- United States

- /

- Commercial Services

- /

- NYSE:MSA

MSA Safety (MSA): Evaluating Valuation as New Certified Safety Products Launch

Reviewed by Simply Wall St

MSA Safety (NYSE:MSA) just made waves by announcing two new safety products. These include its first cellular-connected gas detector and an upgraded SCBA that meets the latest U.S. safety standards. These launches could shape the company’s growth prospects.

See our latest analysis for MSA Safety.

MSA Safety’s steady rollout of product upgrades and new technology comes after a period of muted price action. The company’s one-year total shareholder return sits at -6.8%. With innovations gaining traction and management forecasting margin improvements, momentum could be poised to turn as investors reassess growth potential.

If game-changing safety solutions are on your radar, this is a perfect time to expand your search and discover fast growing stocks with high insider ownership

Yet with the stock still trading well below analyst targets and a 23% discount to some intrinsic valuations, the question remains: does the current share price present real value, or is future growth fully accounted for?

Most Popular Narrative: 14.4% Undervalued

MSA Safety last traded at $160.47, while the most popular valuation narrative points toward a fair value closer to $187.40. This creates a bullish outlook based on the company’s execution and new growth levers.

Recent results exceeded expectations. This was driven by robust backlog conversion and contributions from recent acquisitions.

Want a peek behind these optimistic numbers? The narrative’s fair value depends on a crucial combination: forward-looking earnings momentum, margin targets, and valuation multiples that might surprise you. Only readers of the full narrative see exactly which bold projections make this possible.

Result: Fair Value of $187.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures and uncertain short-cycle demand could challenge the bullish outlook if cost headwinds or core product weakness become more pronounced.

Find out about the key risks to this MSA Safety narrative.

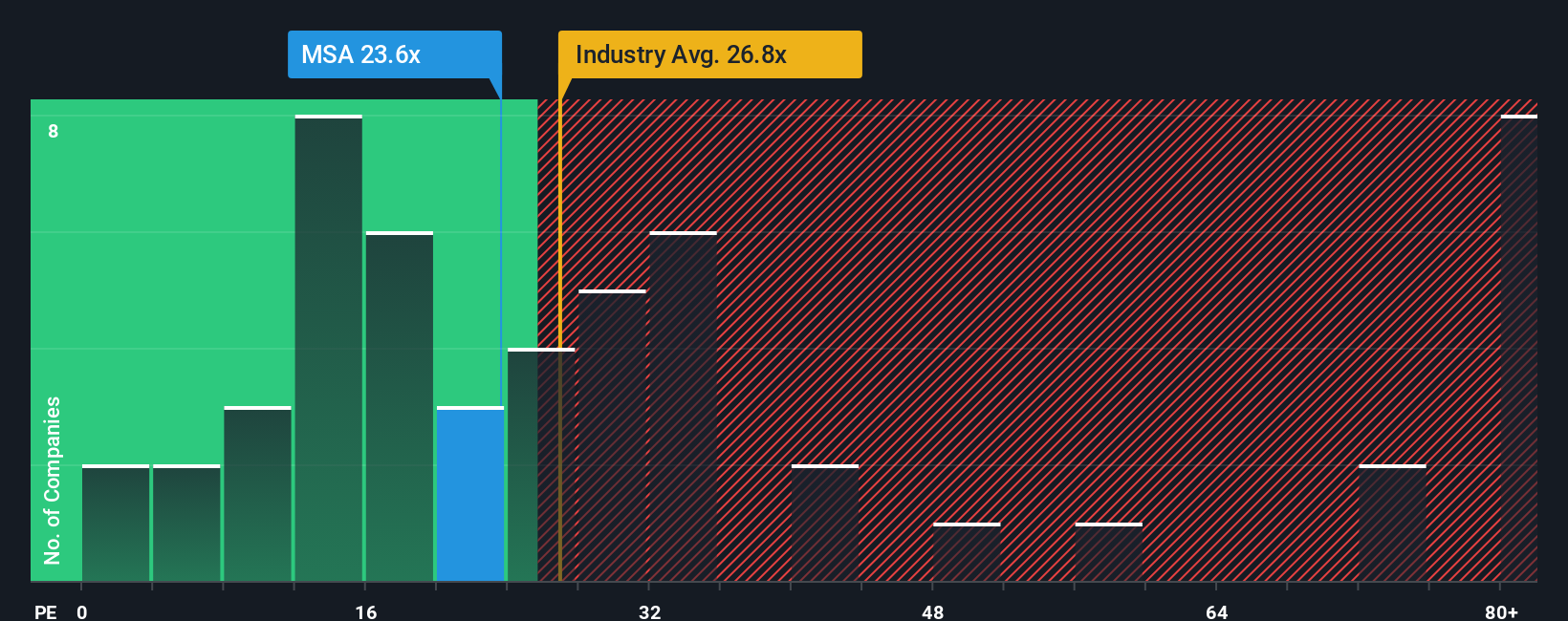

Another View: Multiples Paint a Mixed Picture

Looking at valuation ratios, MSA trades at 22.4 times earnings, just above the US Commercial Services sector average of 22.2, but well above the average of similar peers at 16.4. While the fair ratio sits at 23.7, this premium could indicate less headroom or a quality premium, depending on your outlook. Is this multiple more warning sign or overlooked opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSA Safety Narrative

If you have a different perspective or want to dig into the numbers yourself, you’re just minutes away from building your own story. Do it your way

A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don't wait for tomorrow's headlines. Use the Simply Wall Street Screener now to uncover new stocks and timely opportunities others might be missing.

- Power up your portfolio with passive income by checking out these 16 dividend stocks with yields > 3%, which features yields above 3% and resilient financials.

- Tap into the AI trend and spot high-growth potential among these 24 AI penny stocks, as these stocks are transforming industries and redefining what’s possible with machine learning.

- Target overlooked value with these 871 undervalued stocks based on cash flows, where strong cash flows could signal bargains before they experience growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives