- United States

- /

- Commercial Services

- /

- NYSE:VSTS

Independent Vice Chairman of Vestis Douglas Pertz Buys 1,061% More Shares

Vestis Corporation (NYSE:VSTS) shareholders (or potential shareholders) will be happy to see that the Independent Vice Chairman, Douglas Pertz, recently bought a whopping US$1.1m worth of stock, at a price of US$10.02. That increased their holding by a full 1,061%, which arguably implies the sort of confidence required for a shy sweet-natured nerd to ask the most popular kid in the school to go out on a date.

Check out our latest analysis for Vestis

Vestis Insider Transactions Over The Last Year

Notably, that recent purchase by Douglas Pertz is the biggest insider purchase of Vestis shares that we've seen in the last year. So it's clear an insider wanted to buy, at around the current price, which is US$10.23. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the Vestis insiders decided to buy shares at close to current prices.

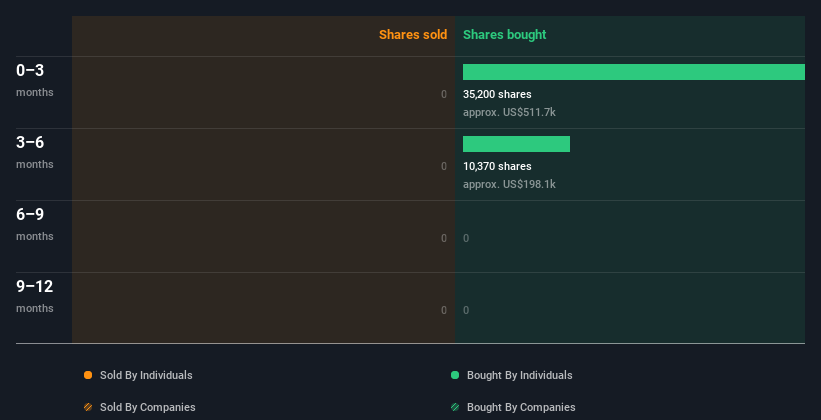

While Vestis insiders bought shares during the last year, they didn't sell. They paid about US$11.51 on average. These transactions suggest that insiders have considered the current price attractive. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Vestis is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Vestis Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Based on our data, Vestis insiders have about 0.2% of the stock, worth approximately US$3.0m. We consider this fairly low insider ownership.

So What Does This Data Suggest About Vestis Insiders?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Vestis insiders are reasonably well aligned, and optimistic for the future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we found 3 warning signs for Vestis that deserve your attention before buying any shares.

Of course Vestis may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VSTS

Vestis

Provides uniform rentals and workplace supplies in the United States and Canada.

Undervalued with limited growth.