- United States

- /

- Aerospace & Defense

- /

- NYSE:TXT

Did Textron's (TXT) CEO Change and Segment Shake-Up Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Textron Inc. has announced several significant changes, including naming Lisa Atherton as its next CEO and approving a business realignment that will eliminate Textron eAviation as a standalone segment, with related activities integrated into other divisions effective January 2026.

- This transition in leadership and segment structure underscores Textron's intent to leverage established business units for greater operational efficiency and to align product development with targeted customer bases.

- We'll explore how the upcoming CEO change and business restructuring may influence Textron's investment narrative and longer-term outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Textron Investment Narrative Recap

To be a Textron shareholder, you need confidence in its ability to drive value through diversified aerospace, defense, and industrial operations while managing costs and product mix shifts. Recent leadership changes and segment realignment signal an emphasis on operational efficiency; however, the company's primary short term catalyst, momentum from Bell's military contracts, remains intact. The most prominent risk continues to be margin pressure from weaker industrial and aviation product mixes, and neither the CEO transition nor segment restructuring materially alters the immediate risk/reward profile.

Among recent announcements, Textron's plan to fold eAviation into other business segments is closely linked to the company's focus on leveraging synergies and supporting targeted commercial and military programs. This move aims to concentrate expertise in established units like Textron Aviation and Textron Systems, which could help the business respond more efficiently to ongoing demand shifts, particularly important as segment profit growth has lagged revenue, sharpening attention on cost control and execution as key near-term themes.

Yet, despite these shifts, investors should not overlook the potential impact of sustained margin pressure if product mix trends in key segments fail to improve...

Read the full narrative on Textron (it's free!)

Textron's narrative projects $16.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.8% yearly revenue growth and a $284 million earnings increase from $816.0 million today.

Uncover how Textron's forecasts yield a $92.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

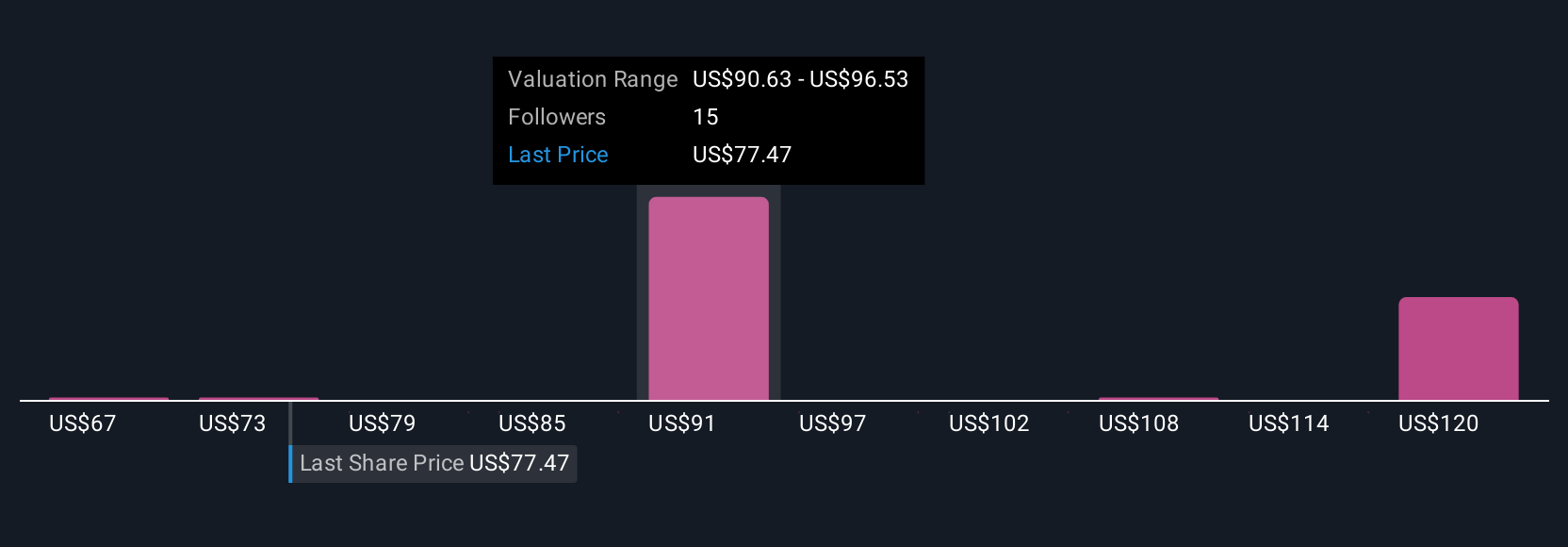

Simply Wall St Community members' fair value targets for Textron range from US$73 to US$125.16, with five distinct perspectives captured. With segment profit growth trailing revenue gains and cost management squarely in focus, your view on Textron’s current efficiency challenge could be pivotal to your investment thesis.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as 57% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Textron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXT

Textron

Operates in the aircraft, defense, industrial, and finance businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives