Stock Analysis

- United States

- /

- Consumer Finance

- /

- NasdaqGM:JFIN

Discovering Undiscovered Gems in the United States August 2024

Reviewed by Simply Wall St

The market has stayed flat over the past 7 days but is up 25% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors seeking undiscovered gems in the United States.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Planet Image International | 119.30% | 2.39% | 0.80% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Helport AI (NasdaqCM:HPAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helport AI Limited is an AI technology company specializing in intelligent products, solutions, and a digital platform aimed at enhancing communication between businesses and their customers to boost sales performance, with a market cap of $255.06 million.

Operations: Helport AI generates its revenue primarily from software and programming, amounting to $21.31 million. The company has a market capitalization of $255.06 million.

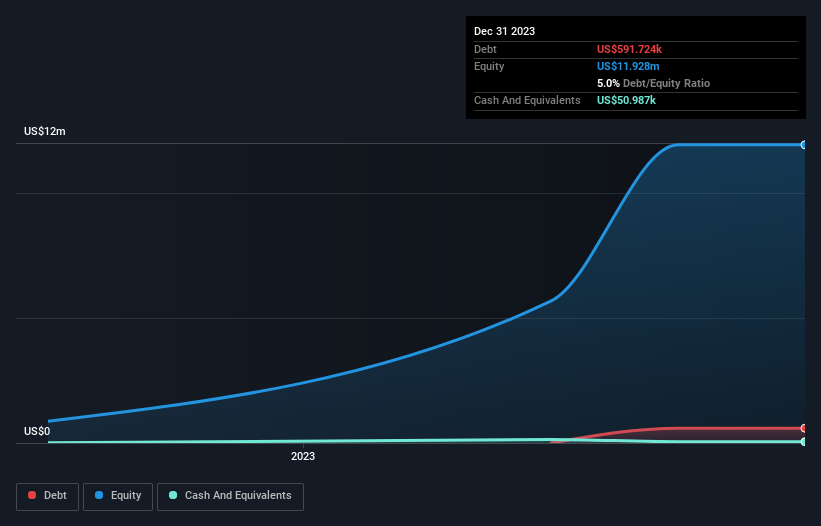

Helport AI, a promising player in the software sector, recently joined the NASDAQ Composite Index on August 6, 2024. The company has shown impressive earnings growth of 208.3% over the past year, far outpacing the industry average of 23.2%. Despite its high level of non-cash earnings and satisfactory net debt to equity ratio at 4.5%, its free cash flow remains negative at -US$1.06M as of December 31, 2023. Additionally, Helport's interest payments are well covered by EBIT (403x coverage), though its share price has been highly volatile over the past three months.

- Click here and access our complete health analysis report to understand the dynamics of Helport AI.

Explore historical data to track Helport AI's performance over time in our Past section.

Jiayin Group (NasdaqGM:JFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiayin Group Inc., along with its subsidiaries, offers online consumer finance services in the People’s Republic of China and has a market cap of $322.44 million.

Operations: The company generated CN¥5.82 billion from its online consumer finance services in the People’s Republic of China.

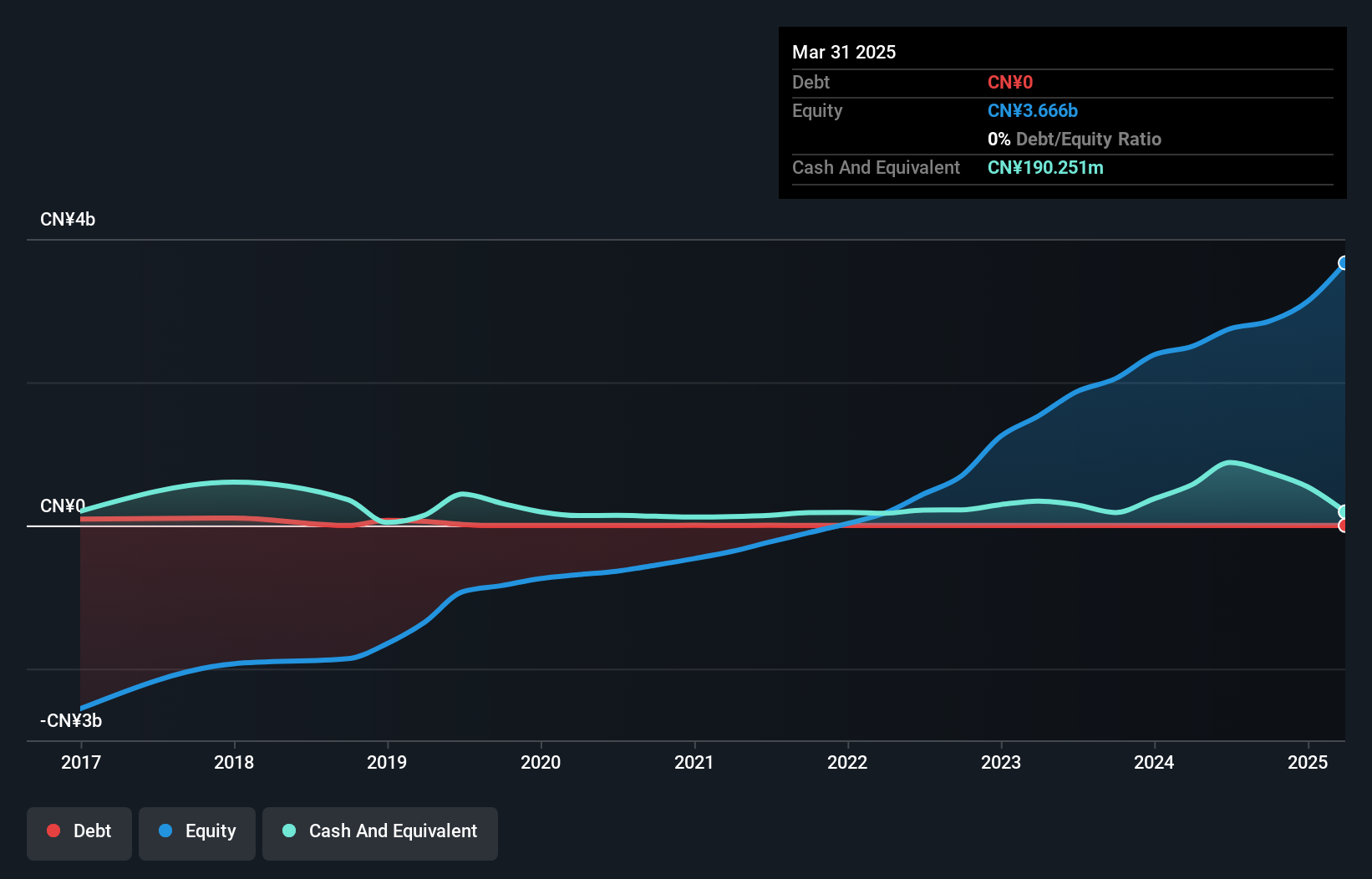

Jiayin Group, a small-cap player in the consumer finance sector, is currently trading at 85.3% below its estimated fair value. Despite being debt-free, Jiayin's net profit margin has decreased to 22.2% from last year's 33.9%. The company reported CNY 1.48 billion in sales for Q1 2024 compared to CNY 1.12 billion a year ago, with net income slightly lower at CNY 273 million versus CNY 280 million previously. Recently, Jiayin declared dividends of $0.50 per ADS and extended its buyback plan till June 2025 without repurchasing any shares this year.

- Take a closer look at Jiayin Group's potential here in our health report.

Review our historical performance report to gain insights into Jiayin Group's's past performance.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hovnanian Enterprises, Inc., with a market cap of $1.24 billion, designs, constructs, markets, and sells residential homes in the United States through its subsidiaries.

Operations: Hovnanian Enterprises generates revenue primarily from its Homebuilding segments, with the West region contributing $1.35 billion, the Northeast $935.87 million, and the Southeast $480.25 million. Financial Services add an additional $66.16 million to its revenue streams.

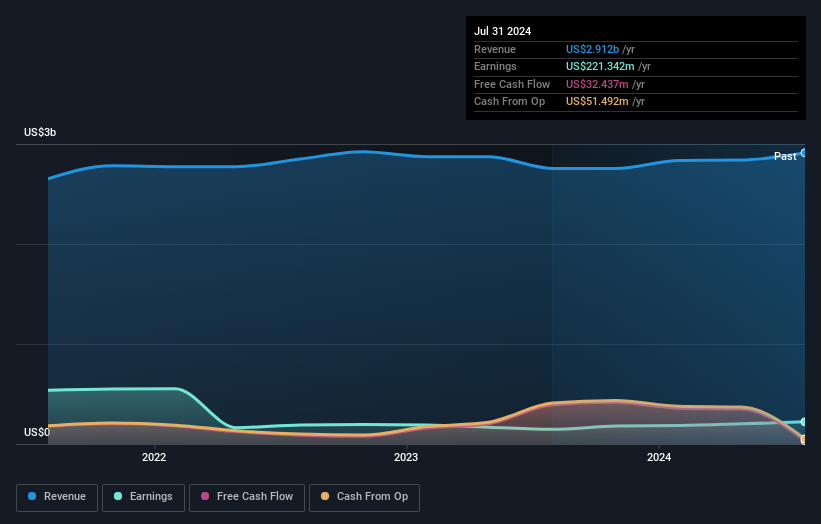

Hovnanian Enterprises seems to be an intriguing pick with its earnings growing by 20.3% over the past year, outpacing the Consumer Durables industry at -2.1%. The company trades at 86.8% below our estimate of its fair value, presenting a potential opportunity for investors. Despite a high net debt to equity ratio of 141.9%, Hovnanian has improved from negative shareholder equity five years ago and now shows positive figures. Recent earnings guidance for FY2024 projects total revenues between US$2.90 billion and US$3.05 billion, with diluted EPS expected between US$29 and US$31.

- Dive into the specifics of Hovnanian Enterprises here with our thorough health report.

Understand Hovnanian Enterprises' track record by examining our Past report.

Taking Advantage

- Gain an insight into the universe of 221 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:JFIN

Jiayin Group

Provides online consumer finance services in the People’s Republic of China.