- United States

- /

- Machinery

- /

- NYSE:WTS

Watts Water Technologies (WTS): Valuation Update Following Raised 2025 Outlook and Strong Q3 Performance

Reviewed by Simply Wall St

Watts Water Technologies (WTS) caught investor attention after reporting third quarter earnings and revenue that came in ahead of expectations. Management also raised the company’s 2025 guidance for both sales and operating margins.

See our latest analysis for Watts Water Technologies.

Watts Water Technologies’ upbeat results and raised outlook added fuel to a rally that’s been building for most of the year, with the stock’s share price up 36% year-to-date and long-term total shareholder returns standing out at 32% over the past year and more than 140% over five years. Recent strength has been driven by strong execution in the Americas, a fresh quarterly dividend, and the strategic Haws acquisition. This momentum signals investors are looking for more than just a short-term bounce.

If you’re curious what other companies are capturing investor attention lately, now’s a great opportunity to discover fast growing stocks with high insider ownership

With the stock already surging on impressive results and upgraded forecasts, the key question is whether Watts Water Technologies remains undervalued today or if the market is fully pricing in its growth prospects and future gains.

Most Popular Narrative: 3.1% Undervalued

With the last close at $273.21 and the narrative’s fair value set at $282, Watts Water Technologies is trading just below this most-followed benchmark, keeping speculation alive over its upside potential.

The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data-driven water conservation, efficiency, and regulatory compliance solutions. This trend is expected to drive higher-margin, recurring revenue and support long-term earnings and margin expansion.

Want to know which bold assumptions are behind this price tag? One cornerstone of the narrative is a multi-year forecast for both revenue growth and profit margins. Hungry to see how these projections add up? Interested in whether analysts are aiming high or playing it safe? Dive in and uncover the details driving the story.

Result: Fair Value of $282 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing European weakness or new tariff pressures could quickly shift expectations and stall the current growth momentum of Watts Water Technologies.

Find out about the key risks to this Watts Water Technologies narrative.

Another View: The Multiples Perspective

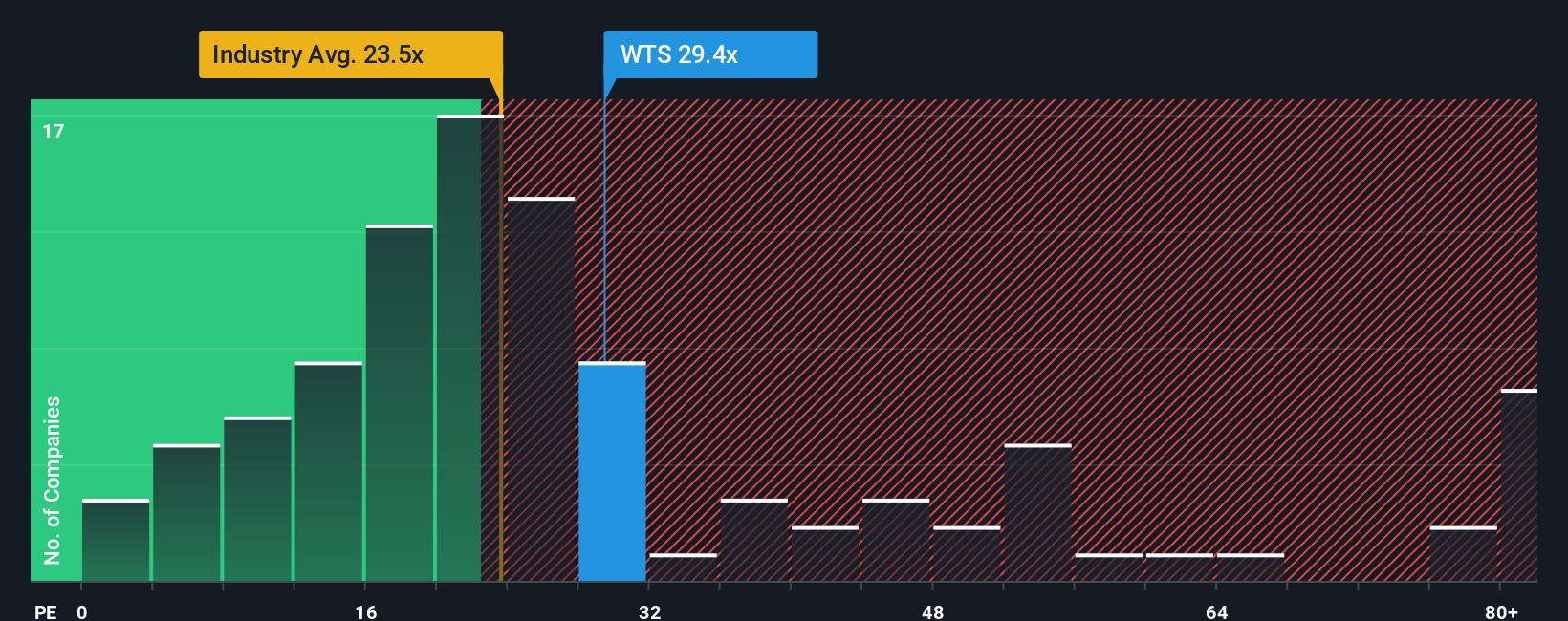

Looking at valuation through the price-to-earnings lens, Watts Water Technologies trades at 28.1 times earnings, which is lofty compared to the US Machinery industry average of 23.8 times and peers at 26.6 times. That is noticeably higher than the fair ratio of 22.3 times, suggesting investors may be paying a premium for growth. Does the market enthusiasm reflect genuine opportunity, or does it raise risks if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Watts Water Technologies Narrative

If you have a different perspective or enjoy digging into the numbers yourself, it’s simple to build and share your own take in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Watts Water Technologies.

Looking for more investment ideas?

Make your next move count by tapping into unique opportunities using the Simply Wall Street Screener. The right stock could be just a click away, so don’t risk missing out on your next great investment.

- Supercharge your strategy by targeting high-potential companies with these 870 undervalued stocks based on cash flows focused on strong cash flow fundamentals.

- Capture income opportunities by selecting these 16 dividend stocks with yields > 3% offering attractive yields above 3% for consistent returns.

- Stay ahead of trends in tomorrow’s technology with these 24 AI penny stocks transforming industries through innovative AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watts Water Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTS

Watts Water Technologies

Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives