- United States

- /

- Aerospace & Defense

- /

- NYSE:TXT

Is Textron a Bargain After New Military Contracts and Share Price Dip?

Reviewed by Bailey Pemberton

- Curious if Textron could be undervalued right now? You are not alone, as many investors are wondering whether the current price offers an opportunity or a warning.

- Textron’s stock has returned 1.3% in the last week, dipped 5.4% over the past month, but is still up 6.1% year-to-date. This reflects both potential and shifting investor sentiment.

- Recent headlines have highlighted Textron’s ongoing innovations in business aviation and new military contracts. These developments have fueled optimism about long-term growth and sparked debates around near-term volatility. Such newsworthy events help explain some of the recent price movement and keep Textron in the spotlight among industrial and defense stocks.

- Textron scores a 5 out of 6 on our undervaluation checks, placing it high on the value radar. Next, we will break down what that score really means, examine different valuation approaches, and introduce a smarter way to size up Textron’s real worth at the end of the article.

Find out why Textron's -8.4% return over the last year is lagging behind its peers.

Approach 1: Textron Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a commonly used valuation technique that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method aims to determine what a business is truly worth based on its ability to generate cash in the years ahead.

For Textron, the latest reported Free Cash Flow is $668.8 Million. Looking ahead, analysts expect Free Cash Flow to steadily climb, reaching $1,240 Million by the end of 2029. These projections are built on direct analyst estimates for the next five years, followed by further extrapolations. This growth trajectory is factored into the two-stage DCF model used for valuation.

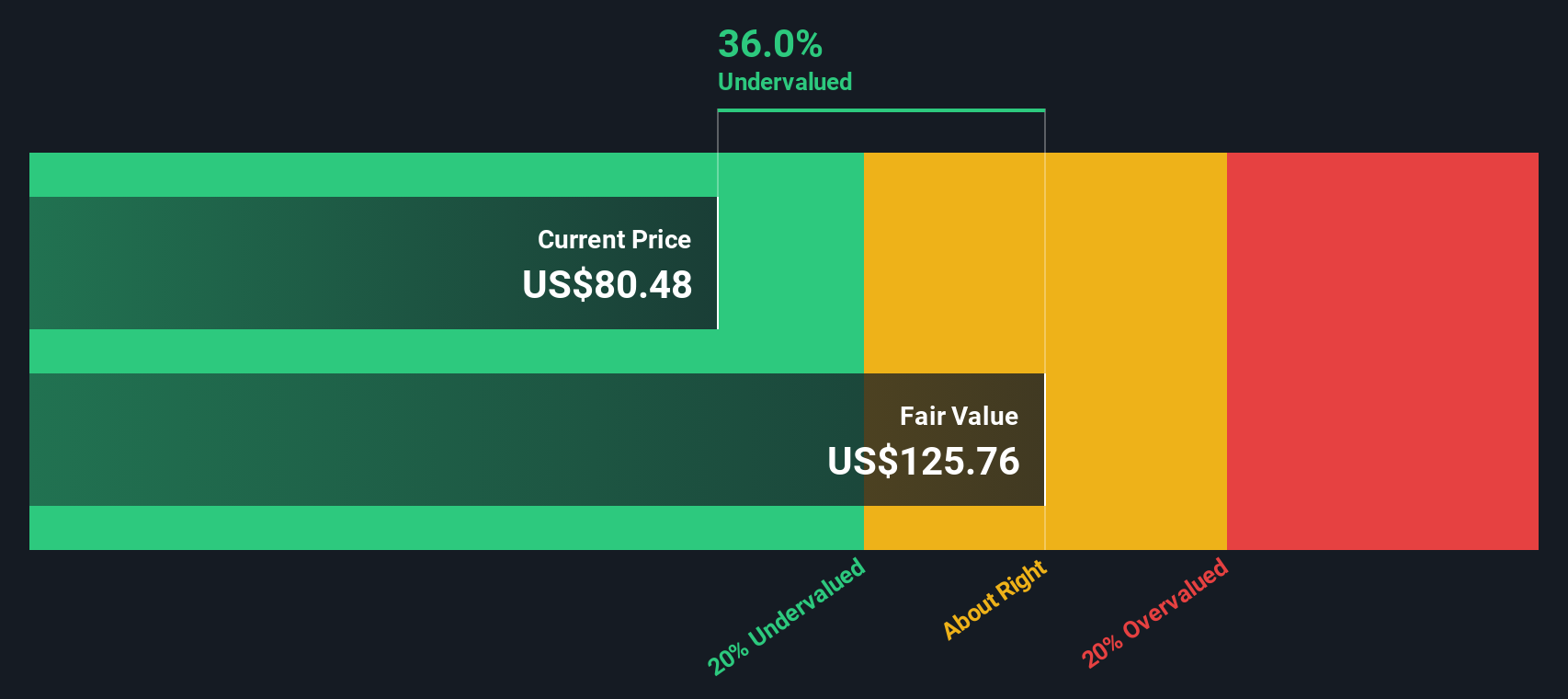

Based on these cash flow projections, the DCF analysis from Simply Wall St calculates an estimated fair value of $134.48 per share for Textron. Compared to the current market price, this implies the stock is trading at about a 40.2% discount.

If these assumptions hold, Textron appears significantly undervalued according to the DCF approach, which may make it an intriguing candidate for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Textron is undervalued by 40.2%. Track this in your watchlist or portfolio, or discover 863 more undervalued stocks based on cash flows.

Approach 2: Textron Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as the go-to metric for valuing profitable companies like Textron. This multiple helps investors gauge how much the market is willing to pay today for a dollar of current earnings. This is especially relevant for established businesses that generate steady profits.

A company’s fair PE ratio depends on a mix of factors, including its projected earnings growth and the risks it faces. Generally, higher expected growth and lower risk justify a higher PE. Below-average growth or higher risk tend to lower the multiple.

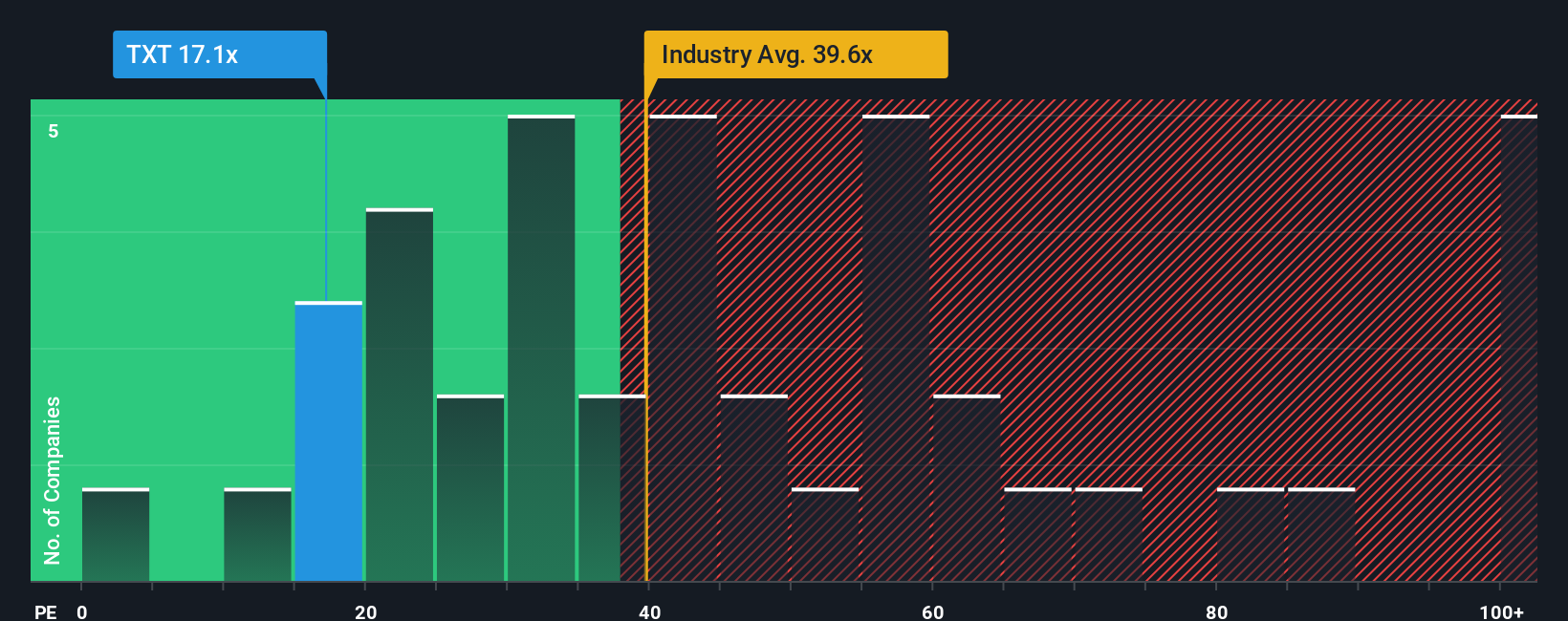

Textron currently trades at a PE ratio of 17.1x. This is notably below both the Aerospace & Defense industry average of 38.0x and its peer group average of 32.3x. While these broad averages provide context, they do not account for company-specific factors like Textron’s unique growth outlook, profitability, or risk profile.

This is where Simply Wall St's Fair Ratio is useful. The Fair Ratio, set at 22.9x for Textron, adjusts for elements such as earnings growth, profit margins, market cap, and sector-specific risks. Unlike simple industry or peer comparisons, the Fair Ratio offers a more nuanced and tailored benchmark for what Textron’s PE should be.

Comparing Textron's actual PE of 17.1x to the Fair Ratio of 22.9x suggests the stock is trading at a considerable discount to what would be justified by its fundamentals and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Textron Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible approach that lets you link your view of a company’s story, including your assumptions about future revenue, earnings, and profit margins, to a financial forecast and a fair value estimate.

Narratives bring numbers to life by letting you express the reasoning behind your valuation, showing how your outlook and expectations translate into a specific price target. On Simply Wall St’s platform, Narratives are available to everyone via the Community page, making it easy for millions of investors to compare, update, and refine their investment perspectives.

This approach helps you decide when to buy or sell by checking if your fair value, based on your Narrative, is above or below the current price. Narratives are continuously updated with new information, such as the latest news or earnings, so your investment view evolves as the company’s story does.

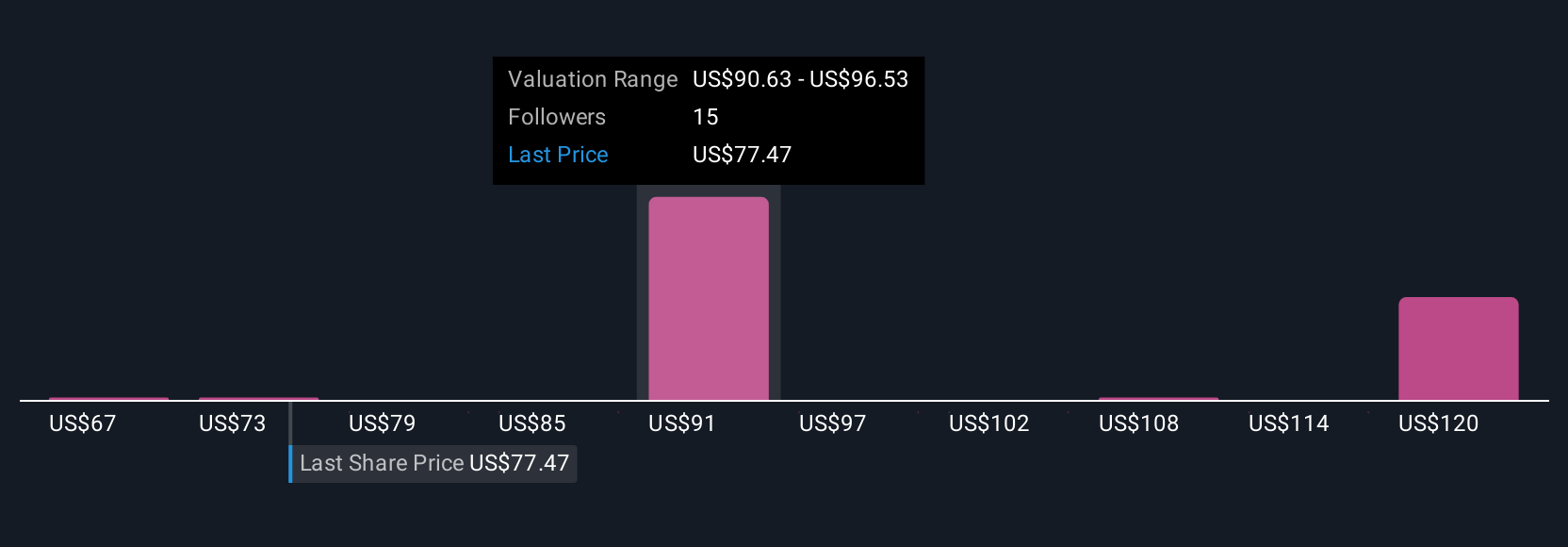

For example, some investors may craft a bullish Narrative for Textron with a fair value as high as $107.0, while others who see more risks might set it closer to $82.0. This showcases how Narratives reflect different outlooks and help you make more informed investing decisions.

Do you think there's more to the story for Textron? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Textron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXT

Textron

Operates in the aircraft, defense, industrial, and finance businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives