Stock Analysis

- United States

- /

- Commercial Services

- /

- NasdaqCM:PESI

Perma-Fix Environmental Services (NASDAQ:PESI) spikes 17% this week, taking five-year gains to 167%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Perma-Fix Environmental Services, Inc. (NASDAQ:PESI) which saw its share price drive 167% higher over five years. Better yet, the share price has risen 17% in the last week.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Perma-Fix Environmental Services

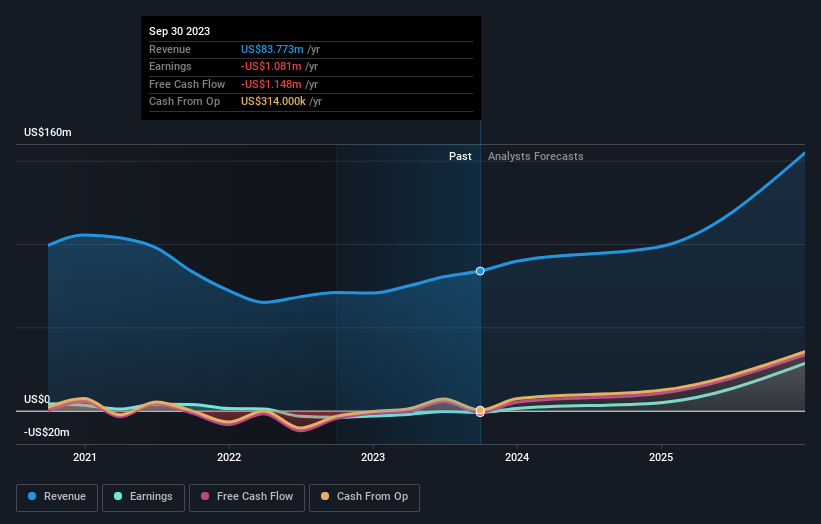

Given that Perma-Fix Environmental Services didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Perma-Fix Environmental Services saw its revenue grow at 5.4% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 22% per year over the last half a decade is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. Some might suggest that the sentiment around the stock is rather positive.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Perma-Fix Environmental Services' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Perma-Fix Environmental Services shareholders are up 13% for the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 22% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Perma-Fix Environmental Services is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Perma-Fix Environmental Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PESI

Perma-Fix Environmental Services

Perma-Fix Environmental Services, Inc., through its subsidiaries, operates as an environmental and technology know-how company in the United States.

Exceptional growth potential with flawless balance sheet.