- United States

- /

- Leisure

- /

- NasdaqCM:POWW

AMMO (NASDAQ:POWW) shareholders are up 14% this past week, but still in the red over the last five years

AMMO, Inc. (NASDAQ:POWW) shareholders should be happy to see the share price up 14% in the last week. But over the last half decade, the stock has not performed well. After all, the share price is down 38% in that time, significantly under-performing the market.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for AMMO

Given that AMMO didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, AMMO grew its revenue at 59% per year. That's better than most loss-making companies. Shareholders are no doubt disappointed with the loss of 7%, each year, in that time. So you might argue the AMMO should get more credit for its rather impressive revenue growth over the period. If that's the case, now might be the smart time to take a close look at it.

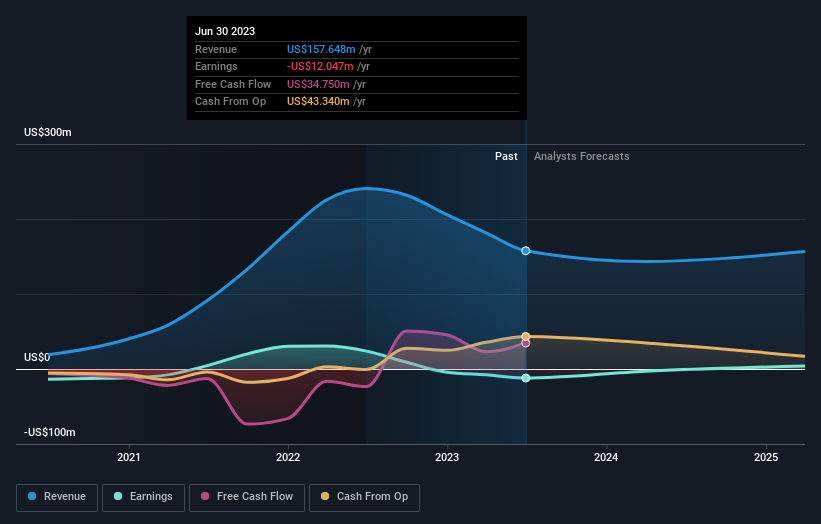

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 22% in the last year, AMMO shareholders lost 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for AMMO you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:POWW

AMMO

Designs, produces, and markets ammunition and ammunition component products for sport and recreational shooters, hunters, individuals desiring home or personal protection, manufacturers, and law enforcement and military agencies.

Flawless balance sheet minimal.