- United States

- /

- Building

- /

- NYSE:ZWS

Should Zurn Elkay’s (ZWS) Dividend Hike and Buyback Expansion Prompt a Fresh Look From Investors?

Reviewed by Sasha Jovanovic

- On October 28, 2025, Zurn Elkay Water Solutions reported third-quarter earnings growth, issued positive fourth-quarter sales guidance, raised its annual dividend by 22% to US$0.44 per share, and expanded its share repurchase program by US$500 million.

- The combination of improved financial performance, a larger dividend, and greater buyback activity reflects management's focus on returning value to shareholders and signals ongoing confidence in future business prospects.

- We'll examine how the expanded buyback and dividend increase may reshape Zurn Elkay's investment narrative amid recent earnings strength.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zurn Elkay Water Solutions Investment Narrative Recap

To be a shareholder in Zurn Elkay Water Solutions, you need confidence in the company’s ability to benefit from ongoing regulatory and funding trends supporting water quality solutions in schools, as well as continued execution in product innovation and cost controls. The strong third-quarter earnings, upward sales guidance, and enhanced capital returns likely reinforce the most important catalysts, policy-driven demand growth and new filtration products, while the near-term risk of normalization after pre-buying activity remains present but does not appear materially changed by the recent results.

Among the latest announcements, the 22% dividend increase to US$0.44 per share is especially relevant. This decision reflects management’s commitment to shareholder returns right after robust earnings growth and may bolster income appeal, while also setting a higher bar for sustaining cash flows amid the catalysts driving current momentum.

By contrast, investors should also be mindful of risks lurking beneath recent headline growth, particularly as pre-buying ahead of price hikes may influence future demand and...

Read the full narrative on Zurn Elkay Water Solutions (it's free!)

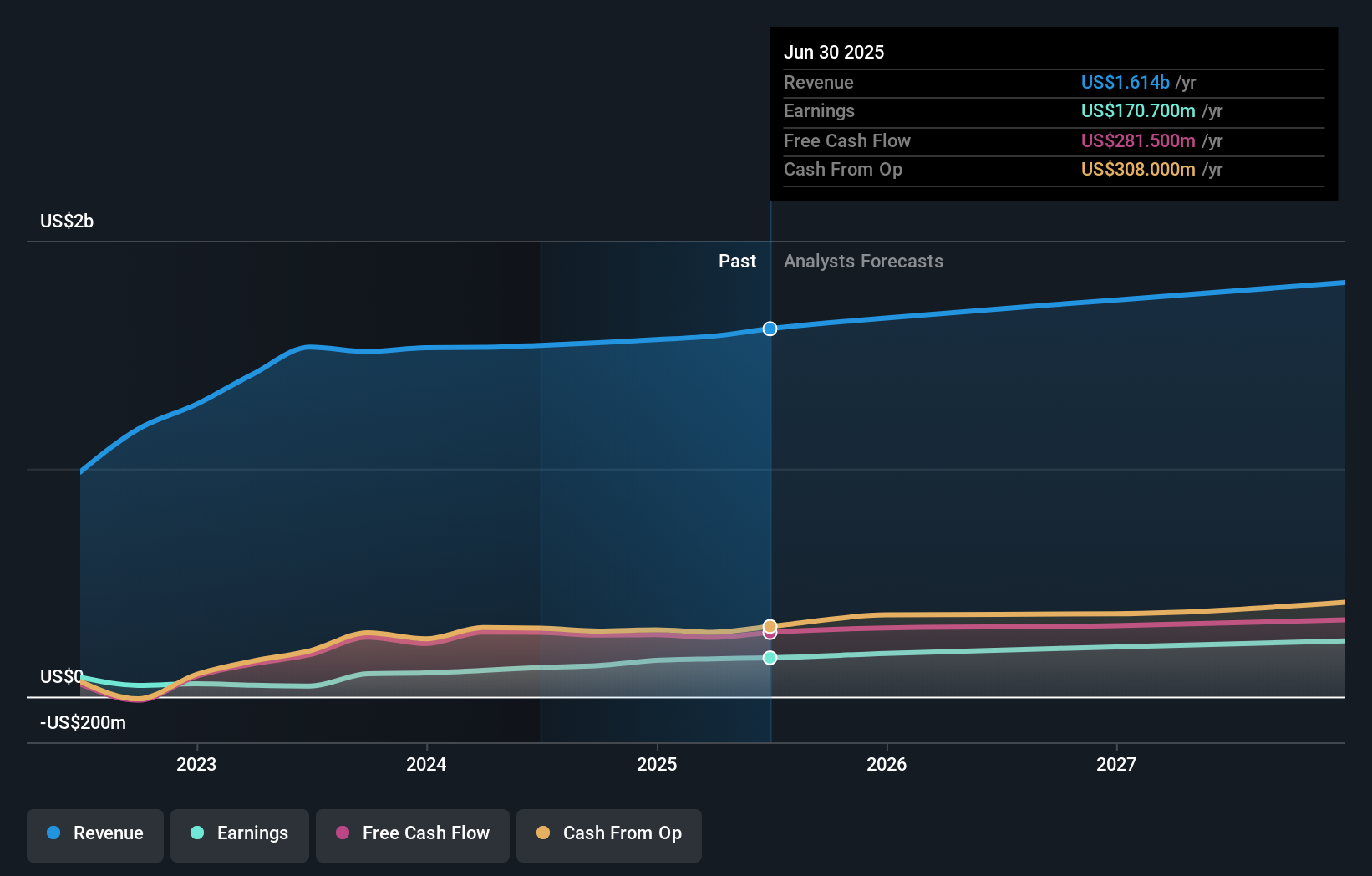

Zurn Elkay Water Solutions' outlook anticipates $1.9 billion in revenue and $266.9 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 5.1% and an earnings increase of $96 million from the current level of $170.7 million.

Uncover how Zurn Elkay Water Solutions' forecasts yield a $49.57 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two pre-event fair value estimates for Zurn Elkay ranging from US$47.10 to US$49.57 per share. While policy-driven demand growth stands out as a key catalyst, the ongoing debate among investors highlights just how crucial end-market visibility may be for assessing the company's direction.

Explore 2 other fair value estimates on Zurn Elkay Water Solutions - why the stock might be worth just $47.10!

Build Your Own Zurn Elkay Water Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zurn Elkay Water Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zurn Elkay Water Solutions' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives