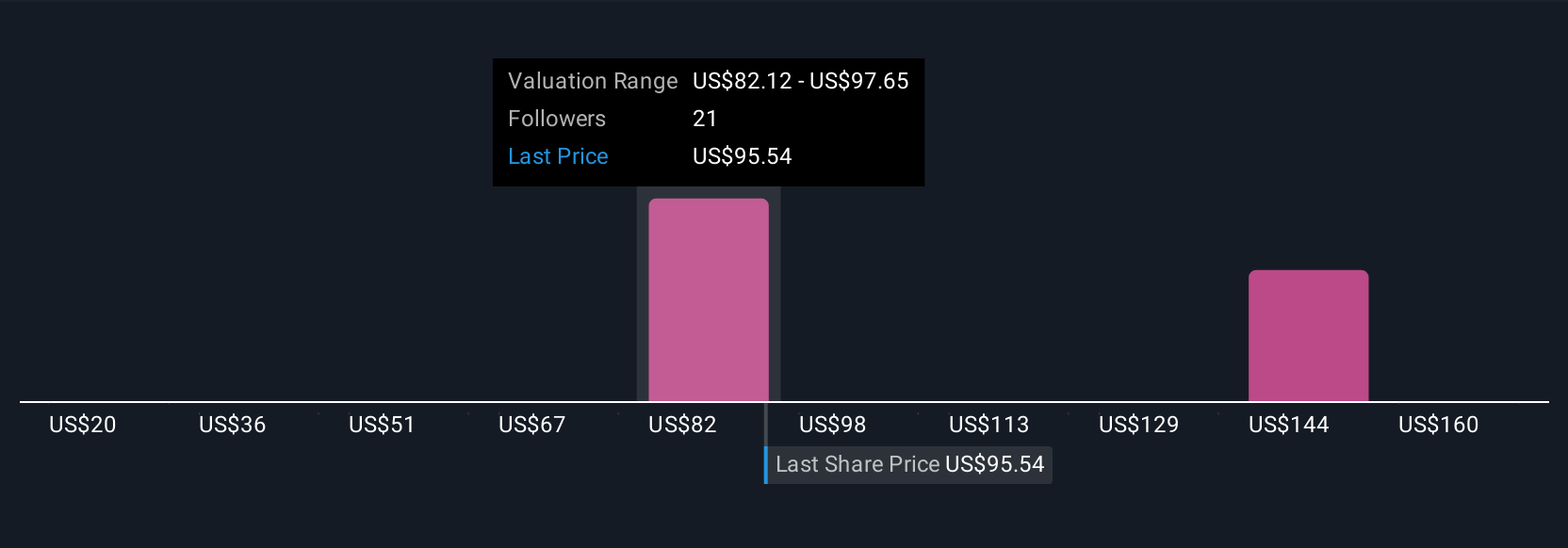

Five different fair value estimates from the Simply Wall St Community range widely from US$86.78 to US$175.29 per share. While opinions differ, many are keeping a close eye on Whirlpool’s efforts to drive international expansion given the persistent pressures in its largest regions.

Explore 5 other fair value estimates on Whirlpool - why the stock might be worth over 2x more than the current price!

Build Your Own Whirlpool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whirlpool research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Whirlpool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whirlpool's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives