- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

The Bull Case For Spirit AeroSystems (SPR) Could Change Following Wider Losses Despite Higher Q3 Sales

Reviewed by Sasha Jovanovic

- Spirit AeroSystems Holdings reported third quarter 2025 earnings, showing sales rose to US$1,585.4 million while net losses increased to US$724.3 million, compared to a year ago.

- Despite higher sales both in the quarter and over nine months, the company’s net losses widened materially, highlighting ongoing cost or margin pressures.

- We’ll examine how the bigger net losses, despite higher sales, are shaping Spirit AeroSystems Holdings’ current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Spirit AeroSystems Holdings' Investment Narrative?

For anyone considering Spirit AeroSystems Holdings, the investment story hinges on faith in a turnaround, particularly with the merger with Boeing slated to close soon. The recent third quarter earnings release complicates the narrative as rising sales failed to stem sharply higher net losses, with net loss widening to US$724.3 million for the period. Such numbers bring margin and cost control issues into sharper focus, raising fresh questions about whether the merger will proceed as smoothly, or as beneficially, as previously expected. Short-term catalysts were closely tied to merger approvals and operational improvements, but the scale of recent losses increases the risk that management is underestimating how difficult immediate profitability will be. It is possible that this latest news could delay or alter transaction terms, making liquidity and debt management even more important issues for shareholders to monitor.

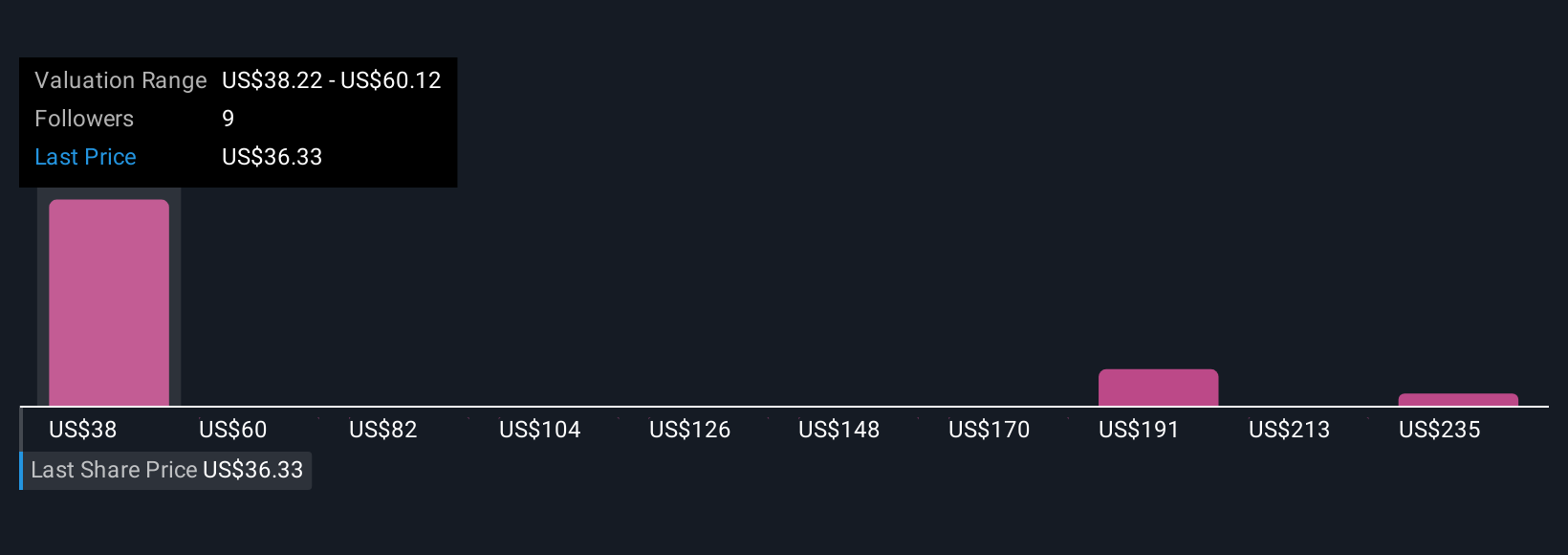

Yet, the corporate merger may still hinge on how rapidly these mounting losses are addressed. Spirit AeroSystems Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Spirit AeroSystems Holdings - why the stock might be worth over 9x more than the current price!

Build Your Own Spirit AeroSystems Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spirit AeroSystems Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Spirit AeroSystems Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spirit AeroSystems Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives