- United States

- /

- Commercial Services

- /

- NYSE:BCO

Exploring Brink's (BCO) Valuation: Is There Still Upside After Steady Share Price Gains?

Reviewed by Simply Wall St

Brink's (BCO) has seen its stock deliver steady returns for investors over the past month, rising about 2%, and is up roughly 6% over the past 3 months. The company’s consistent performance comes as ongoing interest in the security services sector sparks a closer look at how Brink’s is managing growth and profitability this year.

See our latest analysis for Brink's.

Brink's share price has climbed 22% year-to-date, and its one-year total shareholder return stands at 14%. This is a clear sign that investors are rewarding the company’s improving fundamentals and steady growth momentum this year.

If you’re interested in spotting more opportunities beyond Brink’s, now is a great time to discover fast growing stocks with high insider ownership.

With Brink's making solid gains this year and trading about 18% below analyst price targets, investors are left to wonder if there is still room for upside or if the stock is already pricing in future prospects.

Most Popular Narrative: 16% Undervalued

Brink's is currently trading at $112.72, while the most closely followed narrative places fair value much higher. This suggests the market hasn’t fully caught on to the company’s growth outlook. This setup raises the question of what’s driving such a bullish valuation versus recent trading levels.

Investments in digital transformation, including automation, route optimization, and AI/data analytics in logistics, are driving productivity and capital efficiency, directly contributing to operating margin expansion and improved free cash flow conversion. Heightened security and compliance demands from banks and retailers, driven by social, economic, and regulatory volatility, are increasing customer need for sophisticated, premium solutions. This boosts Brink's pricing power, supports robust contract pipelines, and improves customer retention, positively impacting recurring revenues.

Want to see what's fueling this aggressive price target? The surprisingly optimistic projections for future margins and earnings are not what you might expect from a traditional security business. Something big is embedded in these assumptions, and it’s not just steady growth. Curious what helps justify calling for this much upside? Dive in for the answers hidden in the forecast details.

Result: Fair Value of $133.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Brink's heavy reliance on cash-based services and rising competition in digital payments could present challenges to these optimistic growth forecasts in the coming years.

Find out about the key risks to this Brink's narrative.

Another View: Is the Market Missing Something?

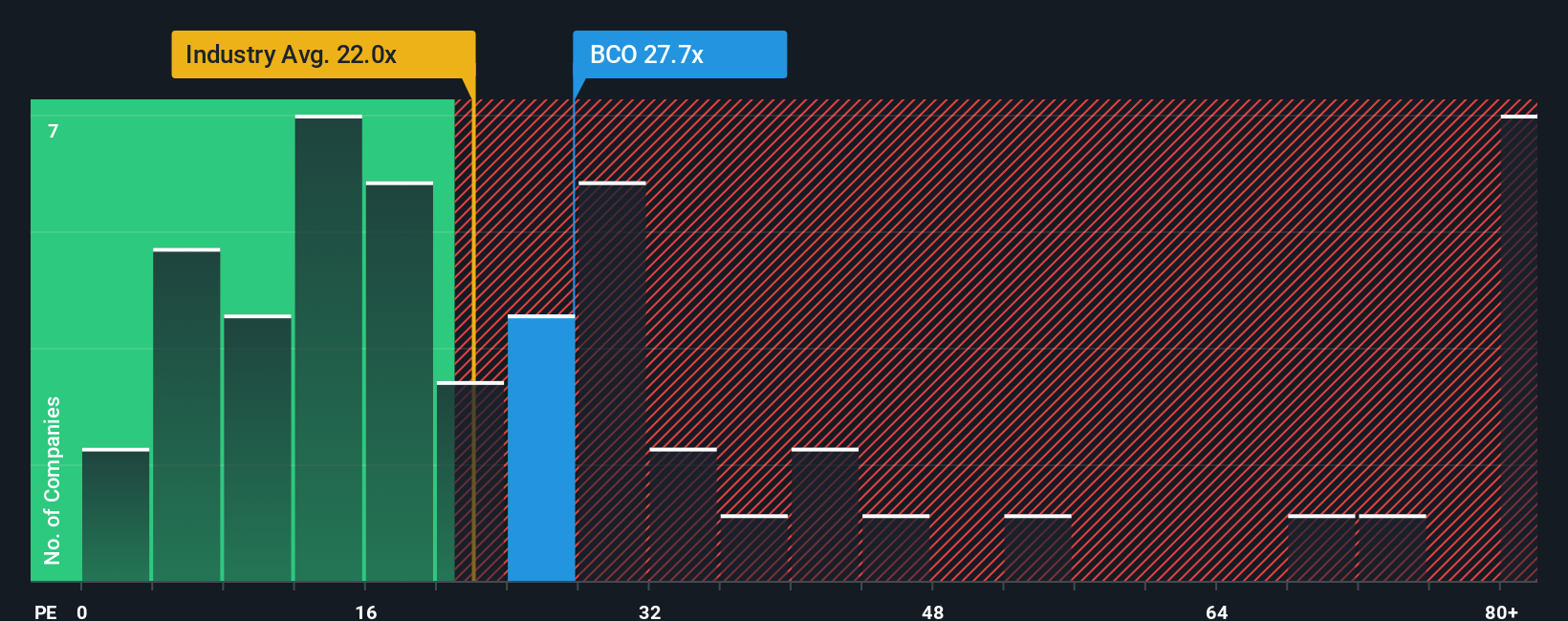

Looking from a different perspective, Brink’s is trading at a price-to-earnings ratio of 27.7x, which is well above both the peer average of 16.5x and the US Commercial Services industry average of 22.2x. However, this remains below its fair ratio of 49.4x, which suggests the stock could rise if the market adjusts to this benchmark. High multiples also highlight valuation risk, especially if expectations fall short. Could Brink’s be riskier than it appears, or is there still room for upward movement?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brink's Narrative

If you want to look beyond these opinions or put your own spin on the data, you can build a complete narrative for yourself in just a few minutes. Do it your way.

A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investing is all about spotting fresh trends early. Do not limit yourself to one company when the market is full of breakthrough opportunities waiting to be found.

- Explore the momentum of cutting-edge innovation by browsing these 25 AI penny stocks making waves in artificial intelligence and automation right now.

- Capture long-term income with peace of mind by evaluating these 16 dividend stocks with yields > 3% offering attractive yields and resilient payout histories.

- Take advantage of the opportunity to get ahead of the curve with these 3588 penny stocks with strong financials poised for rapid growth and potentially outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives