- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Could Tetra Tech's (TTEK) UK Water Deal Hint at a Deeper Shift Toward Recurring Revenue?

Reviewed by Sasha Jovanovic

- Portsmouth Water recently announced it has selected Tetra Tech to deliver engineering design and technical support aimed at boosting the resilience of water services for over 700,000 customers in Southern England and advancing compliance with new regulatory targets.

- This contract highlights Tetra Tech’s recognized expertise in modernizing water infrastructure and leveraging digital platforms to improve operational performance and regulatory readiness.

- Let's explore how this new multi-year engagement with Portsmouth Water could reshape Tetra Tech's narrative around recurring revenue and market positioning.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Tetra Tech Investment Narrative Recap

To be a Tetra Tech shareholder, one needs to believe in the company’s ability to turn global demand for resilient, sustainable water and infrastructure solutions into consistent, high-margin recurring revenue. The new Portsmouth Water contract may support near-term backlog and reinforce market positioning in regulated European water infrastructure, but it does not materially alter the most significant short-term catalysts or mitigate existing risks around U.S. government revenue shifts or earnings predictability.

Among recent announcements, the $990 million NAVFAC Pacific contract stands out as most relevant, reflecting the company’s continued success in securing sizable, multi-year public sector infrastructure work. This provides important backlog support at a time when non-recurring government task flows and episodic disaster response revenues threaten earnings consistency.

By contrast, investors should still keep a close eye on delayed U.S. federal contract awards and their potential impact on revenue visibility as...

Read the full narrative on Tetra Tech (it's free!)

Tetra Tech's outlook anticipates $4.7 billion in revenue and $559.6 million in earnings by 2028. This projection assumes a yearly revenue decline of 0.8% and an earnings increase of $343.5 million from current earnings of $216.1 million.

Uncover how Tetra Tech's forecasts yield a $42.60 fair value, a 33% upside to its current price.

Exploring Other Perspectives

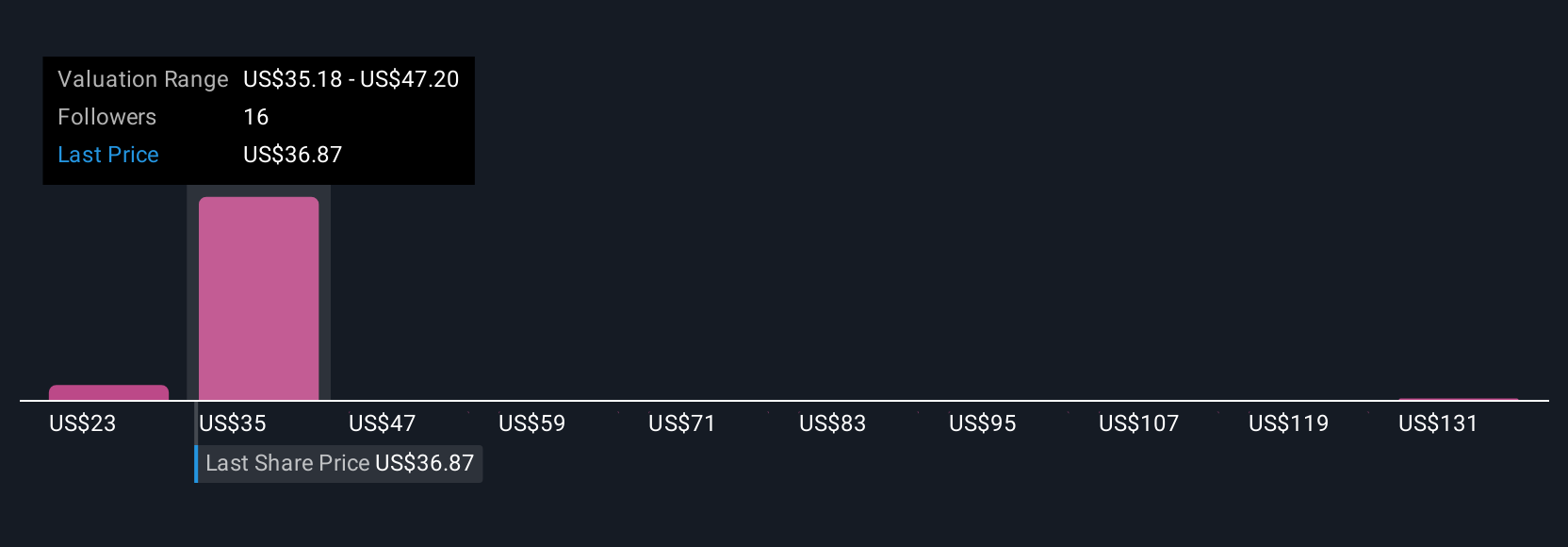

The Simply Wall St Community submitted four fair value estimates for Tetra Tech, ranging widely from US$23.16 to US$42.60 per share. While these outlooks vary, shifting U.S. federal and public sector funding priorities remain central to understanding future growth and stability, so it pays to consider a range of views.

Explore 4 other fair value estimates on Tetra Tech - why the stock might be worth 28% less than the current price!

Build Your Own Tetra Tech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tetra Tech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tetra Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tetra Tech's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services that focuses on water, environment, and sustainable infrastructure.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives