- United States

- /

- Trade Distributors

- /

- NYSE:SITE

Does SiteOne’s (SITE) Modest Guidance Hint at Limits to Its Long-Term Growth Potential?

Reviewed by Sasha Jovanovic

- SiteOne Landscape Supply reported strong third-quarter results, with sales rising to US$1.26 billion and net income reaching US$59.1 million, both above analyst expectations for the period ended September 28, 2025.

- While highlighting the impact of recent acquisitions and operational improvements, SiteOne's guidance pointed to only modest organic sales growth and slightly softer full-year EBITDA expectations.

- We'll explore how cautious guidance, despite a robust third quarter, could impact SiteOne's long-term growth outlook and analyst assumptions.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SiteOne Landscape Supply Investment Narrative Recap

Owning shares in SiteOne Landscape Supply means believing in its ability to expand market share through acquisitions and digital growth, while withstanding sales pressures in cyclical construction and landscaping markets. The recent third-quarter earnings outperformance offers near-term confidence but has not significantly changed the short-term catalyst: the company’s capability to generate organic growth amid softness in new construction and repair. The greatest current risk remains exposure to end-market volatility, which could still impact organic sales.

One announcement that stands out is SiteOne’s July guidance update for modest, low single-digit organic daily sales growth for the remainder of 2025. This recent guidance reinforces the cautious outlook communicated after the strong third quarter, with management signaling continued restraint on expectations for the rest of the year, even after benefiting from recent acquisitions and operational improvements.

Yet despite better-than-expected results, there remains a risk that revenue could...

Read the full narrative on SiteOne Landscape Supply (it's free!)

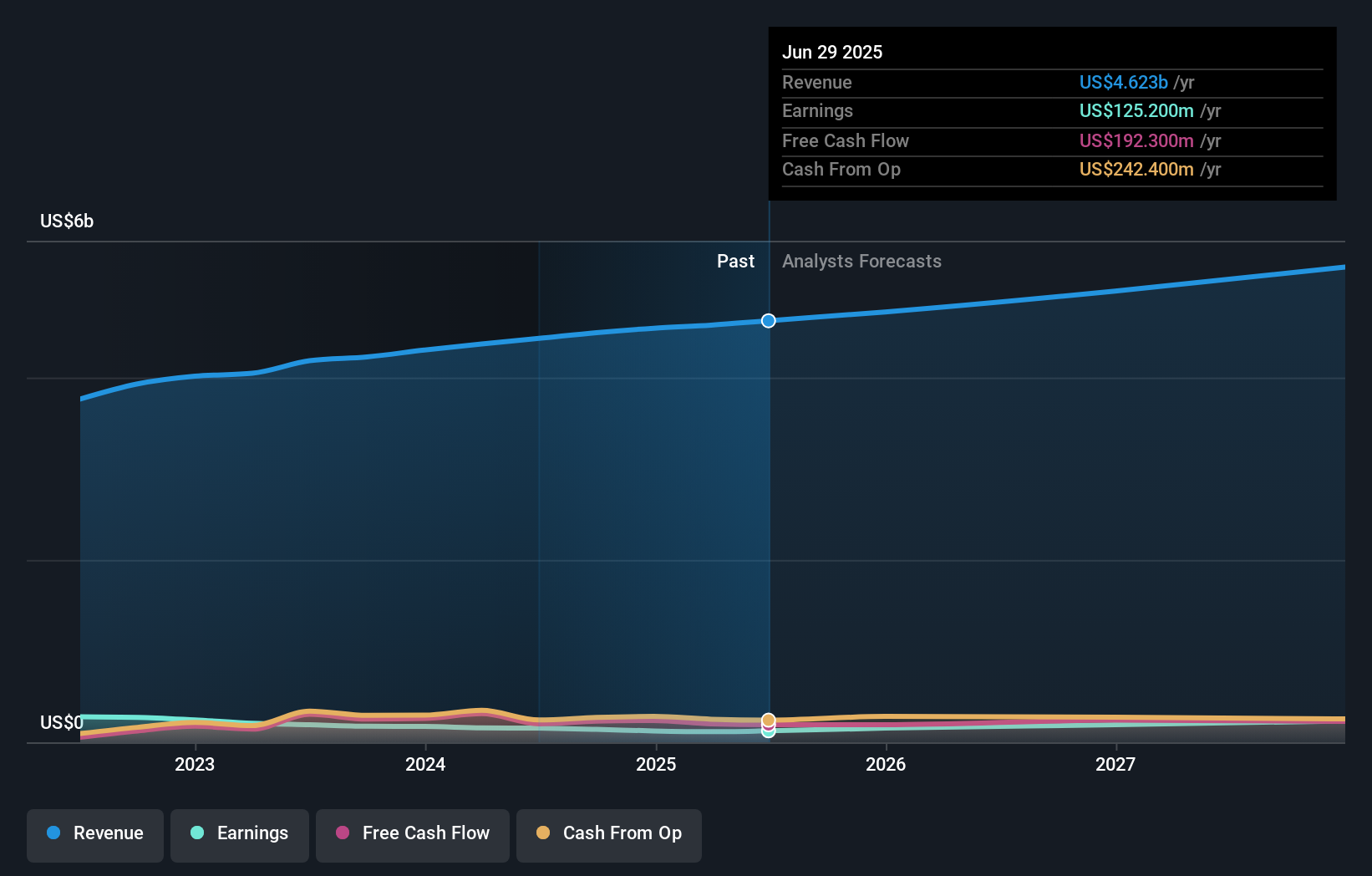

SiteOne Landscape Supply is projected to generate $5.3 billion in revenue and $263.9 million in earnings by 2028. This outlook is based on an expected 4.8% annual revenue growth and a $138.7 million increase in earnings from the current level of $125.2 million.

Uncover how SiteOne Landscape Supply's forecasts yield a $153.90 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated SiteOne’s fair value from as low as US$84 to as high as US$154, based on two individual analyses. While some see potential overvaluation, the muted organic growth outlook shared by management continues to shape a broader debate about sustained earnings expansion. Consider these contrasting viewpoints as you review your own expectations.

Explore 2 other fair value estimates on SiteOne Landscape Supply - why the stock might be worth 32% less than the current price!

Build Your Own SiteOne Landscape Supply Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiteOne Landscape Supply research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free SiteOne Landscape Supply research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiteOne Landscape Supply's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives