- United States

- /

- Luxury

- /

- NYSE:VFC

V.F. Corporation (VFC): Exploring Valuation Following New Class Action Lawsuits Over Vans Disclosure Concerns

Reviewed by Simply Wall St

V.F (VFC) is at the center of investor scrutiny after multiple class action lawsuits surfaced, alleging the company misrepresented its business health and challenges within its Vans brand. These legal actions have brought renewed attention to the company’s recent disclosures and market moves.

See our latest analysis for V.F.

V.F’s share price has been through a turbulent stretch, most recently closing at $14.26 after a long slide. Its year-to-date share price return stands at -33.8%, and the 1-year total shareholder return is a sobering -32.6%. Despite some recent rebounds, with a 90-day share price return of 20.5%, investors remain wary as headlines swing from new lawsuits to a confirmed dividend and cautious revenue guidance. Momentum for the stock still appears mixed as management works to rebuild trust and prove a sustainable turnaround is on the horizon.

If you’re interested in casting a wider net amid these headlines, now could be the perfect moment to discover fast growing stocks with high insider ownership.

With so many legal and operational clouds hanging overhead, the real question is whether V.F’s beaten-down stock offers hidden value for contrarians or if the market has already accounted for all future risks and potential upside.

Most Popular Narrative: 10.9% Undervalued

With V.F’s fair value estimate sitting at $16.00 and shares last closing at $14.26, the narrative suggests room for upside as the company works through brand and operational challenges. Investors are weighing whether these improving forecasts are enough to justify a return to former highs.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. This is expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Want to see what’s fueling this bullish narrative? The real story is hidden in aggressive sales forecasts, rising margins, and a future profit multiple that defies the company’s recent setbacks. Analysts are betting on a turnaround. Find out which make-or-break projections are shaping the fair value estimate.

Result: Fair Value of $16.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines at Vans or delays in executing turnaround plans could quickly undermine any optimism surrounding V.F’s path to recovery.

Find out about the key risks to this V.F narrative.

Another View: Peer Comparisons and Valuation Gaps

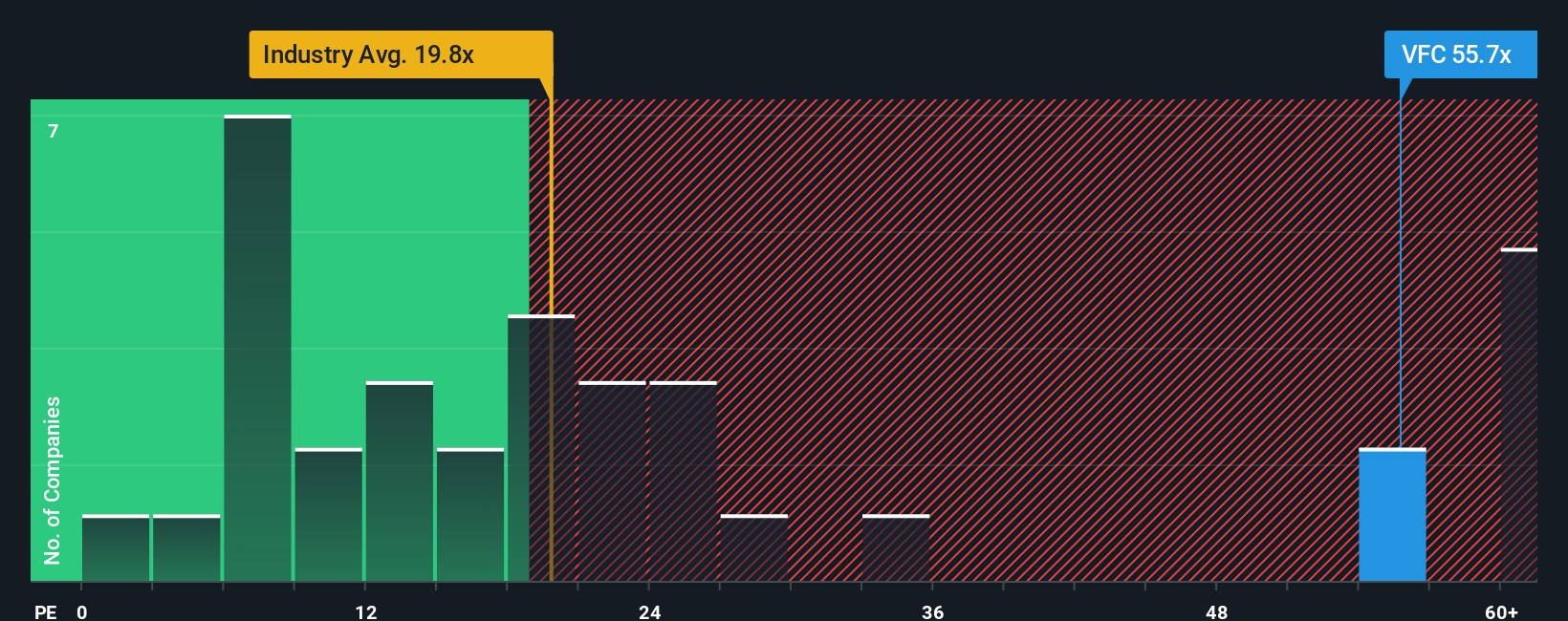

Looking at common valuation measures, V.F’s price-to-earnings ratio stands at 60.4x. This is much higher than both its peer average of 14x and the broader US Luxury industry average of 19.6x. Even when compared to a fair ratio of 25.9x, the current valuation appears stretched, suggesting the market is either pricing in a strong turnaround or taking a wait-and-see approach. Could this premium signal optimism, or does it raise red flags for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own V.F Narrative

If you’re not convinced by the outlook here or you’d rather dive into the numbers yourself, you can craft your own perspective in just a few minutes by using Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly hunt for new opportunities. Give yourself an edge by seizing access to carefully screened stocks in tomorrow’s breakthrough themes and high-potential sectors.

- Unlock value by checking out these 860 undervalued stocks based on cash flows that appear poised for a strong rebound based on future cash flow potential and quality fundamentals.

- Catch the wave of innovation by tapping into these 25 AI penny stocks shaping the future of automation, machine learning, and data-driven business models.

- Step up your passive income strategy by targeting these 17 dividend stocks with yields > 3% delivering robust yields and sustainable dividends for lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives