- United States

- /

- Aerospace & Defense

- /

- NYSE:TXT

Should Textron’s (TXT) Leadership Transition and $500 Million Debt Offering Prompt a Fresh Look by Investors?

Reviewed by Sasha Jovanovic

- Textron Inc. recently announced key leadership changes, appointing Danny Maldonado as president and CEO of its Bell segment, and confirming Lisa Atherton as the next president and CEO of Textron Inc., both effective January 4, 2026.

- In addition, Textron completed a nearly US$500 million fixed-income offering, highlighting a significant evolution in both its executive team and capital structure management.

- We’ll examine how Textron’s executive succession, particularly at Bell, could influence the company’s future performance and investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Textron Investment Narrative Recap

Textron’s investment story rests on its ability to drive profit and revenue growth across defense, aviation, and industrial markets, supported by an experienced leadership team. The recent executive appointments and fixed-income offering are not expected to materially impact Textron’s most important near-term catalyst: the pace of progress on Bell’s FLRAA contracts and new aircraft deliveries. The biggest risk still involves ongoing margin pressures, especially if costs rise or product mix challenges persist.

Among the recent announcements, the US$499.9 million fixed-income offering stands out as most relevant. This new funding may help Textron manage capital needs and maintain flexibility as it adjusts to leadership changes and continues initiatives in its Bell and Aviation segments, keeping attention on execution risks and margin improvement as top priorities.

In contrast, investors should also be aware that potential supply chain and geopolitical risks could ...

Read the full narrative on Textron (it's free!)

Textron's forecast sees revenues reaching $16.2 billion and earnings rising to $1.1 billion by 2028. This outlook is based on expected annual revenue growth of 4.8% and an earnings increase of $284 million from the current earnings of $816 million.

Uncover how Textron's forecasts yield a $92.57 fair value, a 13% upside to its current price.

Exploring Other Perspectives

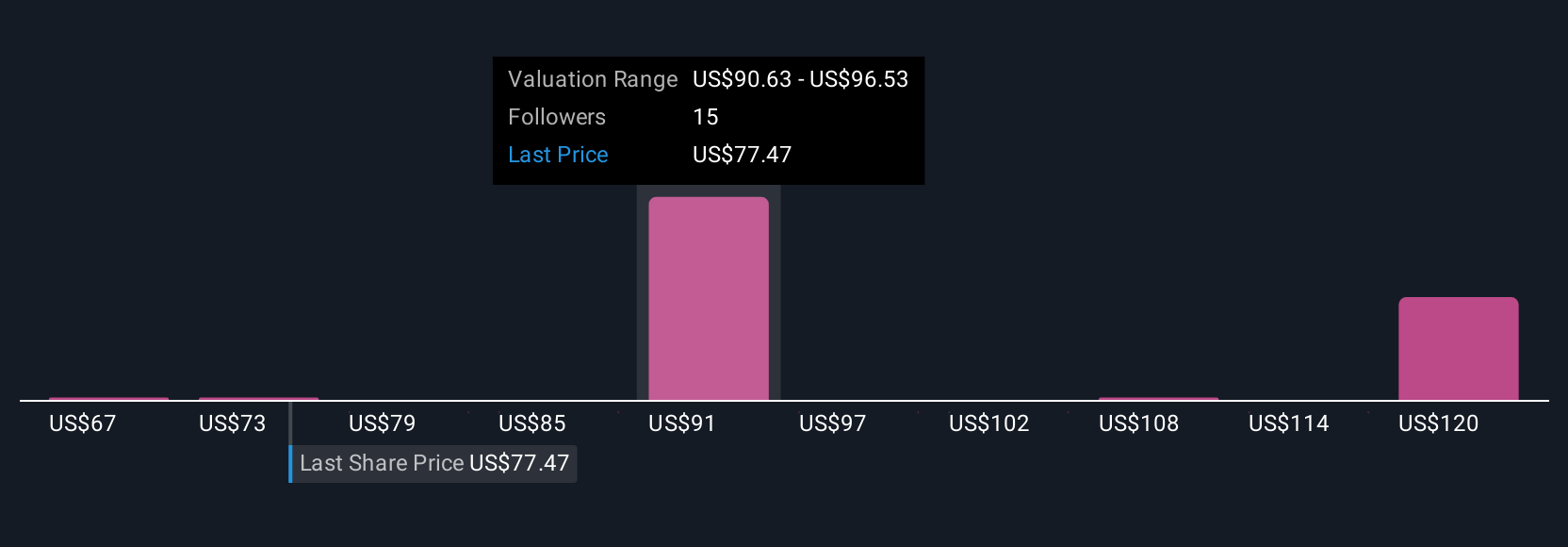

Private investors in the Simply Wall St Community have published five fair value estimates for Textron, ranging from US$73 to US$135.34 per share. While some are focused on funding updates, many remain attentive to ongoing cost management risks affecting net margins, highlighting the varied outlooks worth exploring.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as 65% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Textron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXT

Textron

Operates in the aircraft, defense, industrial, and finance businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives