- United States

- /

- Consumer Durables

- /

- NYSE:KBH

A Fresh Look at KB Home (KBH) Valuation as Investor Sentiment Shifts

Reviewed by Simply Wall St

See our latest analysis for KB Home.

KB Home’s share price has fluctuated this year, with a modest 2.1% rise over the past 90 days. The longer-term total shareholder return is down nearly 25% for the year, but still up more than 100% over three years. The stock’s recent movement suggests shifting sentiment in the homebuilder space, and investors appear to be weighing short-term uncertainty against proven long-term gains.

If you’re keeping an eye on sector trends, it might be the perfect time to look beyond KB Home and discover See the full list for free.

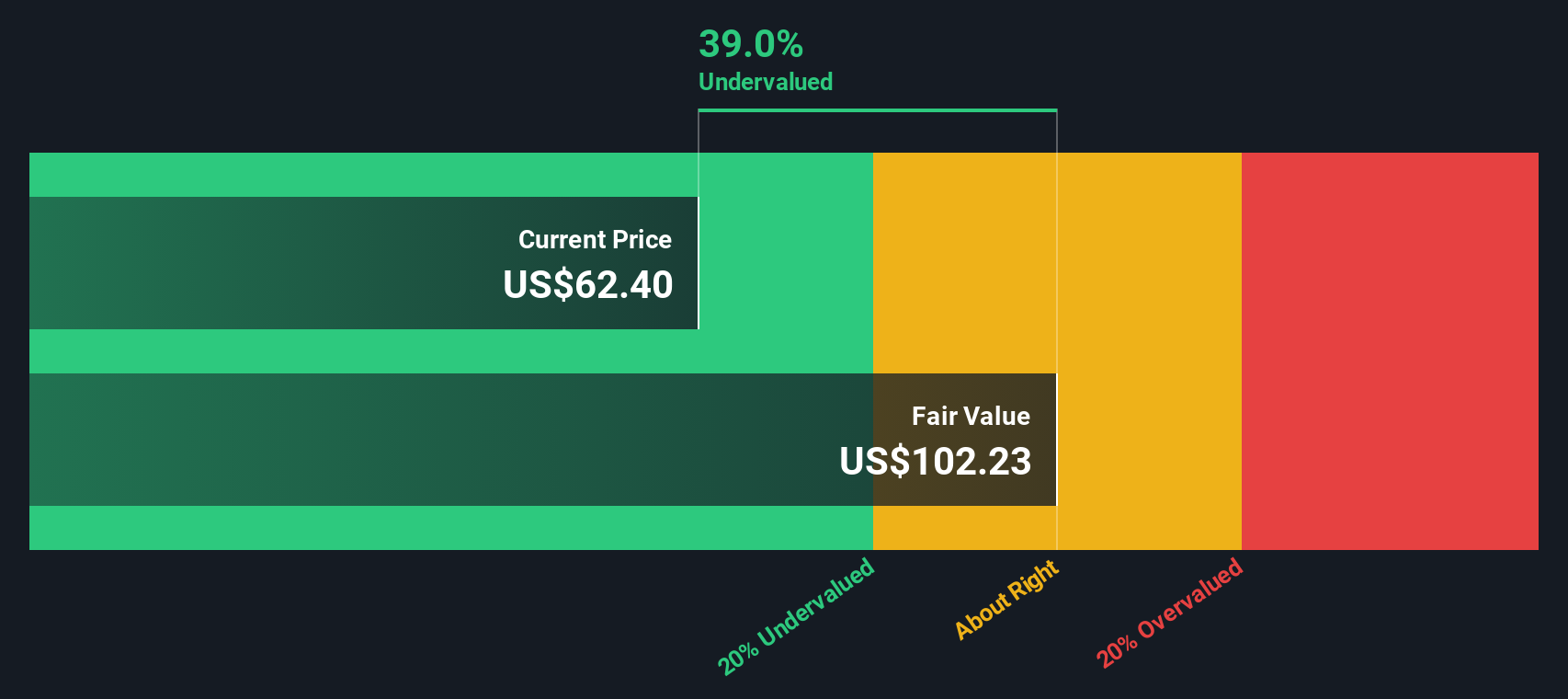

With a modest discount to analyst price targets and recent declines in both revenue and net income, the key question is whether KB Home is currently trading below its true value, or if market expectations have already factored in future growth. Is there untapped potential for buyers, or are the recent moves simply a reflection of what is to come?

Most Popular Narrative: 5.9% Undervalued

With the most followed narrative estimating a fair value of $64.67 for KB Home, shares are trading at a small discount to this benchmark, closing recently at $60.84. The stage is set for a closer look at what may be underpinning this gap.

KB Home is executing a land investment strategy that is increasing their lot position while returning capital to shareholders through share repurchases. This balanced approach aims to enhance earnings growth and shareholder value over the long term.

Curious what financial drivers power that higher valuation? The narrative relies on forecasts of shrinking annual earnings, falling margins, and a profit multiple above the industry average. Want the full story behind these seemingly contradictory projections? The real surprises are within the details.

Result: Fair Value of $64.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty remains. Softening demand and regional challenges could quickly undermine KB Home's optimistic outlook and current valuation case.

Find out about the key risks to this KB Home narrative.

Another View: DCF Model Paints a Different Picture

Looking at KB Home through the lens of our SWS DCF model, a less optimistic perspective emerges. The model estimates fair value at $46.27, which is below the current price. This suggests the stock could actually be overvalued using this approach. Could reality land somewhere in between? Or is one method missing something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KB Home for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KB Home Narrative

If you think there’s another story to tell or want to test your own insights, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when the market holds so much more. Strengthen your strategy and spot your next advantage with targeted stock ideas from our hand-picked screeners:

- Unlock high-yield opportunities and let stable income streams boost your portfolio by considering these 16 dividend stocks with yields > 3%, which offers strong returns above 3%.

- Tap into disruptive technologies before the crowd and position yourself in the future of finance by checking out these 82 cryptocurrency and blockchain stocks, a leader in the transformation of global markets.

- Target undervalued gems and seize stocks overlooked by others with the help of these 870 undervalued stocks based on cash flows, which focuses on companies trading below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives