- United States

- /

- Aerospace & Defense

- /

- NYSE:SARO

StandardAero (SARO): Assessing Valuation as Investor Momentum Softens

Reviewed by Simply Wall St

See our latest analysis for StandardAero.

While StandardAero’s share price has barely budged this week, investors should note that momentum has faded over the past quarter after a solid start to the year. The stock’s year-to-date share price return stands at 9.37%, but its 1-year total shareholder return is down 9.81%, suggesting that confidence has softened even as growth potential still exists.

If you’re interested in other opportunities with a track record of strong growth and insider alignment, now is a good time to discover fast growing stocks with high insider ownership.

With analyst price targets suggesting upside and the company showing robust financial growth, investors are left to consider if StandardAero is currently undervalued or if the market has already factored in all of its future potential. Is there a genuine buying opportunity here, or is everything priced in?

Price-to-Earnings of 67.5x: Is it justified?

StandardAero is trading at a price-to-earnings (P/E) ratio of 67.5x, which stands out as notably expensive against its listed price of $26.84 per share. This elevated multiple sends a clear signal that the market is currently pricing in substantial future profit growth.

The P/E ratio reflects how much investors are willing to pay for each dollar of a company’s earnings. For a business like StandardAero in the Aerospace & Defense sector, a high P/E can sometimes be justified by strong growth expectations or a unique profit profile. However, it also suggests buyers are paying a premium for anticipated results.

Compared to its sector, the contrast is even sharper. The US Aerospace & Defense industry averages a P/E of just 38.5x, while StandardAero’s fair P/E, based on regression analysis, would be 35.8x. The current market valuation nearly doubles these benchmarks, indicating the price may be running well ahead of sector norms and underlying fundamentals.

Explore the SWS fair ratio for StandardAero

Result: Price-to-Earnings of 67.5x (OVERVALUED)

However, persistent sector underperformance or slower than expected earnings growth could quickly alter market sentiment and challenge the current valuation.

Find out about the key risks to this StandardAero narrative.

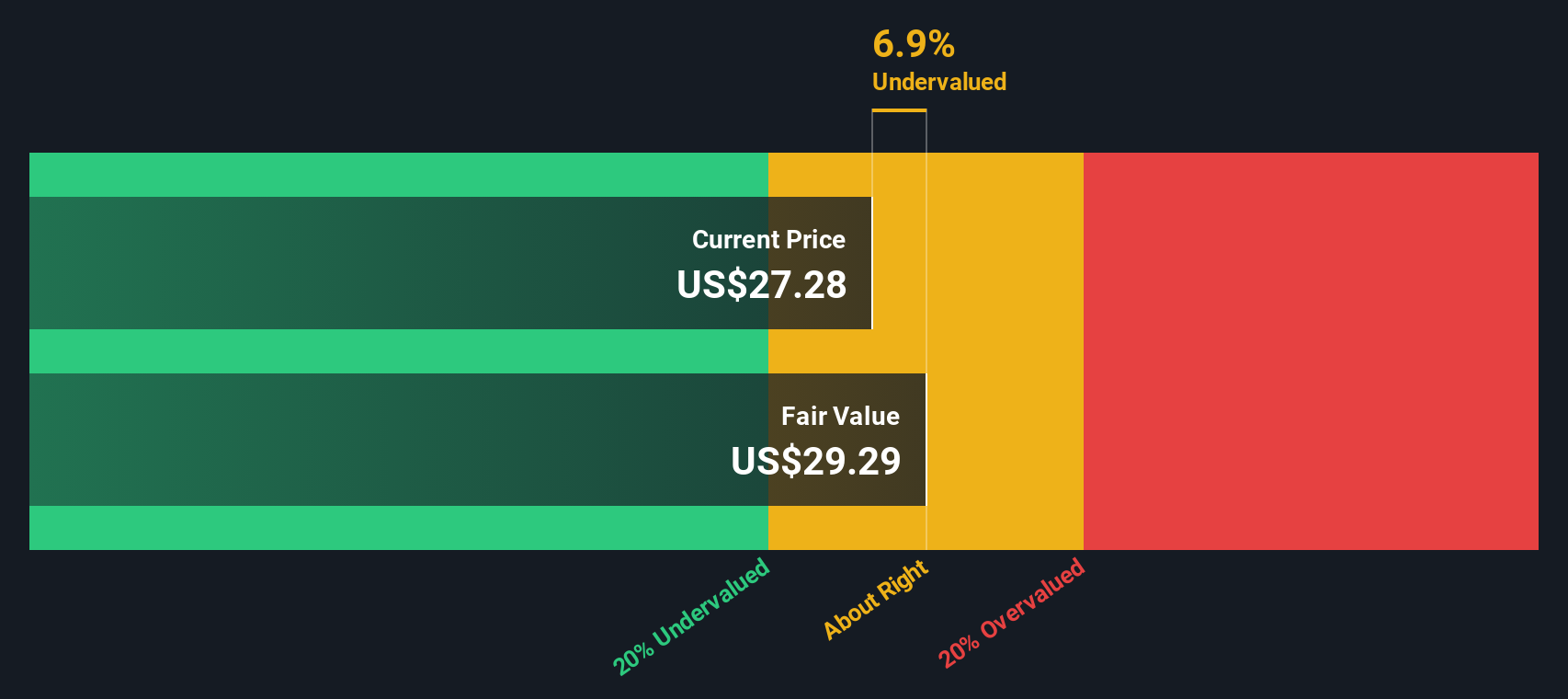

Another View: SWS DCF Model Suggests Undervaluation

While StandardAero appears expensive when considering its P/E ratio, our DCF model offers a contrasting assessment. The SWS DCF model estimates fair value at $31.56 per share, which is about 14.9% higher than the current price. This difference could indicate an overlooked opportunity, or it may highlight a risk that investors should consider.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StandardAero for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StandardAero Narrative

Keep in mind, if you have a different perspective or want to dig into the numbers yourself, you can build your own view in just a few minutes with Do it your way.

A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Great opportunities rarely wait around. Uncover stocks with strong upside potential, sector innovations, and real growth by using these targeted screeners before others spot them.

- Tap into high yields and reliable income by using these 16 dividend stocks with yields > 3% to filter out stocks with market-beating dividend performance.

- Break into the future of medicine by leveraging these 32 healthcare AI stocks for companies revolutionizing healthcare with artificial intelligence.

- Act on undervalued opportunities right now with these 874 undervalued stocks based on cash flows, which focuses on cash flow strength and attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SARO

StandardAero

Provides aerospace engine aftermarket services for fixed and rotary wing aircraft in the United States, Canada, the United Kingdom, Rest of Europe, Asia, and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives