- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv (VRT): Examining Valuation After Strong Share Price Gains in 2024

Reviewed by Simply Wall St

See our latest analysis for Vertiv Holdings Co.

Vertiv’s eye-catching year-to-date share price return of nearly 52% has turned heads, with the company benefiting from robust demand and operational momentum. After a recent surge, some short-term volatility has emerged. Overall, long-term total shareholder returns above 1,000% in three years make this a standout story of sustained growth.

If Vertiv's impressive run raises your curiosity, now might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing to new highs, investors face a familiar question: does Vertiv still offer untapped value, or is the market already factoring in all of its future growth potential?

Most Popular Narrative: 6.7% Undervalued

Vertiv's most closely watched narrative now places its fair value at $192.66, with the stock recently closing at $179.80. This apparent gap is drawing fresh attention, with bullish projections fueling lively debate over the assumptions behind these numbers.

Accelerating global demand for high-density, AI-driven data centers is driving robust growth in Vertiv's sales pipeline and backlog. This is evidenced by recurring record order levels, backlog growth, and management's raised organic sales growth guidance, supporting potentially higher future revenue.

Want to know why analysts believe Vertiv can continue this remarkable run? The narrative’s fair value hinges on aggressive growth projections and margin expansion that could surprise even long-time industry watchers. What specific financial leaps power this bullish outlook? Read on for the formula analysts are betting on.

Result: Fair Value of $192.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions and rapid technological shifts could challenge Vertiv’s margin improvements and long-term growth trajectory. This may temper the current upbeat outlook.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another View: Gauging Value Through the Market’s Lens

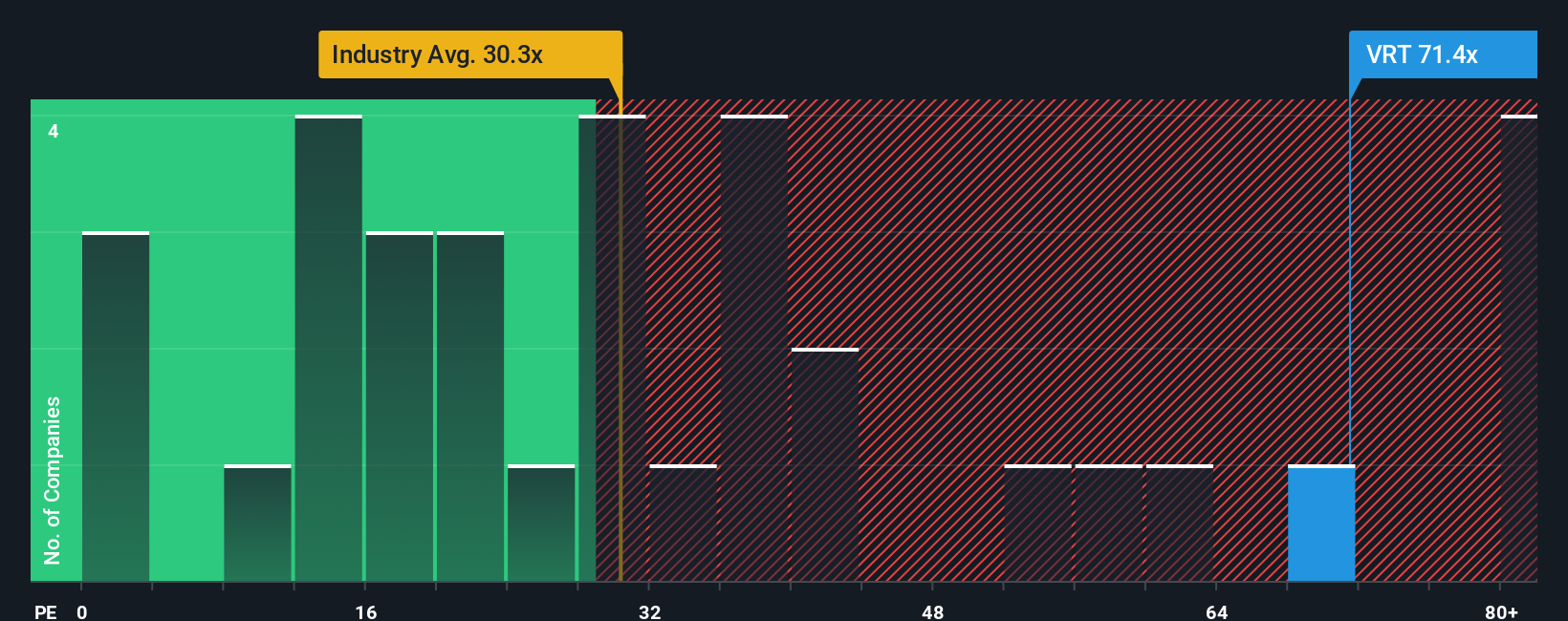

While analyst narratives see Vertiv as undervalued, the market’s favored measure tells a different story. Vertiv’s price-to-earnings ratio stands at 66.5x, which is more than double the US Electrical industry average of 29.9x and even higher than its peers’ 37x. The current ratio also exceeds what is suggested by the fair ratio of 63.6x, indicating that Vertiv may be carrying a valuation premium. Does this premium signal risk, or is it justified by the company’s growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If you see the numbers differently or value your own independent research approach, you can craft your personal outlook for Vertiv in just a few minutes with Do it your way.

A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities slip by when there are incredible stocks waiting to be found. Find your next winning idea by checking out these unique selections:

- Power up your portfolio with steady income by exploring these 16 dividend stocks with yields > 3% yielding more than 3% today.

- Discover fresh potential in healthcare innovation and stay ahead of the curve with these 32 healthcare AI stocks reshaping medicine and biotech.

- Catch the next big trend in digital assets when you browse these 82 cryptocurrency and blockchain stocks poised for breakthroughs in payment and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives