- United States

- /

- Electrical

- /

- NYSE:SMR

Why NuScale Power (SMR) Is Down 23.2% After $750 Million Equity Offering and Steep Quarterly Losses

Reviewed by Sasha Jovanovic

- On November 7, 2025, NuScale Power Corporation filed for a follow-on equity offering to raise up to US$750 million through the sale of Class A common stock, shortly after reporting a rise in quarterly revenue to US$8.24 million but a much larger net loss of US$273.32 million for the third quarter.

- Earlier in the quarter, NuScale affirmed its commitment to exclusive partner ENTRA1 Energy following ENTRA1’s announcement of potential investment of up to US$25 billion under the U.S.-Japan Framework Agreement, highlighting the increasing focus on advanced nuclear energy for rapidly growing sectors like AI data centers and manufacturing.

- We'll explore how NuScale's significant equity raise amid steep quarterly losses affects its growth outlook and analyst assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NuScale Power Investment Narrative Recap

To own NuScale Power, you need to believe in the commercial viability and global adoption of small modular reactors (SMRs), even as the company manages steep ongoing losses and relies on new capital to fund operations. The recent US$750 million equity offering gives NuScale more runway to pursue key projects, but does not materially change the immediate importance of securing long-term power purchase agreements, nor does it resolve the significant cash burn risk in the short term.

Of the recent announcements, the affirmation of NuScale's exclusive partnership with ENTRA1 Energy and the prospect of up to US$25 billion in investment under the U.S.-Japan Framework Agreement stands out. This initiative directly ties to NuScale’s growth catalysts by potentially accelerating infrastructure development and underscoring the rising energy demands from sectors like AI data centers and advanced manufacturing that require reliable, scalable energy solutions.

By contrast, it’s important for investors to be aware that the size of the latest capital raise highlights NuScale’s ongoing need for external funding to cover...

Read the full narrative on NuScale Power (it's free!)

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from -$136.6 million.

Uncover how NuScale Power's forecasts yield a $40.84 fair value, a 26% upside to its current price.

Exploring Other Perspectives

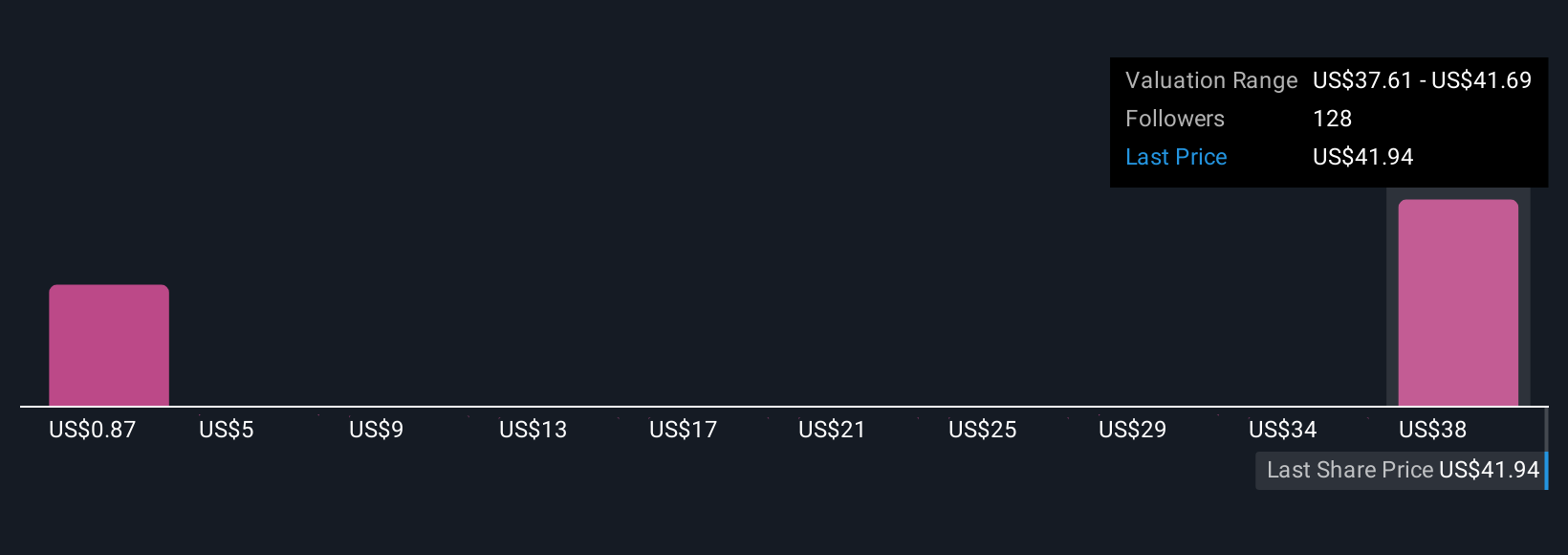

Thirteen private investors in the Simply Wall St Community estimate NuScale’s fair value anywhere from US$1.18 to US$40.84 per share. While this diversity shows that opinions may vary significantly, ongoing cash burn and funding needs remain a widely debated backdrop for any expectations regarding future performance.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth less than half the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives