- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

TransDigm Group (TDG): Exploring the Company’s Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for TransDigm Group.

TransDigm Group’s share price is up modestly year-to-date, but momentum has slowed over the past three months as some recent gains were given back. Even so, its one-year total shareholder return remains in positive territory, with the longer-term performance particularly impressive. TransDigm delivered over 147% total return for shareholders in three years, and nearly 165% over five.

The aerospace sector is always evolving, so if you want to see what other names are making moves, check out the latest opportunities in our aerospace and defense stock screener: See the full list for free.

With the stock off its highs and trading below analyst price targets, investors are left to wonder if TransDigm Group is currently undervalued or if the market has already accounted for all future growth potential.

Most Popular Narrative: 16.9% Undervalued

The latest widely followed narrative puts TransDigm Group’s fair value estimate significantly above its last close price, pointing to further upside if projections hold. This narrative ties the company’s future prospects to specific external demand factors and internal strategies, presenting a strong case for its valuation logic.

Air travel demand continues to increase globally, with airlines maintaining high aircraft utilization and OEMs (Boeing and Airbus) working through exceptionally long backlogs. This indicates a coming rebound in OEM build rates and sustained, recurring aftermarket demand, both of which may drive top-line revenue growth as current supply chain challenges ease.

Want to know the math powering this bullish outlook? The future fair value depends on aggressive profit margin expansion and ambitious revenue growth targets, along with a premium profit multiple that is rarely seen in this sector. But just how bold are those projections? Discover what’s fueling this narrative’s high conviction and see if you agree with the roadmap to that higher target.

Result: Fair Value of $1,557.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory pressures and a maturing aftermarket could challenge TransDigm’s growth outlook. There is potential for downside if these risks materialize.

Find out about the key risks to this TransDigm Group narrative.

Another View: Comparing Market Multiples

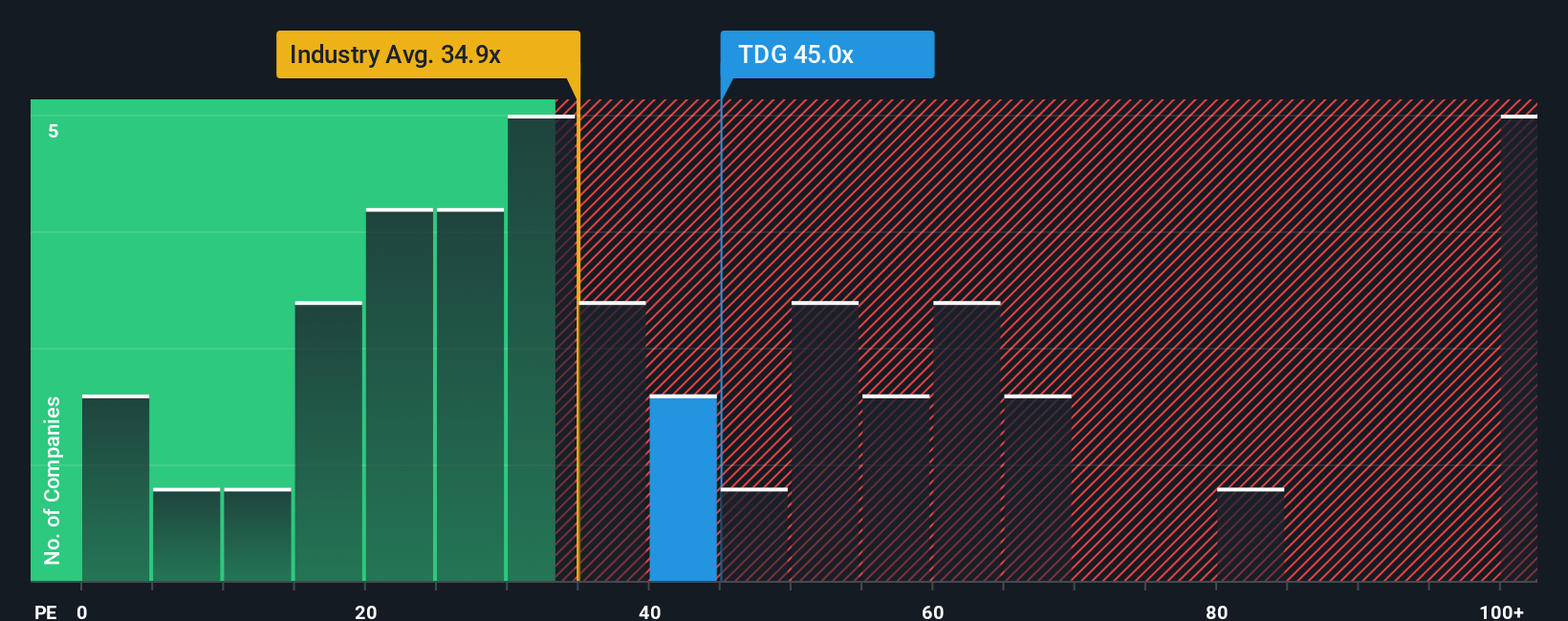

While the fair value discussion provides one estimate, looking at the market’s price-to-earnings ratio tells a different story. TransDigm trades at 41.6 times earnings, notably higher than both peer companies (33.2x) and the industry’s fair ratio of 34.4x. This premium suggests investors are paying up for growth, but it also exposes them to more valuation risk if expectations cool. Are shares truly worth the extra optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your TransDigm Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the chance for smarter investing pass you by. Take just a few minutes to see which stocks are set to shape tomorrow’s markets.

- Capitalize on the growth of artificial intelligence with these 25 AI penny stocks, which highlights strong innovation and transformative business models in this booming sector.

- Tap into dependable income by reviewing these 15 dividend stocks with yields > 3%, offering attractive yields that could help strengthen your portfolio’s foundation.

- Seize opportunities in undervalued companies through these 856 undervalued stocks based on cash flows, where the numbers point to potential bargains waiting for you today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives